Germany, ranked one of the richest countries in the world, is facing a dire problem: not only is the nation heading into a freezing winter with depleted energy reserves, but inflation just soared to the highest in over 70 years, making it increasingly difficult for Germans— many of whom are already on the brink of poverty— to meet their basic needs.

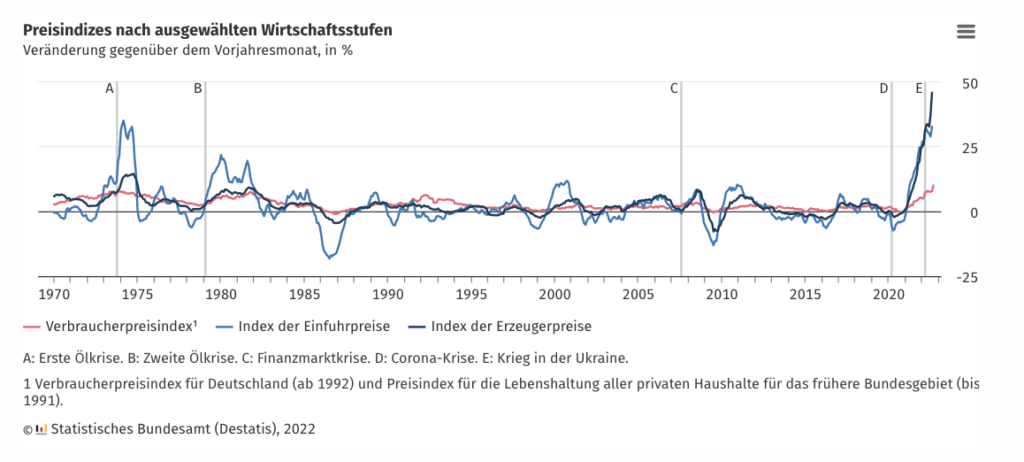

Final data published by Germany’s statistics agency Destatis showed that consumer prices in September, did in fact, jump 1.9% from the month before, hitting a staggering 10% year-over-year, marking the largest annual increase since December 1951. Likewise, by European Union harmonized standards inflation rose 2.2% between August and September, and 10.9% compared to one year ago.

“The main reasons for the high inflation are still enormous price increases for energy products. But we are also increasingly seeing price increases for many other goods, especially food,” said president of the Federal Statistical Office Dr. Georg Thiel. Germans paid a staggering 43.9% more for energy products compared to September 2021; light heating oil was up more than double at 108.4%, natural gas jumped 95.1%, and electricity prices were up 21%.

Making matters worse is the rising cost of food, which increased 18.7% year-over-year in September, with price increases being noted across all food groups. Excluding food and energy (the two things Europeans need the most), the inflation rate stood at 4.6%. The majority of the upward pressure on prices is stemming from the ongoing conflict in Ukraine, which is sending energy costs soaring for upstream economic sectors. Meanwhile, the September expiry of two temporary relief measures— a 9-euro ticket and fuel discount originally imposed back in June— added to the overall acceleration in prices last month.

Information for this briefing was found via Destatis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.