The rapid spread of the deadly coronavirus has caused governments to significantly restrict movement by imposing mandatory lockdowns and stay-at-home orders. As a result, the travel industry has been severely impacted, with some companies hanging on by the last remaining thread of income. Car rental provider Hertz Global (NYSE: HTZ) has been so negatively crushed by coronavirus restrictions, the company has defaulted on mandatory operating lease payments, laid off over 10,000 employees, and even begun preparations for a potential bankruptcy filing.

Much of the revenue Hertz was receiving prior to the pandemic stemmed from its strategically-placed locations at airports, which accounted for over two thirds of last year’s revenue. Now however, the number of consumers using air travel in the US has dropped by almost 95%. Hertz also rents its fleet of cars to those consumers getting their vehicles repaired at shops, but with stay-at-home orders being imposed across the country, the number of road collisions and vehicle malfunctions has also decreased. These severed revenue streams have thus put Hertz in an unfavorable financial situation.

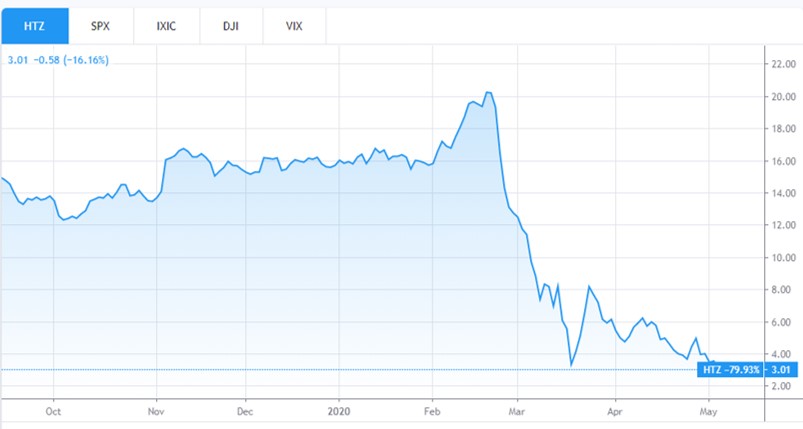

As of current, Hertz is $17 billion in debt, and its stock has dropped by almost 80% since the beginning of the year, with a 16% drop on Tuesday alone. The company was given a grace period by its senior lenders to get its financials in order which expired on May 4. However, Hertz can breathe a sigh of relief for a few more weeks, as that lifeline has been extended until May 22, which gives the company some extra time to come up with a financial strategy in order to overcome the negative impacts presented by the coronavirus pandemic.

Information for this briefing was found via CNN Business and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.