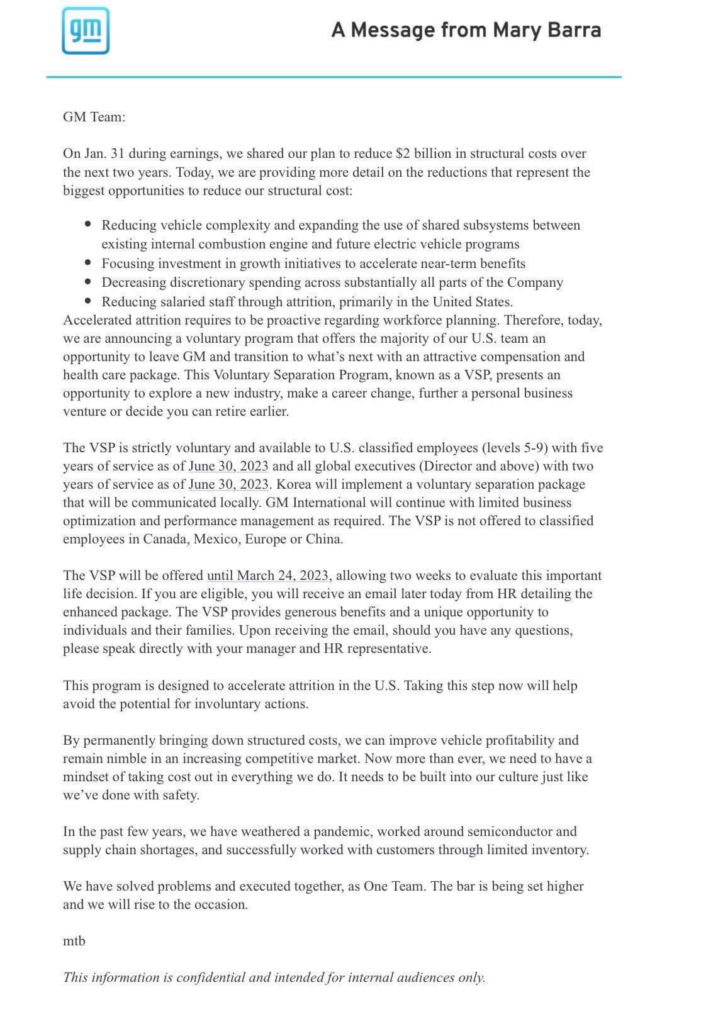

According to a statement addressed to staff Thursday by CEO Mary Barra, General Motors (NYSE: GM) will offer voluntary buyouts to a “majority” of its 58,000 U.S. white-collar employees in order to eliminate $2 billion in structural expenses over the next two years.

The “Voluntary Separation Program” (VSP) will be available to all salaried employees in the United States who have worked for the corporation for five years or more as of June 30, and are classified as being “levels 5-9.” Outside of the United States, the automaker will offer buyouts to executives who have been with the company for at least two years.

“This program is designed to accelerate attrition in the US. Taking this step now will help avoid the potential for involuntary actions,” Barra said in a communique to GM employees.

The buyout offer comes after the Detroit automaker announced last week that it would lay off approximately 500 salaried employees worldwide. This contrasts with what Barra said in the January earnings call that the company wasn’t planning layoffs at the time.

Some observers are reading “involuntary actions” as more potential layoffs should VSP have less than ideal number of takers.

Passage below *seems* to hint that if buyouts do not work, layoffs at #GM *could* happen again.

— Dylan Shane Dulberg (@dylandulberg) March 9, 2023

•@FOX2News pic.twitter.com/EuqVr8DETM

Employees in the United States who are authorized for the buyout will get one month’s compensation for each year worked up to a total of 12 months, as well as COBRA health coverage. They will also earn team performance bonuses and outplacement services on a prorated basis. Global employees will be paid a base pay, bonuses, COBRA coverage, and outplacement services.

The last time GM provided such a substantial buyout program was in 2018-2019 for around 18,000 North American salaried employees.

The buyout offer is the latest move by GM to achieve its recently unveiled $2 billion cost-cutting scheme in January, estimating that 30% to 50% of the savings will be realized by 2023. At the time, officials stated that they intended to reduce headcount through attrition rather than layoffs.

Yet @GM’s CEO’s compensation package for Ms. Mary Barra increased by 23% for 2022. Maybe she should set the example and take a cut before cutting others? pic.twitter.com/p3ky1OHumw

— Cody (@HockeyTownJedi) March 9, 2023

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.