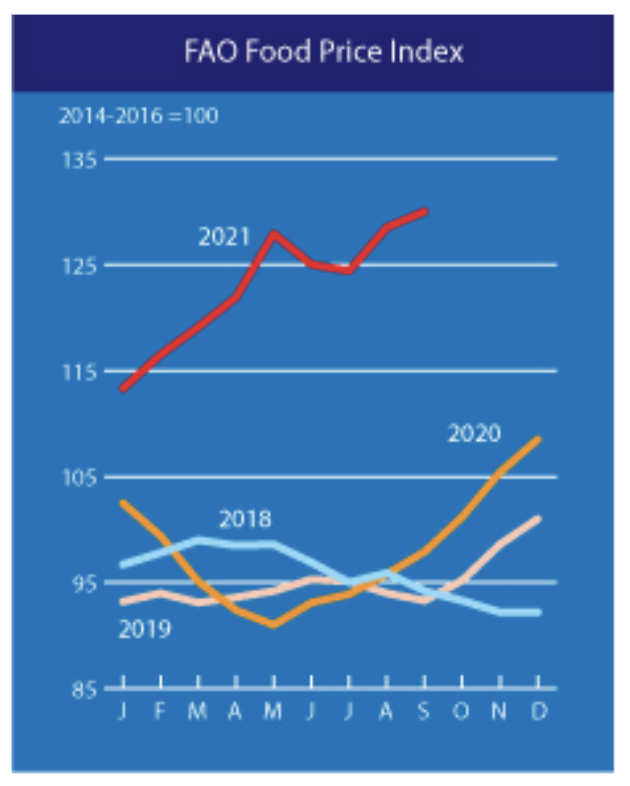

Food prices around the globe increased for the second consecutive month in September to the highest in a decade, amid adverse weather and growing global demand.

The Food and Agriculture Organization of the United Nations’ (FAO) food price index jumped 130 points in September to the highest since 2011, as food prices advanced 32.8% from year-ago levels. The overall growth in food prices was primarily attributed to price surges for vegetable oils, cereals, and sugar, as some producing regions experienced dismal harvest conditions.

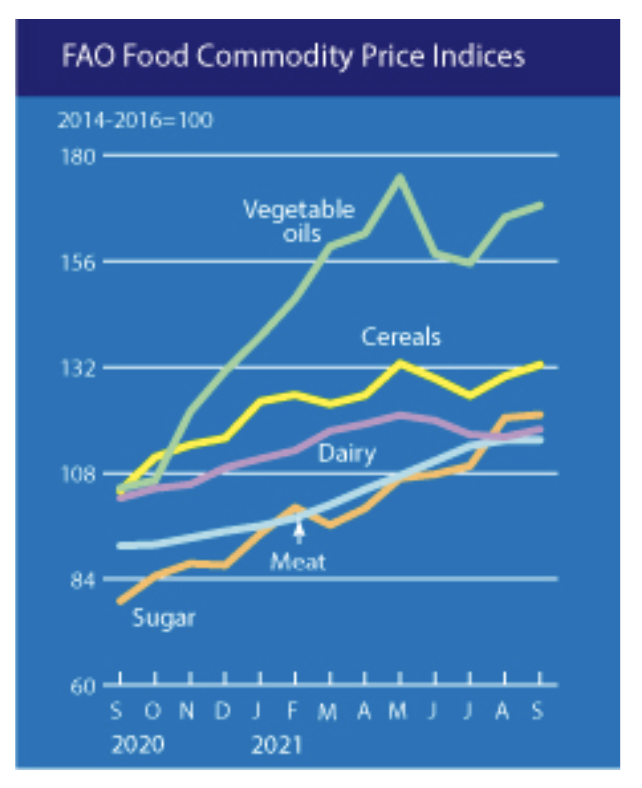

The price index for vegetable oil was up 1.7% between August and September, and has risen by about 60% year-over-year, as uncertainty over labour shortages in Malaysia sent palm oil costs higher. The cereal price index was 2% higher last month, as strong demand around the globe significantly outpaced export supply. The FAO estimates that global cereal production hit a record 2.8 billion tons this year, but was still not enough to offset a larger increase in consumption.

Sugar prices rose 0.5% in September, largely as a result of below average weather conditions in Brazil, which is the largest sugar exporter in the world. However, the FAO anticipates that better-than-expected production in Thailand and India will be help alleviate some of the current price pressures.

The meat price index continued to trend upwards for the twelfth consecutive month, and is 23.6% higher from September 2020. Poultry prices trended lower as global supply increased, while pork prices also slumped last month amid lower demand from Europe and China.

Information for this briefing was found via the FAO. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.