If you would ask Credit Suisse contributor Zoltan Pozsar, the world is heading into a new monetary order – what he calls the Bretton Woods III. In a nutshell, we are bound to see the rise of commodities as a primary monetary influence that might see the fall of the dollar and the rise of currencies in the East.

“When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities,” said Pozsar in his dispatch on March 7.

He expounded on this in his latest article published on Thursday, detailing the framework for the so-called commodity-driven monetary world order Bretton Woods III.

“If we are right, our framework will be the right framework to think about how to trade interest rates in coming years,” Pozsar started. He theorizes that:

- inflation will be higher

- the level of rates will be higher

- demand for commodity reserves will be higher, which will naturally replace the demand for foreign currency reserves

- demand for dollars will be lower as more trade will be done in other currencies; and

- the negative cross-currency basis (the dollar premium) will naturally fade away and potentially become a positive cross-currency basis.

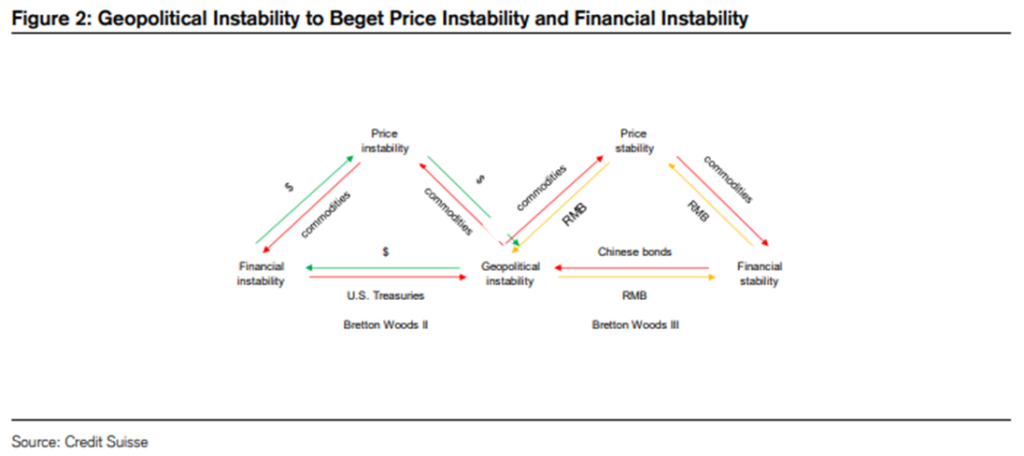

The key arguments in viewing the onset of a new world monetary order are the complexity brought by the rising commodity prices, and the geopolitical instability caused by the Russia-Ukraine war. Simply put, money is starting to change its characterization from how we know it.

It's time to pay attention to the trade in physical commodities, says Credit Suisse's markets guru Zoltan Pozsar (formerly with the US Treasury and the Fed).

— Javier Blas (@JavierBlas) April 1, 2022

And he has some reading recommendations… pic.twitter.com/F550BPrFO5

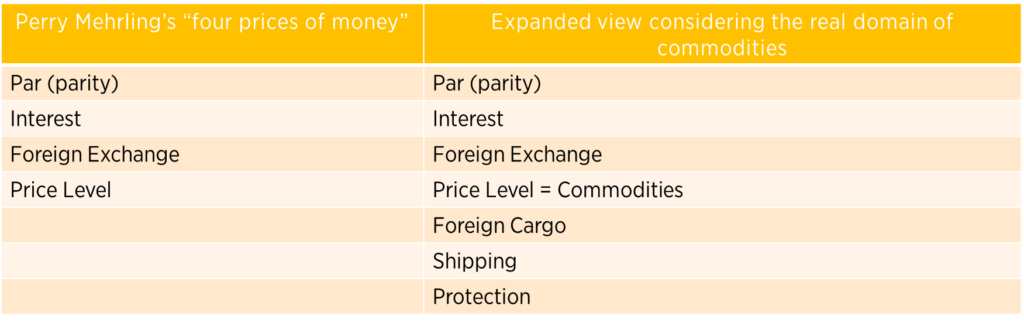

Basing his position on Perry Mehrling’s “four prices of money”: par, interest, foreign exchange, and price levels, which are all defined by nominal values agreed upon and regulated by monetary institutions, Pozsar said that the domain of real values of the commodities must be taken into account moving forward. With these being outside the purview of central banks, he believes Bretton Woods II is nearing its end.

“Central banks have it easy when it comes to policing the prices of money in the nominal domain, but not when it comes to policing prices in the real domain of commodities, especially when pressures come not from demand, but supply,” he added.

In a case where commodities will pretty much dictate the new world monetary order, factors like the geopolitical standing of the commodities supplier in the international community, the real added cost on foreign cargo given the shift in trade partners, and the protection of the safety of shipping these commodities must be considered.

“The point we make is that for price stability, we need structural stability in both the nominal and in the real domains–deflation (structural) happens when demand cannot be funded, and, contrarily, inflation (structural) happens when supply is disrupted by war and other events.”

Foreign cargo

On foreign cargo, the world is suddenly seeing commodity-supplying nations making demands on paying for the exports in their respective currencies: Russia demands its exports are paid in rubles and Saudi Arabia has expressed openness to paying for Chinese exports in renminbi.

“It used to be as simple as ‘our currency, your problem’. Now it’s ‘our commodity, your problem’,” as Pozsar puts it.

And in a situation like this, supplier nations get to supersede the monetary world order. “According to estimates by the US Department of Agriculture, China holds half of the world’s wheat reserves and 70% of its corn. In contrast, the U.S. controls only 6% and 12% of the global wheat and corn reserves,” said Pozsar.

He also added that “energy and commodities are needed for virtually everything,” and as the leading energy exporter, Russia virtually “exports everything.”

Shipping

While Europe and other energy-importing nations are working on cutting off their dependency on Russia, the country is bound to look for customers in the East–primarily China–through less-efficient routes. This leads to a domino effect where China would import fewer resources from a much closer Middle East, and Europe looking into sourcing its energy imports from other producers with no established efficient routes. Essentially, this is why Pozsar believes the added cost of shipping would factor in the price of money.

“Consider that as cheap Russian oil gets diverted to China, China will buy less oil from the Middle East and then Middle Eastern oil will now have to be shipped to Europe with the same loss of efficiency as the shipment of Baltic oil to China,” he said.

Pozsar painted a picture of the possible scenarios coming off from these new trade routes, essentially concluding that shipments might take four months instead of around a week. He also laid out how the current trade routes and shipping vessel capacities would provide for a much harder import-export synergy in the new geopolitical realliances–which again, would cost more.

“Russia exports every major commodity imaginable, and the same problems will show up in other products and also with ships that move dry, as opposed to wet cargo. It will be a big mess,” explained Pozsar.

Protection

With the price of money heavily tied to commodities, its protection and security are expected to influence the new world monetary order.

Pozsar explained that while “currency, deposits, and money fund shares are interchangeable always at par,” the value of commodities is at the mercy of its security and consistency of shipment. Factors that might affect this include power shift (and price control) in favor of route regulators and bottlenecks in sea routes caused by external factors.

“More expensive ships. More expensive cargo. More expensive transit fees. Much longer transit routes. More risks of piracy. More to pay for insurance. More price-volatile cargo. More margin calls. More need for term bank credit,” he relayed.

The triangle of a new world order

Citing Ray Dalio’s stagflation view, Pozsar said that “the price signals from the four pillars of commodity trading will dominate the signals coming from the four prices of money.”

Arising from the ashes of the current geopolitical conflict, commodities-driven monetary world order would replace the current one, as Pozsar puts it.

“Commodity reserves will be an essential part of Bretton Woods III, and historically wars are won by those who have more food and energy supplies,” he added. In the new world order, banks would create eurorenminbi mainly to accumulate for buying Chinese Treasuries, outside money like gold (instead of G7 inside money), and commodity reserves instead of foreign currency reserves.

With the new approach to understanding the monetary order, financial and price stability may be achieved over time–but not without taking hits on inflation and interest rates.

“The new trinity of Bretton Woods III will be about ‘our commodity, your problem’– the EU’s inflation problem for sure, if not the inflation problem of the entire G7,” Pozsar ended.

Information for this briefing was found via Credit Suisse. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

The World Economic Forum demands 2 things .. 1. The death of all Americans & 2. The world financial system moves to China..Ambassador Mount..

Makes sense.. .. The richest person in the world (Putin) has had enough and now wants things on his terms .. ( I get that ) ( I don’t agree with war and the innocent people being killed)

Energy, food and your health – the 3 most important things in life ( + doctors)

since just when did Vlad get anywhere near the House of Saud? – You must do too much M$M.