In the famous and loosely paraphrased words of Zoltan Pozsar, you can print more money but you can’t print oil, natural gas, coal, etc…

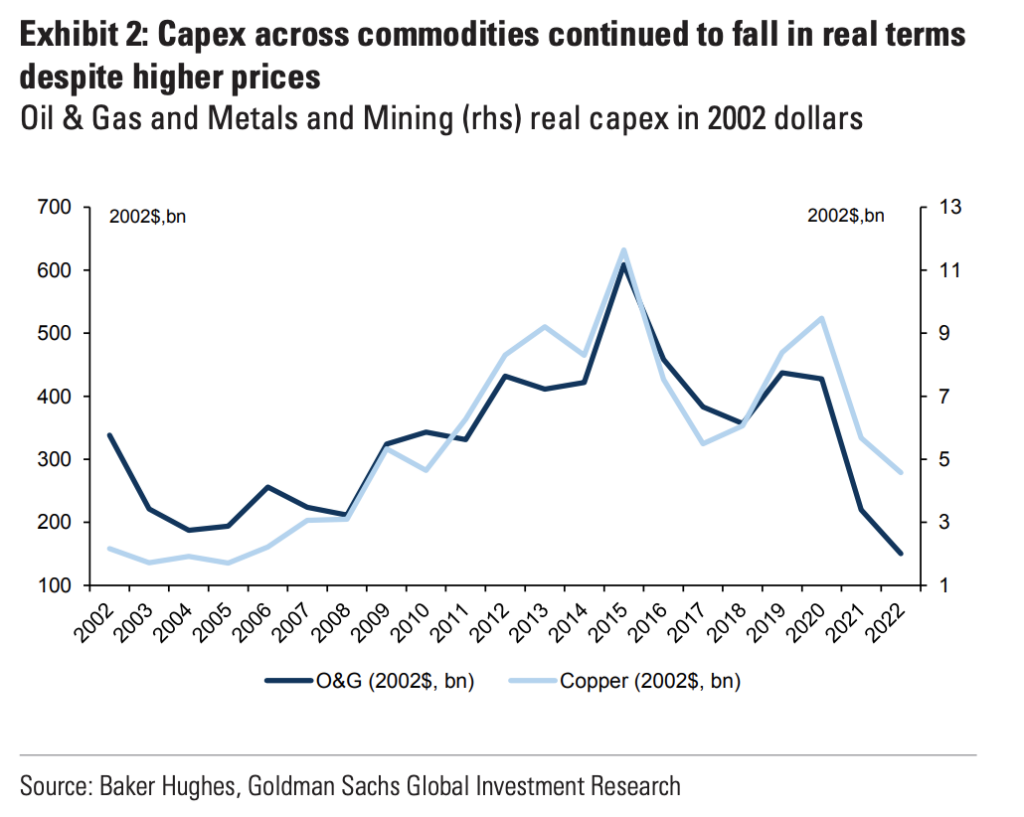

Which is why Goldman Sachs analysts are expecting the strongest bull market for commodities yet. In fact, despite the worsening global economic slump dragging down demand, weak supply of raw materials such as oil and natural gas will reinforce commodity prices by the end of the first quarter 2023. “Despite a near doubling year-on-year of many commodity prices by May 2022, capex across the entire commodity complex disappointed,” the bank’s analysts wrote in a December 14 note.

“This is the single most important revelation of 2022— even the extraordinarily high prices seen earlier this year cannot create sufficient capital inflows and hence supply response to solve long-term shortages.” The analysts pointed to lack of new oil field exploration and mining investment as the main reason behind falling stockpiles and tightened commodity markets. “Without sufficient capex to create spare supply capacity, commodities will remain stuck in a state of long-run shortages, with higher and more volatile prices.”

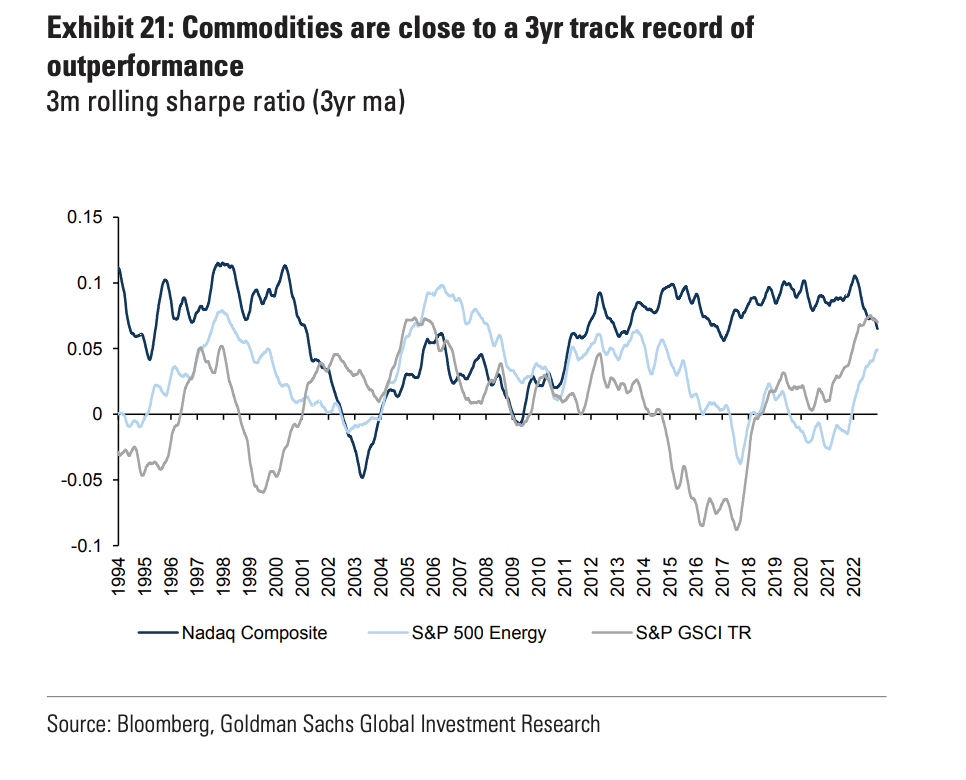

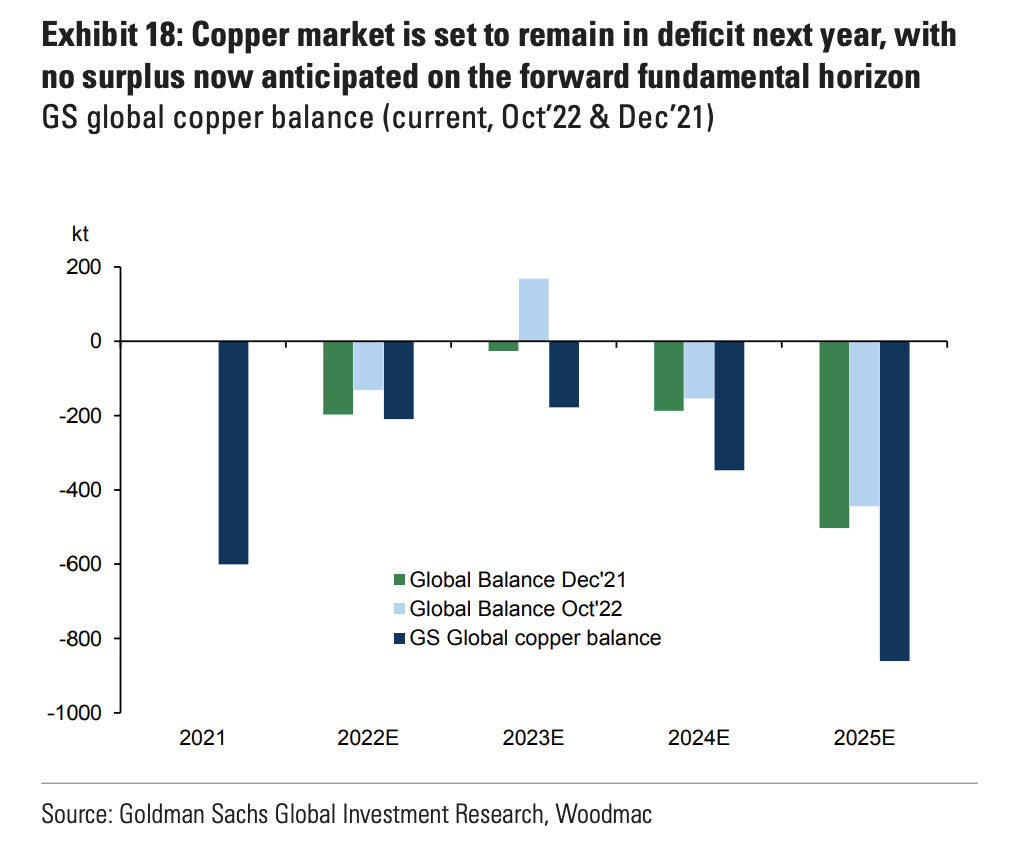

Since the beginning of the year, the S&P GSCI Total Return Index— which gauges movements of commodity prices— gave investors a sizeable return of 24%; on the contrary, US stocks slumped about 16% during the same period. But, according to the analysts, the gains will be even more pronounced come next year, with the index heeding returns of up to 43%. Goldman Sachs expects Brent crude prices to reach upwards of $105 per barrel in the fourth quarter 2023, while copper prices are forecast to rise from a current $8,400 per ton to around $10,050 per ton.

Information for this briefing was found via Goldman Sachs and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.