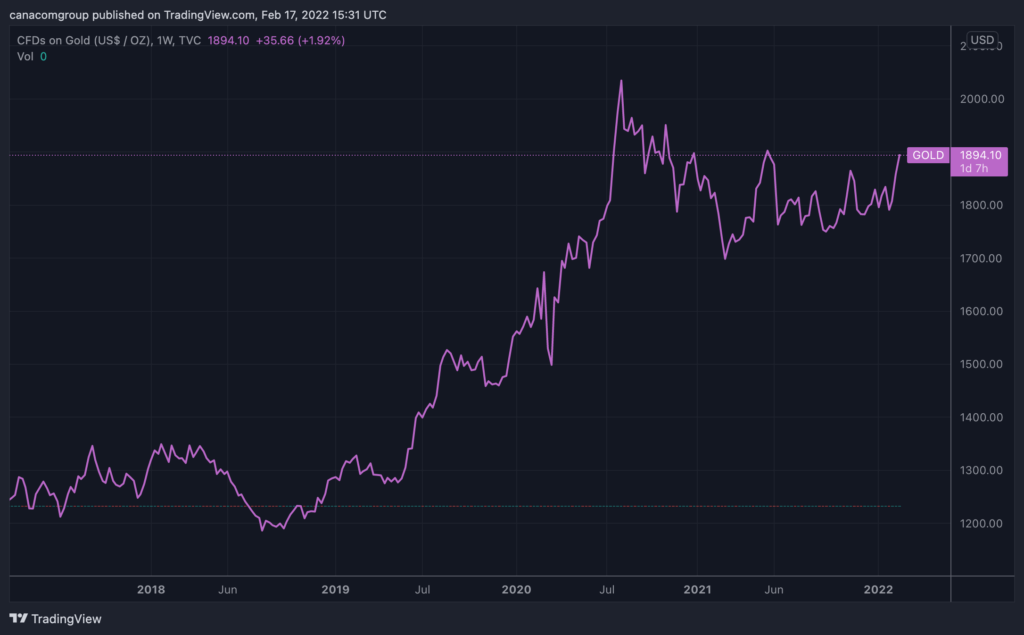

Gold has been relishing a strong rally as of recent, as global markets continue to assess the conflict between Russia and Ukraine.

Spot gold soared to the highest since June 2021 to $1,899 per ounce on Thursday, as markets weigh in risks stemming from a potential Russian invasion of Ukraine. Although Russia has since reportedly decreased its troop count near Ukraine’s border and subsequently diffused some tensions, the US is still adamant that Russia will still invade its neighbour this week, despite its previous doomsday predictions failing to materialize.

Assessing the potential risk of an invasion, US President Joe Biden told the media on Thursday that Russia is “prepared to go into Ukraine, attack Ukraine,” even though his previous forecast of a Wednesday invasion has come and gone.

16 February 2022. Meanwhile in Ukraine@mfa_russia pic.twitter.com/59xuQjqSjQ

— Russia in RSA 🇷🇺 (@EmbassyofRussia) February 16, 2022

Nonetheless, tensions between the two nations remain high. On Thursday, American officials insisted Moscow is not being truthful about the scope of its troop withdrawal, and is instead sending thousands more boots to the Ukrainian border. However, no evidence was provided to substantiate the anonymous official’s claim, with video footage depicting Russian tanks being moved to regions away from the Ukrainian border instead. In response, the US State Department labeled the video— which was released by Russia’s Ministry of Defence— as propaganda.

State Department Calls Russian Video Of Train Moving Tanks Away From Ukraine Border 'Propaganda' https://t.co/9x3D7At8o9

— Politic Talks (@politic_talks) February 16, 2022

Information for this briefing was found via Reuters and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.