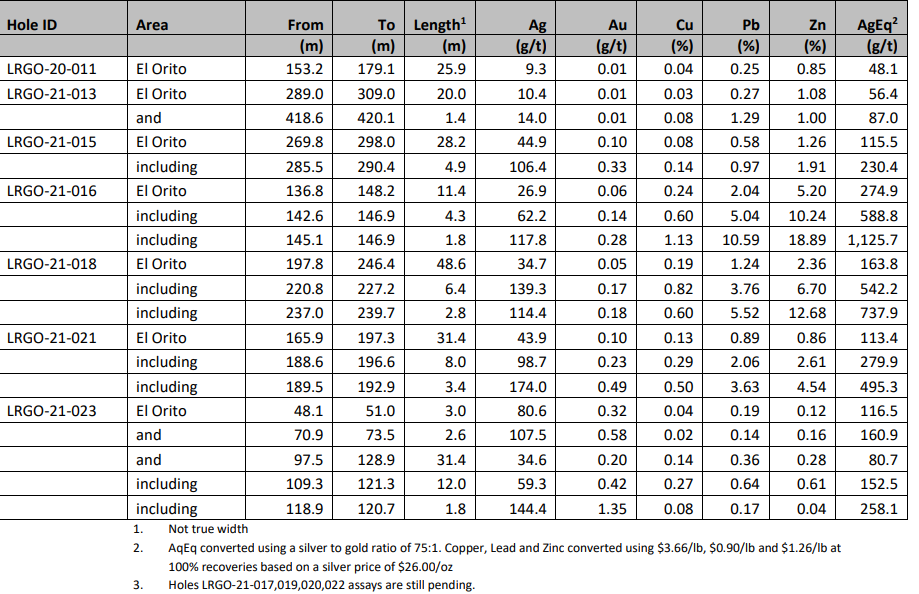

On March 31, GoGold Resources Inc. (TSX: GGD) announced constructive assay results from the seven holes it drilled in the El Orito area of its Los Ricos North project in the Mexican state of Jalisco. GoGold is a junior silver miner whose sole focus is Mexico.

In particular, one hole intersected 11.4 meters with a silver equivalent (AgEq) content of 275 grams per tonne of resources. That 11.4-m segment included 1.8 m with a 1,126 g/t AgEq composition. These seven drill holes are part of a planned 2021 100,000-meter drilling program at Los Ricos North covering the El Favor, La Trini, Casados, and El Orito regions.

The strike length between El Orito and El Favor is approximately 2.5 kilometers (km) and is open in both directions. The mineralized structure of this discovery has a vertical height of 750 meters measured from the surface outcrops at El Favor to the intersections of the El Orito drill holes.

GoGold’s Businesses

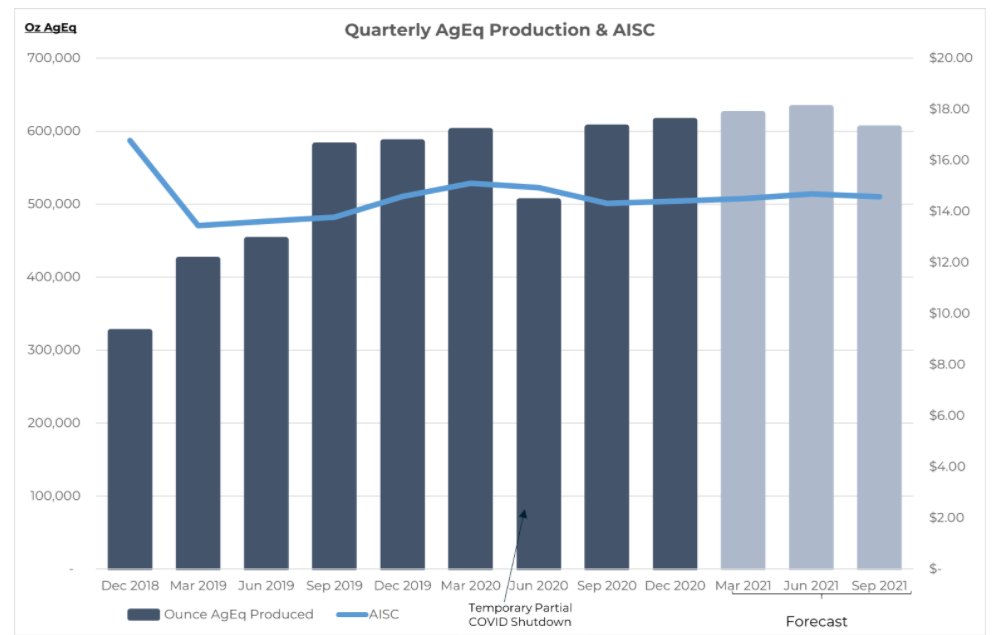

GoGold is an unusually well-funded junior miner. Its operating Parral Tailings silver mine in Hidalgo del Parral in the state of Chihuahhua is a heap leach facility which processes historic tailings. The tailings are trucked 11 km to the facility where a solution is applied. In turn, saleable silver, gold and copper are produced. GoGold uses cash flow from Parral to fund its G&A expenses and to contribute to the Los Ricos South and Los Ricos North exploration projects. Parral generated US$6.7 million of free cash flow in the quarter ended December 31, 2020.

Los Ricos South has estimated mineral resources of 63.7 million and 19.9 million ounces of AgEq on Measured & Indicated and Inferred bases, respectively. In addition, a third-party consultant in January 2021 published a Preliminary Economic Assessment (PEA) on Los Ricos South, which projected a US$295 million net present value (based on a 5% discount rate).

The planned 100,000-meter drilling program Los Ricos North Project may be one of the largest such initiatives in Mexico. GoGold hopes to hire a consultant later this year to formally estimate the magnitude of that property’s mineral resources.

Strong Balance Sheet and Solid Cash Flows

GoGold is among the best capitalized junior miners; it has about C$66.5 million of net cash on its balance sheet. In addition, the company has generated positive operating cash flow in each of the last five reported quarters, including about C$7.3 million in the first fiscal quarter of FY21. (As noted above, cash flow from the Parral Tailings mine contributed more than 100% of this total.)

| (in thousands of U.S. dollars, except for shares outstanding) | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 |

| Operating Income | $4,020 | $4,223 | $254 | ($687) | $160 |

| Net Income (A) | $4,237 | $3,518 | $2 | ($1,993) | $535 |

| EPS – Diluted | $0.015 | $0.013 | $0.000 | ($0.010) | $0.003 |

| Operating Cash Flow | $5,863 | $2,702 | $523 | $1,910 | $789 |

| Cash | $56,397 | $52,626 | $17,528 | $19,147 | $5,005 |

| Debt – Period End | $3,133 | $3,514 | $3,884 | $4,249 | $5,365 |

| Shares Outstanding (Millions) | 265.2 | 264.2 | 222.4 | 222.1 | 186.1 |

(A) 4Q FY20 net income excludes US$41.1 million from impairment adjustment reversal.

While GoGold has thus far reported encouraging drilling results at Los Ricos North, a string of less constructive assay results could negatively affect its shares. Also, any significant downturn in Parral Tailing’s operating cash flow could have a similar impact.

As a junior miner, GoGold has many constructive attributes: a solid set of exploration projects, a significant quantity of net cash, and a history of positive operating cash flow. In addition, GoGold’s management team has an impressive track record of selling the companies they have run for significant premiums.

GoGold Resources Inc. trades at $2.45 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Bank Of America Lowers Gold Price Target To $2000? – The Daily Dive feat John-Mark Staude

Returning to the Daily Dive today is that of John-Mark Staude of Riverside Resources (TSXV:...