The Deep Dive has identified MJardin Group (CSE:MJAR) as one of three Canadian cannabis companies that insolvent commercial lender Bridging Finance is known to have lent to. No comprehensive picture of the Bridging borrowers is available, key portions of the Ontario Securities Commission’s submission to Bridging’s ongoing receivership having been redacted. This post is part of an ongoing series on Bridging, and its associates such as Gary Ng.

MJardin Group’s (CSE: MJAR) CSE-listed stock last traded at $0.01 and is currently halted. But, in 2018, it was an up and coming player in the emerging North American cannabis industry; an operations consultant that had recurring revenue from management of operations in Colorado and Nevada. It wasn’t a LOT of revenue (US$12.5 million in the nine months ending September 30, 2017), but it was enough for a small bottom-line profit (US$1.8 million in that period), and a team that knew how to deliver cannabis business success was worth something in 2017.

Like any self-respecting 2018 cannabis company, MJardin was laying a stake to patches of the developing cannabis market on both sides of the border. It was going to acquire Buddy Boy Brands, a US Cannabis property, and also had designs on late-stage Manitoba AMCPR applicant Grand River Organics.

Bridging Finance loaned it C$32 million to buy Buddy Boy Brands, and another C$5.5 million to buy Grand River.

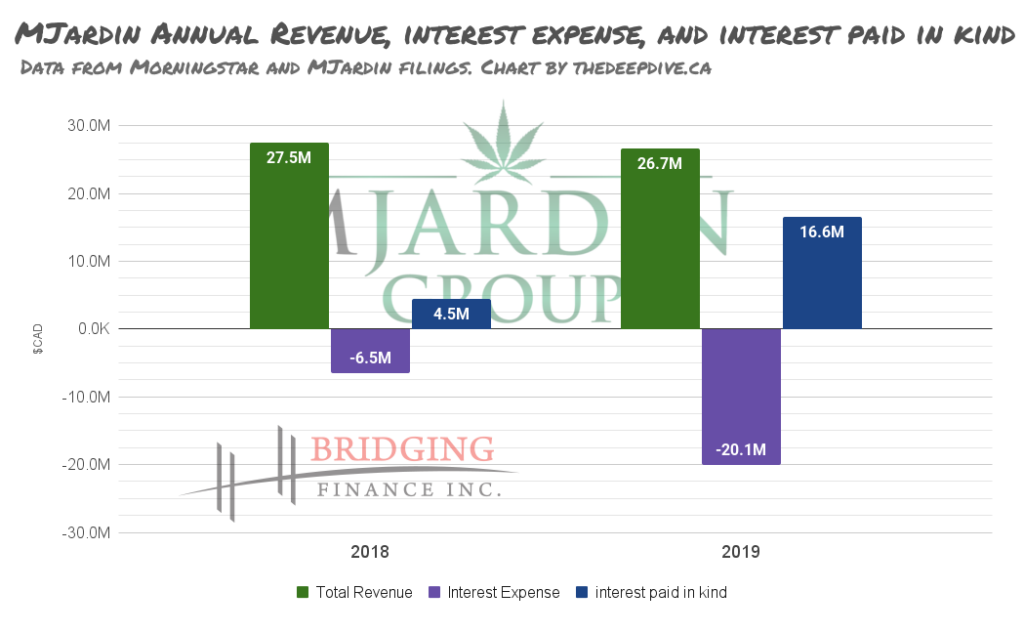

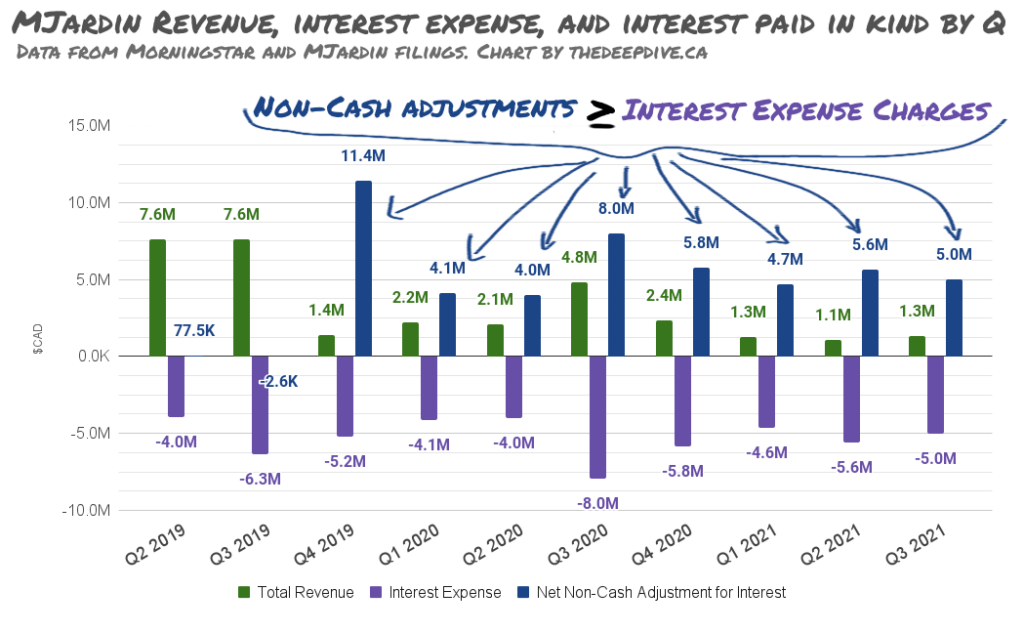

High-risk borrowers are subject to steep rates. In this case prime +10.8%, accruing daily and compounding monthly. That’s a lot of juice, and it wouldn’t be realistic for a lender to expect MJardin to pay it in cash at regular intervals. But Bridging, innovative capital engineers that they are, gave MJardin the option to pay a portion of the interest (4%) in kind (by issuing stock). As the debt grew, they also allowed payment in kind (PIK) via accruals added to the principle.

Buddy Boy Brands had $16.2 million of outstanding promissory notes receivable, paying interest at 20%, so half of it was a wash. No word on who Buddy Boy lent that money to.

The Nevada operations that MJardin consulted for were called GreenMart, and it seemed like the company was always in the process of acquiring the business. One of those deals that’s going to happen any time now, just waiting to clean up some of the company’s debt (with a stock issuance), transfer the license, etc.

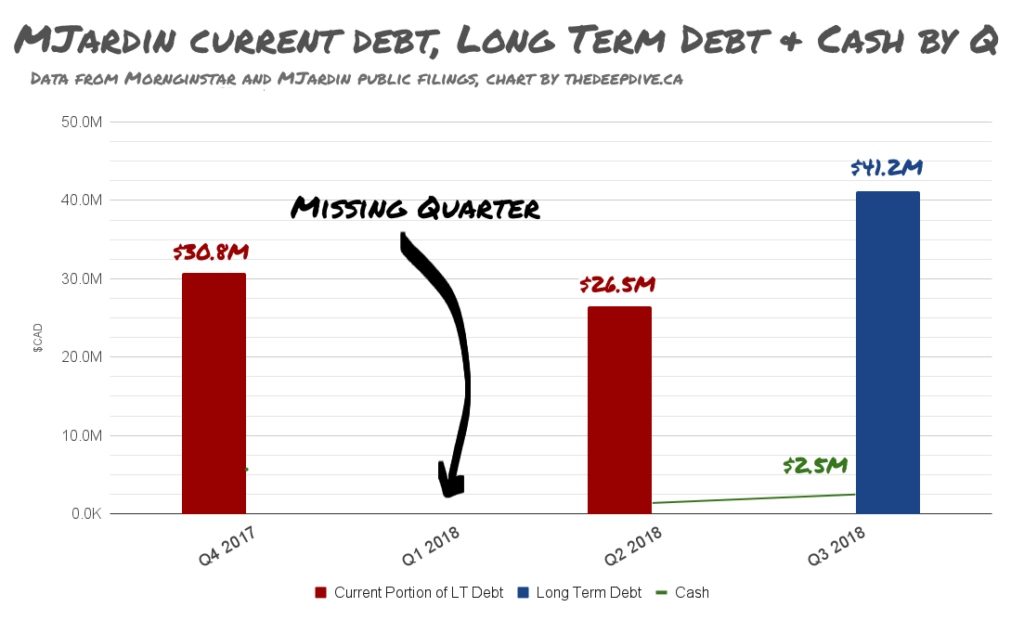

MJardin went back to Bridging in August of 2018 for an additional $15.3 million for a US property acquisition related to GreenMart, and it all rounded out to $41.2 million in outstanding debt. The loan covenants all stipulate that Bridging gets its money first if MJardin gets taken over, or if it experiences a liquidity event and, in that context, Bridging starts to look like just another garden variety punter at the cannabis dice game. The difference, of course, is that this shooter found a way to clone its chips.

Bridging loaned MJardin another $8.1 million in November of 2018 to finance a vaguely defined US equity acquisition related to GreenMart, and got seriously busy North of the border.

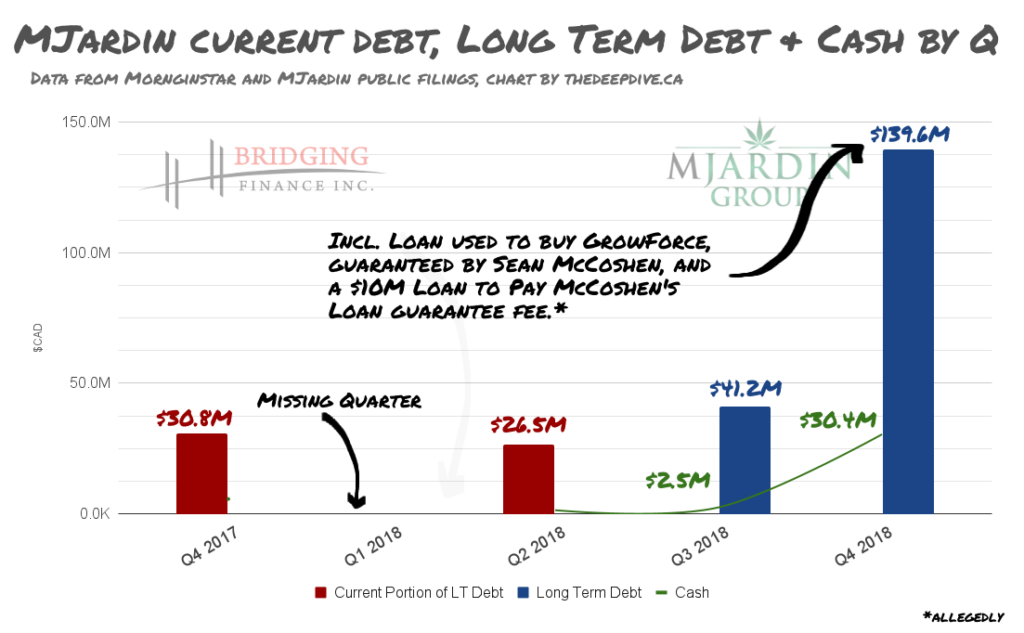

Grand River Organics had been amalgamated into a group of companies called “GrowForce,” which MJardin bought in November of 2018 in an all-stock deal that had a face value of $102.8 million. Naturally, building out a facility takes money, and Bridging wanted to help them out with that. MJardin was running out of things to borrow against, but Bridging CEO David Sharpe is nothing if not a problem solver.

Daniel Tourangeau, who leads the Ontario Securities Commission’s investigation into Bridging, was told by MJardin CEO Rishi Gautam that Sharpe introduced him in the spring of 2018 to one Sean McCoshen, who made himself available as a personal guarantor for the GrowForce loan. The guarantee was to be provided for a small fee, payable at a later date. In Gautam’s telling, he didn’t like the idea at first, but was persuaded by McCoshen and Sharpe. When McCoshen started coming around demanding full payment of his $10 million guarantee fee (now!), Gautam did the reasonable thing and borrowed the $10 million to pay McCoshen off from Bridging, who was happy to accommodate.

By Q4 2018, MJardin had borrowed $90.23 million from Bridging to finance the GrowForce acquisition and expansion… and to service $96.6 million in current liabilities that GrowForce had at the time of acquisition. The portion of those liabilities that constituted outstanding debt to Bridging or anyone else is unknown.

A growing pile of loans outstanding to a borrower with a flat to declining revenue profile, no real assets, and a rapidly declining equity price would put your average lender in a fit, but Bridging didn’t seem bothered. It granted extensions and allowed for payments to be made as accruals. As the balance became a larger MJardin liability, so too did it grow as a Bridging asset.

The interest being accrued counts as income for Bridging, and every dollar of this extended IOU being warehoused on MJardin’s books is another dollar in the Bridging NAV, which has to show growth from its previous annual high for the General Partner to be eligible for the 80/20 income split it earns as a performance bonus.

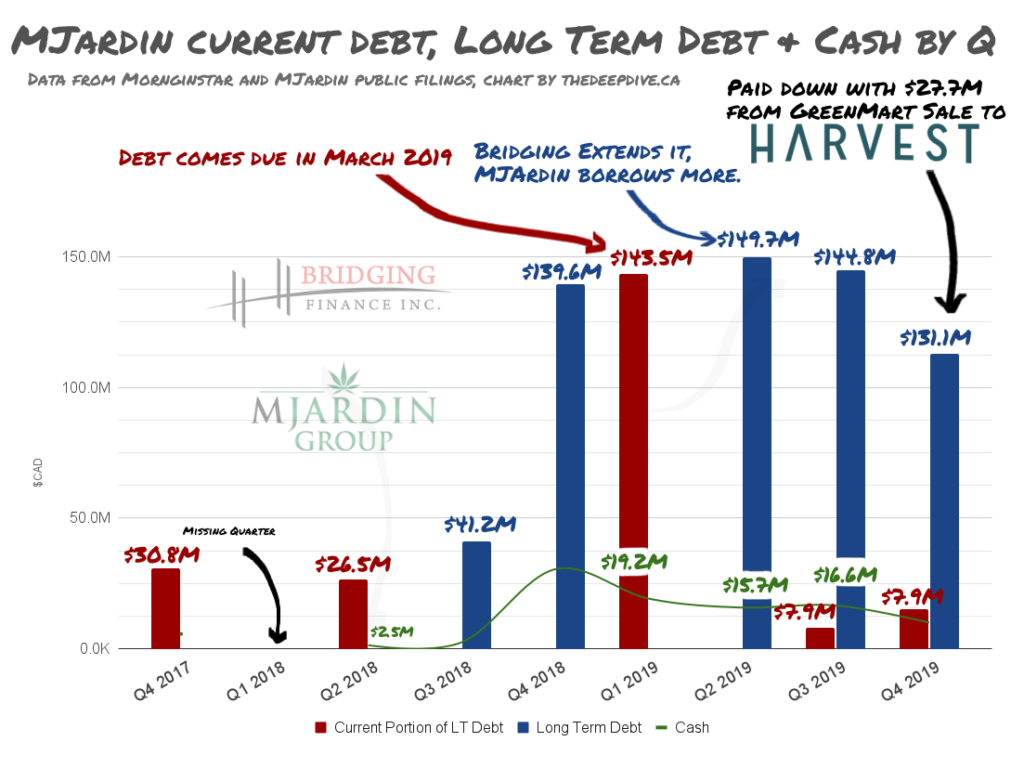

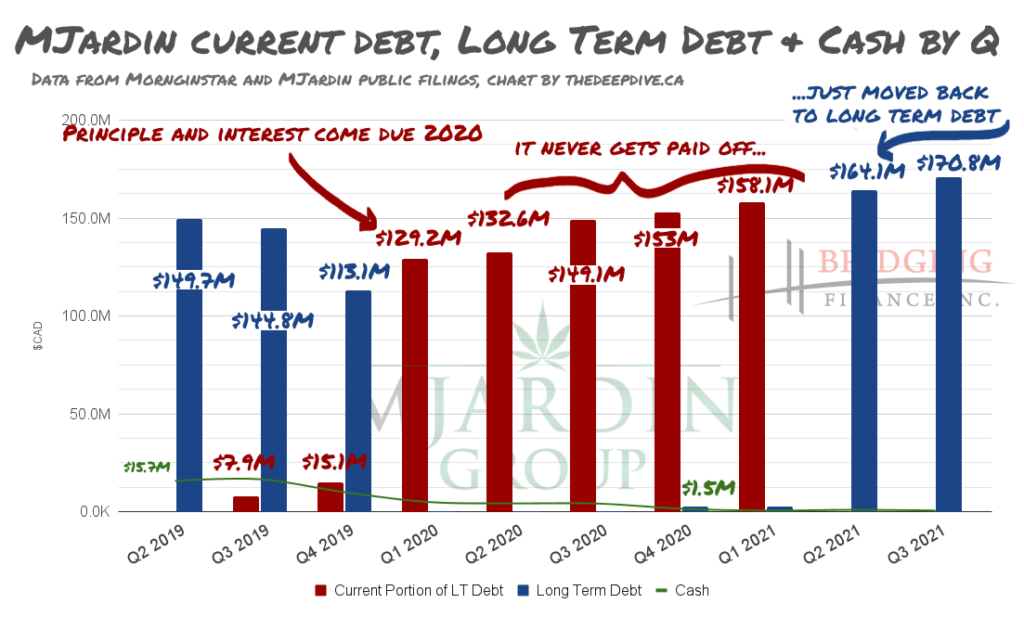

When it all came due in 2019, Bridging made some changes to the structure and loaned them some additional money. When the dust settled on that, MJardin owed Bridging $149 million by April of 2021, and didn’t have to start making $1.7 million monthly payments against the interest and principal until July of 2020.

In 2019, the company recorded $20 million in interest expenses, even though it only took in $26 million in revenue. Adjustments recorded in the cashflow statements indicate that $16.6 million of that was interest paid in kind.

On the last day of 2019, MJardin was able to pay down $27.7 million worth of the Bridging debt with the proceeds from the sale of GreenMart to fellow Bridging borrower Harvest Health – more on that later.

With GreenMart gone, US operations revenue fell from $8.9 million in Q1 2019 to $2.2 million in Q1 of 2020. MJardin didn’t have $1.7 million in revenue most months, so blowing that $1.7 million payment in July of 2020 was a foregone conclusion, but Bridging was pretty cool about it. They extended the covenants and allowed for the interest payments to be accrued until maturity… and were even kind enough to extend MJardin, newly divested of its largest revenue source, some additional credit.

The balance remained a current asset until it blew past its maturity date without slowing down. The demand notice issued by Bridging Receiver PricewaterhouseCoopers March 16th, 2022, calculated the outstanding debt at $177,393,579.38. On March 23rd, a judge appointed KSV Restructuring to be the Receiver for MJardin. PwC, presumably, was unable to take the file due to the inherent conflict of being the receiver of record in MJardin’s largest secured creditor’s ongoing receivership.

It’s difficult now to consider that the company was ever anything but a rest stop for Bridging unitholders’ money on its drawn out trip into oblivion, and there are a lot more MJardins where this one came from. These loans are among the sixty outstanding loans that were on Bridging books when PwC Receivers were untangling them in April of 2021. Forty of those loans were under review, eight were owed by borrowers who were insolvent or on their way to insolvency litigation, and six had an ongoing factoring agreement.

We have limited information on the specifics of any of this debt, the very detailed Tourangeau affidavit having been redacted in court filings to remove the exhibits that lay out who borrowed all of this money, but $98 million of it (on paper) was briefly owed by Gary Ng.

Stay tuned…

Information for this story was found via the Globe and Mail, BNN Bloomberg, Sedar and the other sources mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

In the most recent unitholder reporting as at November 30, 2021, 58 loans with a book value of $2.1 billion were outstanding of which 13 loans with a book value of $590 million were in insolvency or litigation. 5 loans with a book value of $8 million have an ongoing factoring arrangement. We know that the Receiver is forecasting that it will recover between $701 million and $880 million from the loan portfolio.

CSE says the shares are delisted as of March,

At the request of the company the common shares of MJardin Group, Inc. will be delisted at market close on March 25, 2022.

MJardin Group is currently suspended. See bulletin 2022-0320.

https://thecse.com/en/about/publications/bulletins/2022-0332-delist-mjardin-group-inc-mjar