Canada’s de-facto futures housing market is backfiring for investors looking to make a profit on the country’s skyrocketing real estate values.

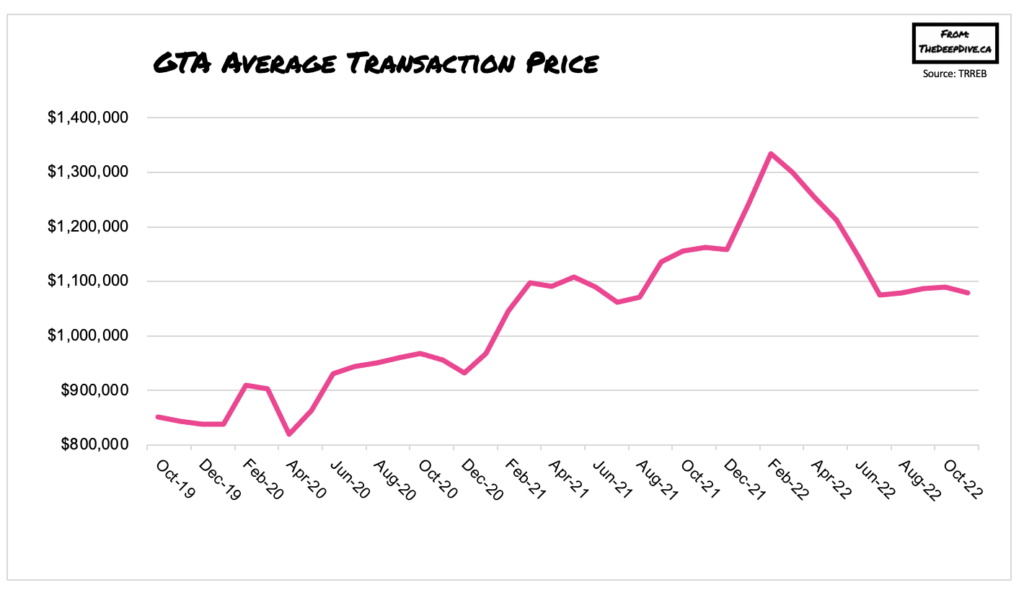

With interest rates rapidly on the rise and no sign of relief anytime soon, Canadian home prices are plunging across the country— leaving investors suddenly vulnerable to massive losses. When housing prices in major urban cities such as Toronto skyrocketed during the pandemic thanks to ultra-low mortgage rates and high demand, speculators flocked to buy contracts for pre-construction condos, with the intention of selling them before the units are completed and walk away with generous profits.

Just like Wall Street traders bet on stocks, commodities, and gold, pre-construction buyers were speculating home values would continue increasing, making it an easy— and seemingly sure-way— to make a nice profit. But, when the Bank of Canada embarked on an aggressive tightening cycle that brought the overnight rate from near-zero to 4.25% in less than a year, many pre-construction speculators were left stuck between a rock and a hard place. They either have to sell their contract at a loss, or abide by the obligation and take out a mortgage they likely can’t afford.

“What you’re seeing is a sizeable chunk of people who went out there and bought these condos thinking that it was an easy flip and an easy way to make money,” explained Jordon Scrinko, a real estate agent from Ontario, to Bloomberg. “Unfortunately there’s far more inventory than anyone expected, and the market isn’t where they were hoping.” Indeed, according to data from listing service Broker Pocket, the number of such pre-construction contracts for sale have shot up substantially, jumping by double in the six-month period through to September.

For eight consecutive months, home prices across Canada have been declining, particularly in the ultra-urban centres of Toronto and Vancouver. The only thing keeping home values from catastrophically slumping further is lack of inventory. However, the wave of pre-construction buyers looking to offload their losses could send the country’s real estate market into an even deeper tailspin. Data from Urbanation shows pre-construction contracts nearing completion sold by their original buyer increase supply in the condo market by as much as 13% in Toronto.

Arguably, though, the pre-construction condo fallout is also creating a paradox effect: the same issue threatening to increase supply is also laying the ground for a forthcoming housing shortage. Builders rely on pre-construction sales to shore up funding for new housing projects, but with a lack of investors willing to speculate on real estate values, soon there may not be an adequate level of new homes for Canada’s rapidly-growing population.

“Units that don’t launch for pre-sale today are units that aren’t delivered in about five years time,” Urbanation president Shaun Hilderbrand told Bloomberg. “The issue is that this is going to slow down the supply pipeline at the same time that immigration targets are being raised to record highs.”

Information for this briefing was found via Bloomberg and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.