After gold prices slumped below $1,800 per ounce in the past days following expectations that the US Federal Reserve will continue raising interest rates, the commodity rose above the price mark after the Bank of Japan shocked markets Tuesday by doubling a cap on 10-year yields.

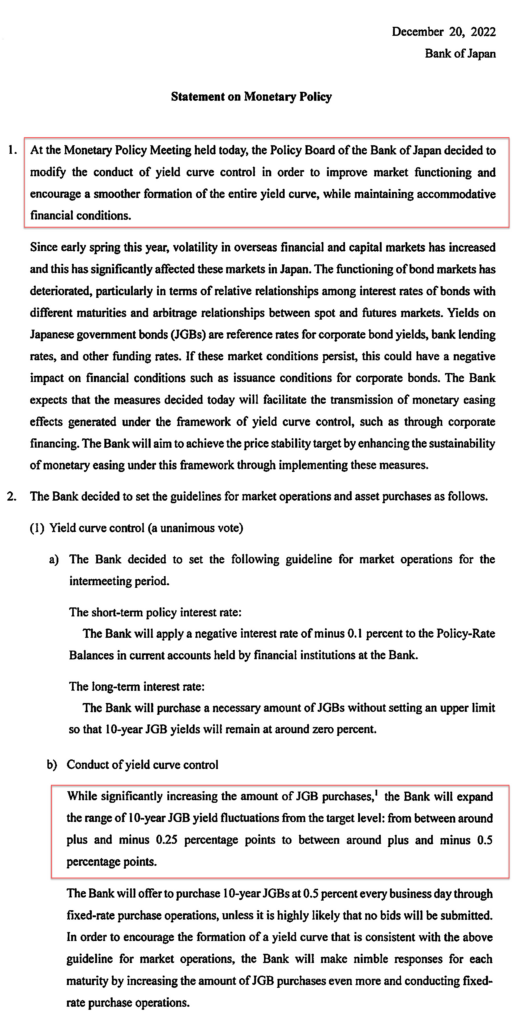

“While increasing the [Japanese government bonds] purchases, the Bank will expand the range of 10-year JGB yield fluctuations from the target level: from between around plus and minus 0.25 percentage points to between around plus and minus 0.5 percentage points,” the central bank’s statement read.

The central bank stated that the move would improve the sustainability of its monetary easing, but many analysts saw it as setting the framework for exiting a decade of stimulus policies.

Bank of Japan Governor Haruhiko Kuroda said later in the day at a news conference that the move was intended to smooth out irregularities in the structure of the yield curve and ensure that the benefits of the bank’s stimulus program are directed to markets and businesses.

“Today’s step is aimed at improving market functions, thereby helping enhance the effect of our monetary easing. It’s therefore not an interest rate hike,” Kuroda said.

The decision on Tuesday took all 47 economists polled by Bloomberg by surprise. While the majority of them agreed that the bank should do more to improve the operation of the bond market, no one expected a change in December.

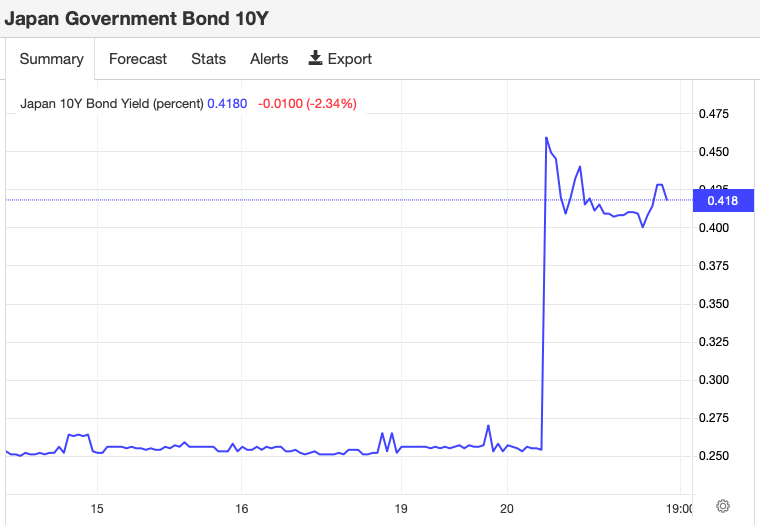

However, following the move, trading of 10-year JGB futures were reportedly halted due to a circuit breaker.

❗️ BENCHMARK 10-YEAR JGB FUTURES TRADING SUSPENDED DUE TO CIRCUIT BREAKER: RTRS pic.twitter.com/qSaiI75nGR

— Cable FX Macro (@cablefxmacro) December 20, 2022

The Bank of Japan’s decision announcement on Tuesday did not mention inflation as a basis for allowing government bond yields to rise as high as 0.5%. Instead, it emphasized the government bond market’s poor functioning and disparities between the 10-year government bond yield and the yield on bonds of other maturities.

On the other hand, many are seeing the disconnect with increasing the JGB purchases and doubling the benchmark rate at a time that the country is sustaining one of its highest debt-to-GDP ratios. The bank announced a strategy for the first quarter of 2023 that calls for the purchase of approximately 9 trillion in Japanese government bonds per month, equivalent to $68 billion, up from 7.3 trillion the previous month. The decision offers the bank more leverage to reduce bond yields if market pressure is pushing them up.

6/10

— Jim Bianco biancoresearch.eth (@biancoresearch) December 20, 2022

The JGB market is collapsing so ….

*BOJ ANNOUNCES UNSCHEDULED BOND BUYING OPERATION

What is the fair value of the 10-year JGB?

The 10-swap rate might offer a clue (orange). Now at 0.65%. It was becoming untenable to "force" 10-year JGBs (blue) to stay at 0.25%. pic.twitter.com/hjihN8ixWT

If they're going to let rates float higher, why do they need to increase the JGB purchasing amount?

— Stanphyl Capital ❌ (@StanphylCap) December 20, 2022

Man, their government debt to GDP is just a ticking time bomb (the detonation of which, of course, is impossible to time)! https://t.co/CvrGVOmi1g

Japan’s 10-year government bond yield rose to as high as 0.47% on Tuesday, its highest level since 2015.

Meanwhile, the Japanese yen rose more than 2% to 133 per dollar, reaching its highest level in four months. The move breathes life to the country’s currency which has sustained a decline in recent months.

The benchmark rate hike follows the Japanese government’s new $270-billion economic spending package unveiled in October–a desperate effort to uphold the country’s currency and support a weakening economy thanks to surging inflation.

Gold also surged to rise above the $1,800-mark following the Bank of Japan’s decision.

As the the ninth largest gold owner in the world, with 765.2 tons of gold in its reserves, the Asian country’s policies affect the gold prices. Back in September, gold fluctuated as Japan engaged in the foreign exchange market, and central banks throughout the world tightened monetary policy in response to the Federal Reserve.

Japan’s interest rates remain low in comparison to the United States and Europe, owing to slower inflation. The US Federal Reserve hiked its benchmark federal-funds rate last week to a range of 4.25% to 4.5%, a 15-year high, while the European Central Bank announced a 2% increase from 1.5%.

China’s central bank slashed two interest rates in August, despite inflation being relatively restrained.

Information for this briefing was found via The Japan Times, The Wall Street Journal, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.