Although China’s economy fared considerably better than the rest of the world throughout the Covid-19 pandemic, investors are beginning to shift their attention away from Chinese stocks and into US ones, according to new research by EPFR Global.

During 2020, China become a major destination for foreign investment, as the pandemic prompted a panic sell-off in major stock markets. The Chinese economy was one of the first to face the Covid-19 crisis, imposing sweeping lockdowns and stay-at-home orders. Due to this, the country was also able to overcome the negative economic effects from the pandemic a lot quicker than other nations. This lead to an explosion in economic growth for China, while other relative economies suffered major downturns.

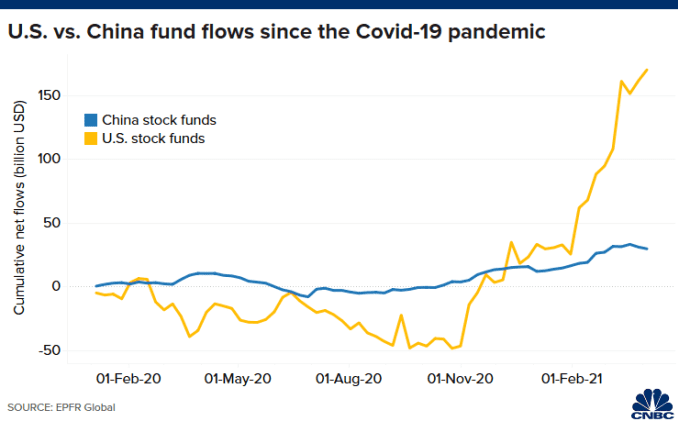

However, it appears that investors’ sentiment in 2021 has shifted once again, this time in favour of the US, according to CNBC citing EPFR, a data fund tracker which provides fund flows and asset allocation information to financial institutions around the world. The data indicates that net cumulative flows to US stock funds turned positive following the US presidential election in November 2020, and have risen to $170 billion by the week ending April 7.

In the meantime, inflows to Chinese assets showed signs of slowing down, even falling behind US levels. As the report finds, net cumulative flows into Chinese stock funds totalled $29.78 billion during the same period. According to EPFR director of research Cameron Brandt, interest in both country’s stocks have skyrocketed over the past year, particularly in US assets.

“The baton seems to be getting handed over,” Brandt said. He explained that investors have been betting on US stocks in the short run due to extensive stimulus spending, while China’s monetary policy is expected to be more prudent. Going forward, Brandt anticipates that inflows into Chinese assets will likely continue to remain strong, as demand among retail investors is not showing signs of dissipating anytime soon.

Information for this briefing was found via CNBC. Thee author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.