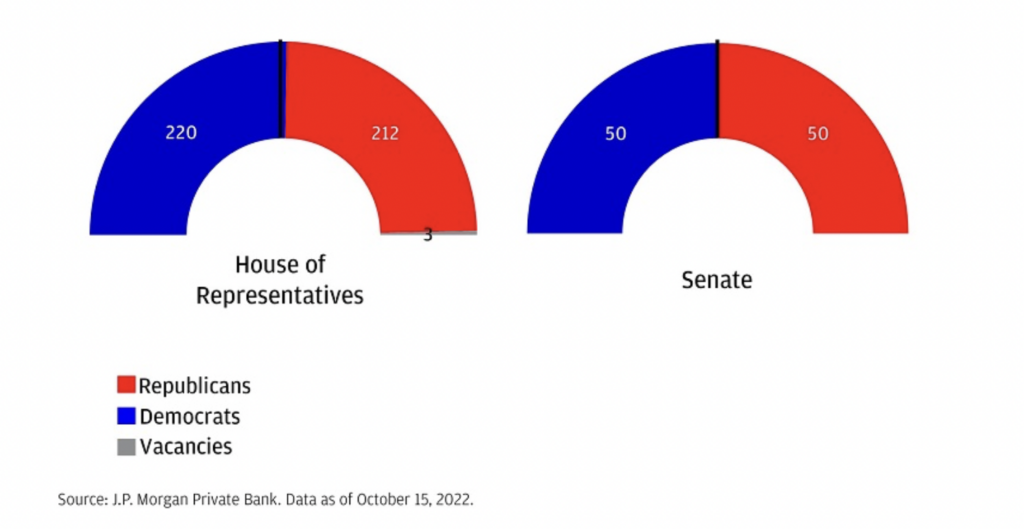

In addition to the Federal Reserve meetings and Consumer Price Index releases over the next few months, the November 8 U.S. mid-term elections could have major stock market implications. Democrats currently control each chamber by narrow margins.

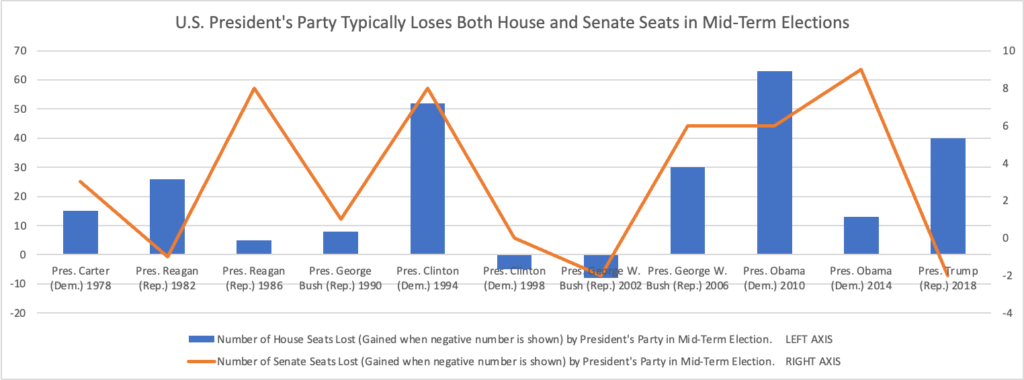

History shows that the sitting U.S. president’s party loses a substantial quantity of seats in both the House and Senate in mid-terms. Since the 1980 mid-terms, those losses have averaged more than 21 seats in the House and three in the Senate. If the 2022 mid-term results mirror these averages, the Republicans will have the majorities in both chambers as of January 1, 2023.

Such a result seems consistent with recent polling results. President Biden’s 39% approval rating is similar to his predecessor’s low mark at the same juncture in his term, and is markedly lower than other recent U.S. presidents at the time of mid-terms. In addition, soaring inflation seems to be a top-of-mind issue for voters of both parties, an inauspicious sign for Democrats.

If Republicans seize control of Congress (barring unlikely two-thirds veto-proof majorities), few bills of any substance seem likely to be passed by Congress and signed by President Biden before the November 2024 presidential election. Such gridlock could be appreciated by investors as any tax increases, significant spending initiatives, and fossil fuel regulations will likely be shelved for some time.

A Republican takeover of the House, coupled with the Democrats’ retaining power in the Senate, would likely have similar practical implication for future legislation. Little would get accomplished in the next two years in that scenario either.

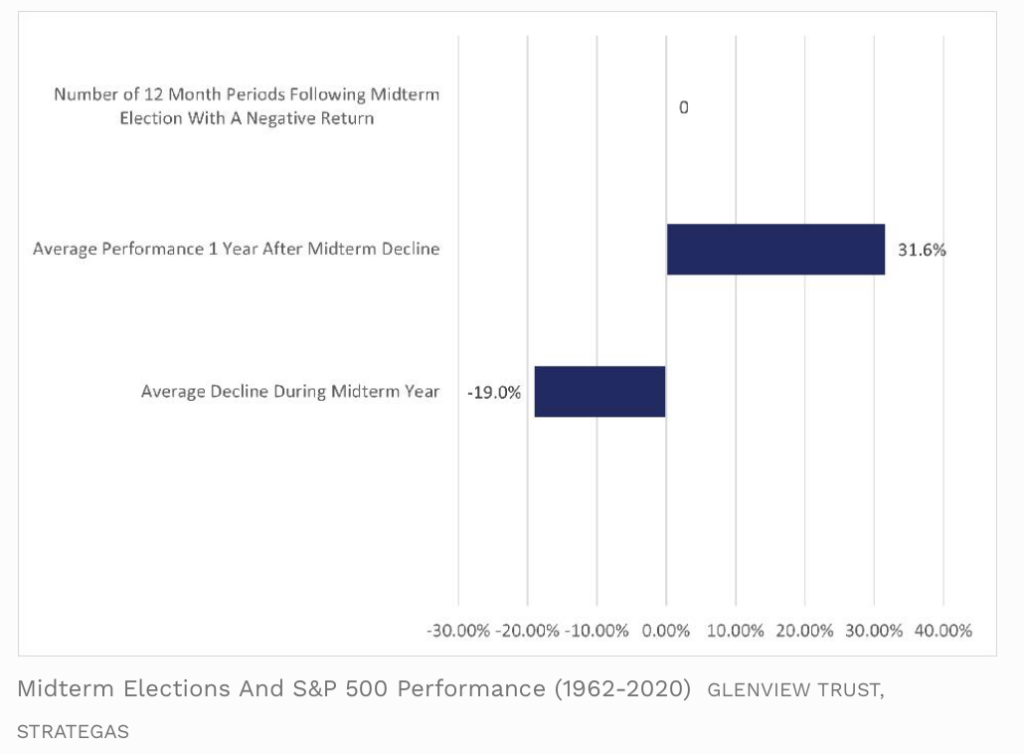

Interestingly, history also suggests that for stock market investors it may not matter which party prevails in the mid-terms, and that the overall stock market weakness seen so far this year is not that unusual. According to Strategas Securities, LLC, an institutional research firm, the S&P 500 has declined 19% on average during down stock market mid-term years leading up to an election, and has risen 32% on average over the twelve months after such a down market lead-in to a mid-term election.

Indeed, Strategas notes returns on stocks have been positive over the twelve months following every mid-term election since 1942. This statistic may be put to a stern test in 2023 if an economic downturn were to occur as many economists predict.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.