Haywood Capital Markets recently became the latest firm to initiate coverage on Ascend Wellness (CSE: AAWH.u). The firm gave the company a C$16.50 price target, slightly above the Street consensus of $16.29, and a buy rating. Haywood says, “with only a fraction of its assets currently operational, we see room for continued margin improvement through late 2021 and into 2022 as well as strong revenue growth.”

Haywood’s investment thesis is pretty straightforward for Ascend Wellness. For the first point, they believe that the market is not properly looking at production catalysts. They believe that only a fraction of its assets are operational, and once fully operational, it will help drive revenue and margin improvement.

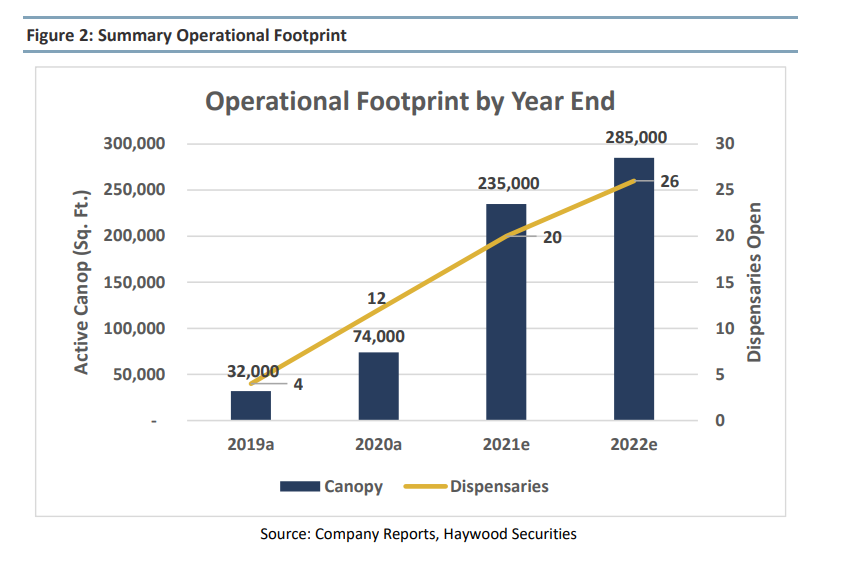

The company entered 2020 with 12 dispensaries and 74,000 square feet of cultivation. It plans to end 2021 with 20 dispensaries and 235,000 square feet of cultivation. The cultivation increase is expected to come from the firms key states of Illinois, Massachusetts, New Jersey, and Ohio.

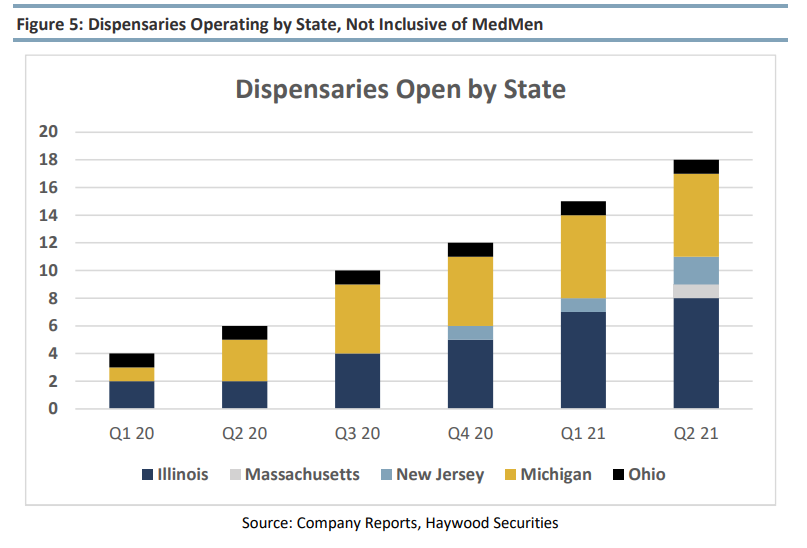

The second point is the business’s key focus on retail locations to drive strong store economics. The company has some key locations such as downtown Boston which is right outside the shopping district and southwest Illinois near St. Louis. The company has grown its transactions from 874,000 in all of 2020 to 573,000 in just the second quarter. Haywood says, “Ascend focuses on creating a premier shopping experience with flexible options including ordering for in-store pickup, appointments for guided shopping, and self-browsing.”

The third point is that the company is focusing on going deep into their operational states, and management expects to do M&A or organically to hit state limits. Ascend is currently operational in 5 states and has a pending acquisition to enter it’s sixth state, which is New York. Presently, Ascend has active operations in Illinois, Massachusetts, New Jersey, Michigan, and Ohio. Illinois, Massachusetts, and New Jersey all have great economics as supply has not reached up to demand, Haywood adds.

Additionally, Haywood points out that the company is trading at the lower end of both revenue and EBITDA multiples. The company currently trades at 3.1x 2022 revenue and 8.9x 2022 EBITDA, while its peer’s trade between 3-6x 2022 revenue and 10-15x 2022 EBITDA.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.