FULL DISCLOSURE: Goliath Resources is a sponsor of theDeepDive.ca.

Goliath Resources (TSXV: GOT) has seen a bullish update from Stifel analysts, who highlighted a significant increase in gold-equivalent grades at the company’s Surebet property in British Columbia’s Golden Triangle. The update follows Goliath releasing gold-equivalent assays for 54 of the 110 holes drilled at Surebet under the 2025 program.

New assay results from 54 holes drilled during the 2025 summer season show that the inclusion of by-product metals, including silver, copper, lead, and zinc, increased the average gold-equivalent value by 13.2% over gold alone as per Stifel’s analysis.

Stifel notes that these incremental metals provide a critical operating cost coverage cushion. At spot prices, the by-product revenue equates to roughly $101/tonne, more than double the projected surface unit costs of $50/tonne for a potential 4,000 tonne-per-day operation.

The report emphasizes Goliath’s logistical advantage over peers in the region. Located less than 10km from tidewater at Hastings Arm, the project is positioned to minimize concentrate transport costs. This is particularly vital as Goliath expects to recover approximately half of its gold via a bulk concentrate. Stifel contrasts this with other inland assets, such as the Eskay Creek project, which faces significantly higher transport fees for its concentrate.

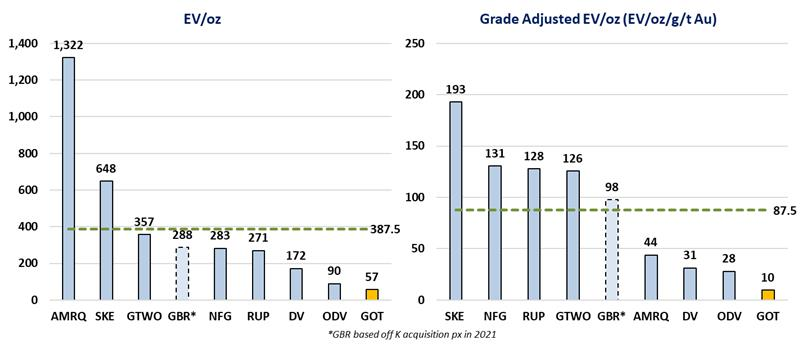

Stifel argues that Goliath remains heavily undervalued at current price levels. The company currently trades at a grade-adjusted $10/oz gold, a steep discount to more advanced competitors who average $88/oz.

Analysts at Stifel notably drew a direct comparison to the Dixie project (formerly owned by Great Bear Resources), which Kinross Gold acquired for US$1.45 billion in 2022. According to Stifel, the first 150 holes at Surebet averaged 124 gram-metres, nearly mirroring the 129 gram-metres seen at Dixie’s LP Zone during a similar stage of development.

FULL DISCLOSURE: Goliath Resources Limited is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Goliath Resources Limited. The author has been compensated to cover Goliath Resources Limited on The Deep Dive, with The Deep Dive having full editorial control. This is not a recommendation to buy or sell. We may buy or sell securities of the company at any time. Always do additional research and consult a professional before purchasing a security.