On March 17th, Green Thumb Industries (CSE: GTII) reported their fourth quarter and year end financial results. The company announced quarterly revenue of $177.2 million and full year revenue of $556.6 million. For adjusted EBITDA, the company announced positive $65.4 million and $179.6 million for the fourth quarter and year-end respectively. This was the companies second consecutive quarter of positive GAAP net income.

Green Thumb currently has 14 analysts covering the company with a weighted 12-month price target of C$56.04. This is up from last month, which was C$43.74. Three analysts have strong buy ratings, while the majority, 10 have buy ratings. One analyst has a sell rating. The street high comes from Craig Hallum with a C$74.40 price target and the lowest is from Roth Capital Partners with a C$45 price target.

In Canaccord’s note, they increased their 12-month price target to C$52 from C$47, while reiterating their speculative buy rating on the name. Matt Bottomley, Canaccord’s analyst, says the price target raise comes off the back off of “another very strong quarter,” and they are now expecting a larger revenue ramp in both Illinois and Pennsylvania after these results.

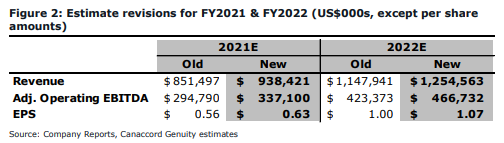

Green Thumb beat all of Canaccord’s estimates for the fourth quarter. Most notably, they beat Canaccord’s revenue estimate by ~$3.5 million and adjusted gross margin by ~$15 million. The bottom line beat was great as well, with net income beating by ~$16.5 million and EPS by $0.03 cents.

Bottomley says that the beat primarily came from the company’s leading position in Illinois and Pennsylvania even though same-store sales were down 6% quarter over quarter. He writes, “we believe GTI’s exposure in Illinois is one of the most material value drivers for the company at this time. We estimate that GTI is competing for the #1 spot in the market with a current share of >20% and 100% wholesale penetration.”

Below you can see the changes Canaccord has made to their 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.