As a means of softening the blow to the US economy and ultimately American’s wallets, the federal government has opened the money hose wide open, blasting trillions of dollars of stimulus funding in every nook and cranny of America. But such spending does not go without consequence. The sudden and drastic increase in the US money supply will inevitably lead to a wave of inflation to the point that the central bank will be at ends with how to stabilize the US dollar.

Bearish hedge fund manager Crispin Odey however, predicts the government could most likely revert to Depression-era solutions, according to a letter obtained by Bloomberg. One of those solutions involves the government purchasing privately-owned gold and then outlawing any further private ownership thereafter as a means of increasing currency value.

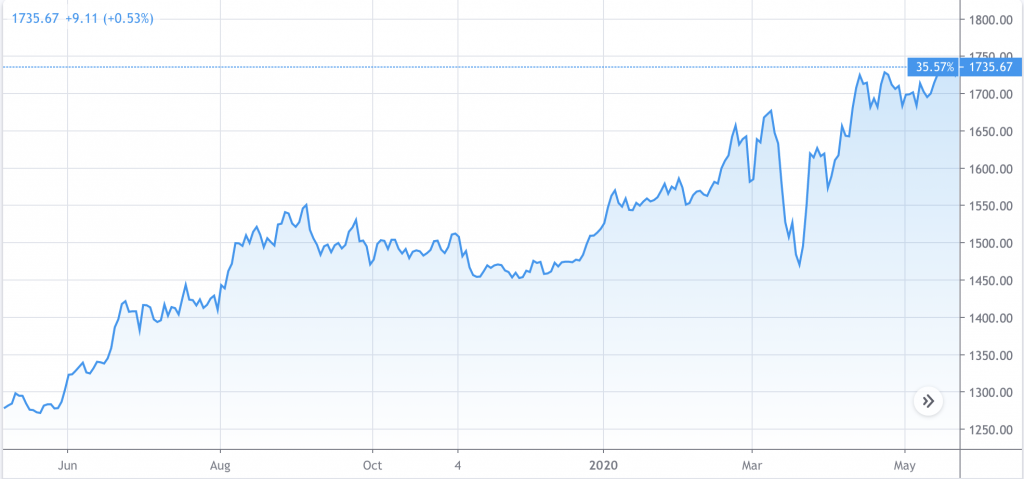

Back in April, Odey went on a shopping spree, and increased his gold holdings as a means of riding out the financial crisis stemming from the coronavirus pandemic. Now, the price of gold is heading towards historic highs, and many investors are flocking to the precious metal as a safe haven during such uncertain times.

But now, Odin is warning clients that gold trade could come to a halt, and its private ownership could become jeopardized. In the event that the government needs to secure a new store of value in order to resume world trade once the economy begins recovering, private gold ownership may become illegal. However, Odin predicts that inflation could spike to anywhere between 5% to 15%, creating a significant obstacle for the US government and the central bank.

Information for this briefing was found via Bloomberg, Markets Insider, and Trading View. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.