A startling money laundering revelation has recently emerged, implicating some of the world’s largest banks as complicit in moving trillions of dollars in dirty money.

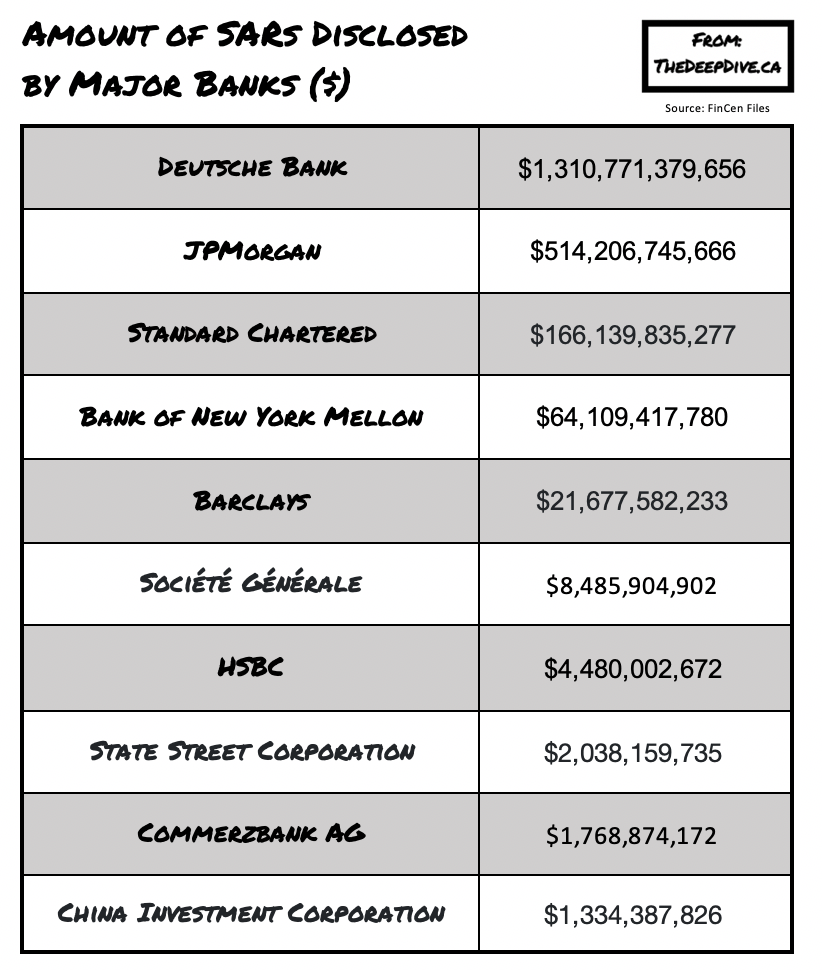

According to an investigation by the International Consortium for Investigative Journalists (ICIJ), several major world banks including JPMorgan, HSBC, Deutsche Bank, Standard Chartered, and the Bank of New York Mellon processed trillions of dollars in transactions that were flagged as suspicious. The results of the haunting investigation are based on over 2,100 suspicious activity reports (SARs) which were filed by the US Department of Treasury’s Financial Crime Enforcement Network (FinCEN) between the years of 1999 and 2017. Buzzfeed News originally obtained the documents, later sharing them with the ICIJ.

The disturbing results of the investigation show that these big banks have been completely neglecting money laundering crackdowns, and instead continued to move astounding amounts of unlawful cash for vast criminal networks and dangerous oligarchs. In fact, JPMorgan moved more than $500 billion for companies and questionable people, which turned out to be tied to the looting of public funds in Venezuela, Malaysia, and Ukraine. Although the US bank reached settlements with US authorities back in 2011, 2013, and 2014 while promising to increase its money laundering controls, JPMorgan continued to allow corrupt transactions to flow through its accounts.

In response to these startling revelations, ICIJ reached out to JPMorgan for comment, only to be turned down, with the bank stating that it is legally prohibited from discussing the transactions of its clients. However, JPMorgan is not the only bank that has been complicit in illegal money laundering schemes despite crackdowns by authorities. The FinCEN Files paint a grim picture of the underground world of international banking, implicating dozens of banks around the world in financial crimes.

The files show that many other banks, especially Deutsche Bank, have been moving trillions of dollars in illegal cash through accounts that do not seem to have owners. Furthermore, the banks have also been complicit in failing to notify authorities regarding transactions flagged as money laundering until many years after the fact, whilst continuing to engage in business with clients that have been partaking in financial frauds and public corruption scandals.

Although authorities have been employing vast resources against the battle of global money laundering, such as ordering these big banks to improve their detection practices, fining them billions of dollars and even threatening them with criminal charges, it still appears that the financial criminals continue to have the upper hand. According to the ICIJ investigation, the numerous tactics by authorities do not appear to have an effect on the big banks, as many still continue to play a critical role in the migration of dirty money obtained via fraud, organized crime, corruption, and even terrorism.

According to estimates compiled by the United Nations Office on Drugs and Crime, more than $2.4 trillion worth of illicit funds are laundered each year – the equivalent of 2.7% of global GDP. However, the agency determined that approximately less than 1% of the money laundering schemes are actually detected by authorities. So why do these big banks continuously defy authority’s orders, and instead opt to engage in these illegal activities? Well, banks have an incentive to move the dirty money because it is very profitable to do so.

Banks collect copious amounts in fees when money is moved through the web of accounts that are owned by questionable characters. Indeed, JPMorgan gained more than half a billion dollars worth of revenues when it served as the chief banker for Bernie Madoff, who was later convicted of a $65 billion Ponzi scheme. However, such business dealings with criminals do carry a significant amount of risk for the banks.

In 2014, JPMorgan was ordered to pay $2.6 billion in fines in order to settle investigations regarding its role in the Madoff controversy. Then back in 2011, the bank was also ordered to pay $88.3 million due to its violation of economic sanctions against Iran and other countries that were subject to US embargoes at the time. The bank ultimately ended up receiving a “cease and desist” order for failing to identify suspicious activity.

Nonetheless, JPMorgan still defied law enforcement orders, continuing to move dirty money for criminals involved in financial crimes as detailed in the FinCEN Files. Even with threats of criminal prosecution and fines, it appears that profits from the chilling underground world continue to dominate the global financial system, whilst buying off banks and undermining democratic systems around the world.

Information for this briefing was found via the ICIJ. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

I’M GOING TO PUT THIS ONE ALL WAY DOWN!