With a turbulent second quarter at an end, major US banks have begun releasing their financial reports. Wells Fargo released its financials on Tuesday, suffering its first quarterly loss since the Great Depression. The following day however, Goldman Sachs also released its financials, with a vastly different outcome.

Second quarter earnings for Goldman Sachs were the highest in almost a decade, crushing previous estimates in light of the coronavirus pandemic. The bank had generated $2.42 billion in profit, which equates to approximately $6.26 per share – thus significantly surpassing a Refinitiv forecast of only $3.78 per share. Moreover, Goldman also earned revenues of $13.3 billion, which is $3.5 billion more than the estimate. As a result, the bank’s shares rose by 1.5% on the news.

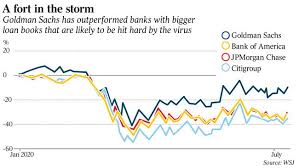

Goldman Sachs is currently one of the only US banks that is the nearest to being a pure-play Wall Street bank, and gets the largest share of its revenue from investment banking and trading on Wall Street. Goldman’s distinct model has previously been a disadvantage, as the other US banks have relied on consumer deposits and retail banking for their profits. Amid the coronavirus pandemic however, the other banks had to set aside significant provisions to cover record losses- something that Goldman was predominantly spared from.

With the Federal Reserve going to all ends of the world to prop up US credit markets, the spur in bond trading and equity issuance has amassed a record amount of banking fees for Goldman. Revenue from bond trading reached $4.24 billion – an increase of nearly 150%. In the meantime, equity trading revenue was up 46% to a total of $2.94 billion, the highest in 11 years.

Goldman’s consumer and wealth management division had an increase of 9% in revenue to a total of $1.36 billion, stemming from an increase in management fees as well as loans from the bank’s Apple Card Partnership. Despite the record earnings however, only three out of Goldman’s four main divisions had produced more revenue compared to the previous year. The bank’s asset management division had its revenue fall by 18% to $2.1 billion, with the downfall attributed to reduced gains from private equity holdings.

Information for this briefing was found via CNBC, Bloomberg, The Australian Business Review, and Goldman Sachs. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.