Great Bear Resources (TSXV: GBR) today announced further results from its currently ongoing 2020 drill program at its flagship Dixie project in the Red Lake District of Ontario. Highlights of the results include the doubling of confirmed depths of gold mineralization, and the finding of the widest high-grade gold mineralization of the project.

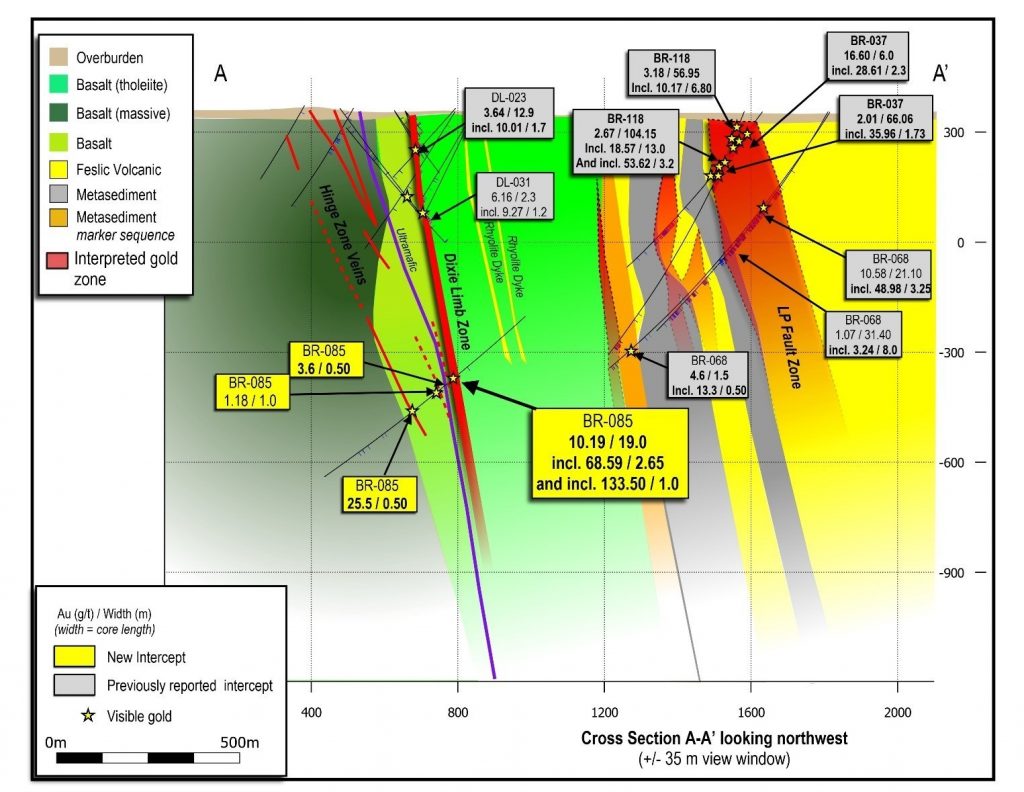

The results were centered around that of LP fault drill hole BR-085, which the company extended from a depth of 524 metres to that of 1,509 metres downhole to intersect what is referred to as the Dixie Limb Zone at depth. The resulting data has doubled the confirmed depth of the zone, while also intersecting the widest, deepest, and highest grade interval found on site to date.

Most significantly, the results suggest that the Dixie Limb Zone and the Hinge Zone may come together at depth.

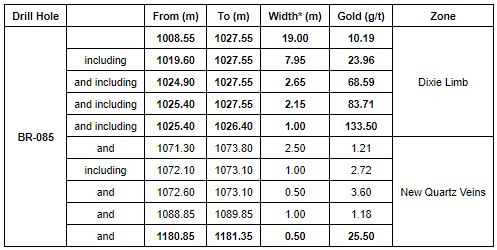

The drilling conducted on BR-085 assayed gold of 10.19 g/t over 19 metres, including 68.59 g/t over 2.65 metres and 133.50 g/t over 1.0 metre. The results intersected deep extensions of Dixie Limb at 740 metres below surface, and new hinge zone type veins at 840 metres below surface. The discovery as a result has doubled the known depth of mineralization.

The 2020 drill program for Great Bear’s Dixie project is currently ongoing, with the company intending to conduct similar drilling on all gold zones, including the LP fault zone. The Dixie project itself consists of 9,140 hectares of contiguous land claims located approximately 22 kilometres southeast of Red Lake, Ontario.

Great Bear Resources last traded at $11.98 on the TSX Venture.

Information for this briefing was found via Sedar and Datametrex AI. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.