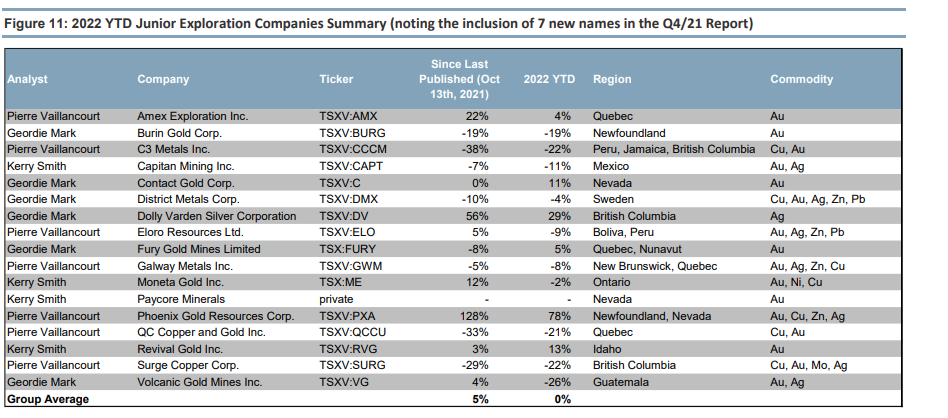

Haywood Capital Markets released its first junior exploration report for 2022. Since the company’s last update in October, only five out of their coverage group saw a positive reaction with the average return being -6%. They say that this provides investors with an attractive entry point as the group trades at historic lows relative to gold. They write, “We believe the junior segment offers deep contrarian value at a low-risk entry point.”

Haywood says that the companies in their universe are selected on a combination of factors, which include equity performance outlook, exploration news flow, and potential resource development. They say that the names in the universe continually changes on this factor, with 7 new names (Burlin Gold, Contact gold, Dolly Varden Silver, Fury Gold, Paycore Minerals, Phoenix Gold, and Revival) appearing on the list since the October publication.

For 2022, Haywood believes that gold is looking at a brighter outlook as there is momentum building in commodities over the next year. Most importantly, Gold has been able to hold above the $1,800 level, which allows producers to generate significant cash flow, ultimately returning capital back to shareholders. Additionally, they believe that gold will remain in a longer-term bullish uptrend.

Though, they believe that now is the time for producers to look for ways to either organically grow or find accretive M&A, especially with the large discount some developers are trading at compared to intrinsic value.

Therefore they believe that consolidation among the junior miners and exploration companies is just a matter of time.

Haywood expects that metal prices could come under pressure during the second half of this year, infrastructure spending and supply chain unclogging could help keep demand steady. Additionally, challenges developing new mines, lower inventories, and supply issues in Europe and China could help keep a supply in check they add. They note that China grew at a slow pace this year with GDP growing 4% year over year. They write, “Weaker year-end growth suggests China may struggle to match 2021 performance as demand eases.” They do expect that the government will continue to support the economy with additional stimulative policies.

Lastly, because of all of this, they believe that explorers and developers should benefit in this environment as “companies with stronger balance sheets seek to expand their pipelines of projects and broaden their portfolios.” They believe that the junior miner and base metal equities are oversold. They note that new active copper drilling projects fell to an eight-month low of 32, the same thing is happening with zinc.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.