Green Thumb Industries Inc. (CSE: GTII) reported their first quarter financials after market close on May 12th, reporting revenue of $194.4 million, up 89.5% year over year. Gross margins came in at 57%, while operating margins came in at 26.5%. The company had an insane 72.9% tax rate and reported a net margin of 5.2%, or $0.05 earnings per share.

Green Thumb currently has 14 analysts covering the company with a weighted 12-month price target of C$57.15. This is slightly higher than before the results, which was C$57.01. Three analysts have strong buy ratings and the other 11 have buy ratings. The street high comes from Craig Hallum with a C$74.40 price target, while the lowest comes in at C$45 from Roth Capital.

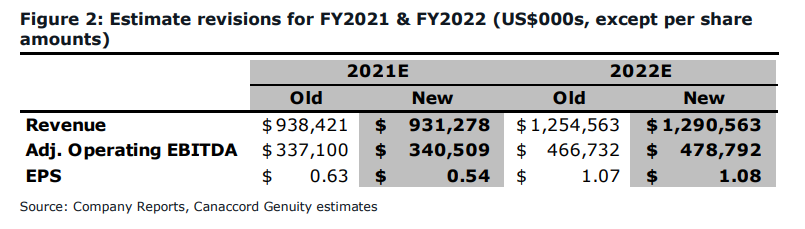

In Canaccord’s note, their analyst Matt Bottomley increases their 12-month price target to C$54, up from C$52, and reiterates their strong buy rating. Bottomley raised their price target off the back of this strong quarter and added in “modest contribution” from Virginia. A C$54 price target represents a 19.8x 2022 EV/EBITDA, while Green Thumb currently trades at 13.1x their 2022 EV/EBITDA.

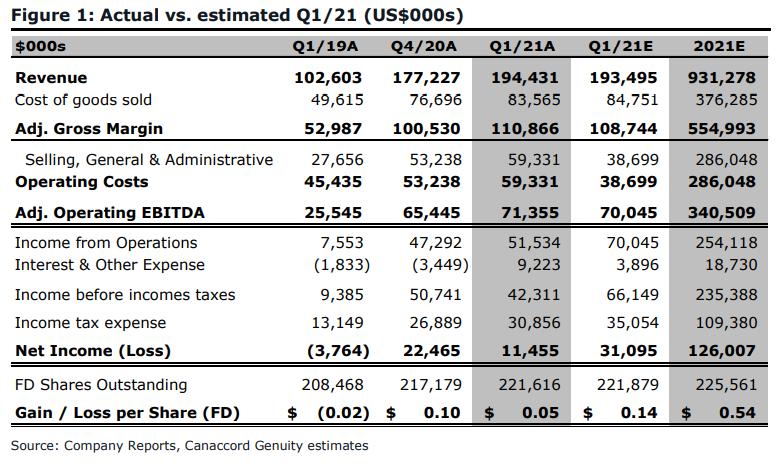

For earnings, the company now is running at an annual run rate of U$778 million in revenue and U$286 million in EBITDA. The companies results beat all of Canaccord’s estimates, which you can see below.

The beat is primarily attributed to the company opening five new stores during the quarter, two in Pennsylvania, one in Illinois, one in New Jersey, and one in California. Same-store sales were up a modest 2% quarter over quarter, which Bottomley believes is due to seasonality. Bottomley writes, “Although we believe GTI’s national exposure generally saw moderate gains to start the year, we believe Illinois and Pennsylvania continue to be the growth drivers of the business most responsible for its outperformance as of late.”

Green Thumb has the second-highest EBITDA numbers amongst its peers at U$71.4 million/36.7% margin, an increase of 9.2% quarter over quarter, while gross margins came in at 57% and SG&A came in flat, in terms of a percentage of revenue.

Bottomley says that Green Thumb has a healthy cash position, with the company ending the quarter at U$267 million in cash, with an additional $157 million closed during the second quarter. Management has mentioned that it will be using its U$217 million senior debt to pay down its U$105.5 million debt which has a higher interest rate.

Below you can see Canaccord’s updated 2021 and 2022 figures.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.