Earlier this week, Haywood Capital Markets initiated coverage on Bragg Gaming (TSX: BRAG) with a C$3.00 price target and buy rating. This comes after Canaccord initiated coverage back in February with the same price target but a speculative buy rating.

Neal Gilmer, their analyst, says that “the company has demonstrated impressive progress recently,” as the company has integrated many M&A names which adds new customers, a larger geographical presence, as well as lowering its concentration risk as now the top 10 customers make up 58% of the revenue versus 72% in 2019.

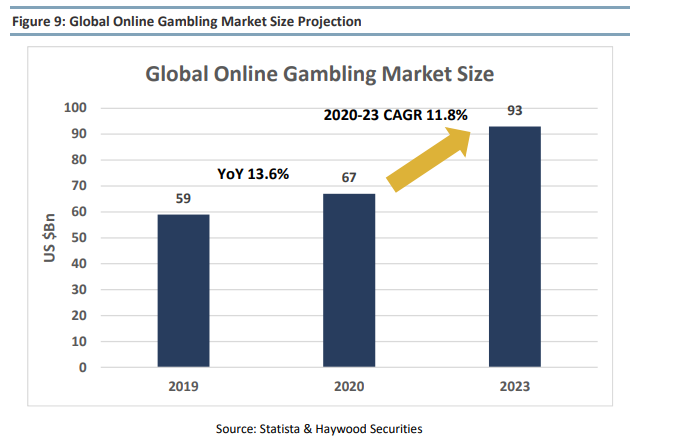

Gilmer expects that the global online gambling market size will grow from U$67 billion in 2020 to U$93 billion in 2023, or at a ~12% compound annual growth rate. He specifically points out the recently introduced Bill C-218 to the Senate in Canada which aims to allow single event or outcome bets as a form of legal gambling.

Gilmer highlights that the upcoming Nasdaq listing should be viewed as positive by investors as it allows for increased access to capital which will help bolster their balance sheet for additional M&A and to pay the earn-out agreements set in place.

Neil Gilmer says that the regulatory changes in Germany are expected to soften Braggs revenue and forecasts that the company will make C$74 million, or $49.3 million Euros, in 2021. This is slightly below the C$75 million management is forecasting themselves. They additionally forecast for 45% gross margins and a modest 7.5% EBITDA margin for 2021. Below you can see their full 2021 and 2022 break down, however note that it’s in Euros and they do not provide a conversion to Canadian dollars.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.