As restrictions continue to be lifted across Canadian provinces, consumers have been flocking to the real estate market to take advantage of low mortgage rates and an improvement in the labour market.

According to the Toronto Regional Real Estate Board, housing sales have surged throughout the month of June, with a total of 8,701 signings. This represents a seasonally adjusted increase of 84% compared to May 2020, and only a 1.4% decline compared to the same time a year prior.

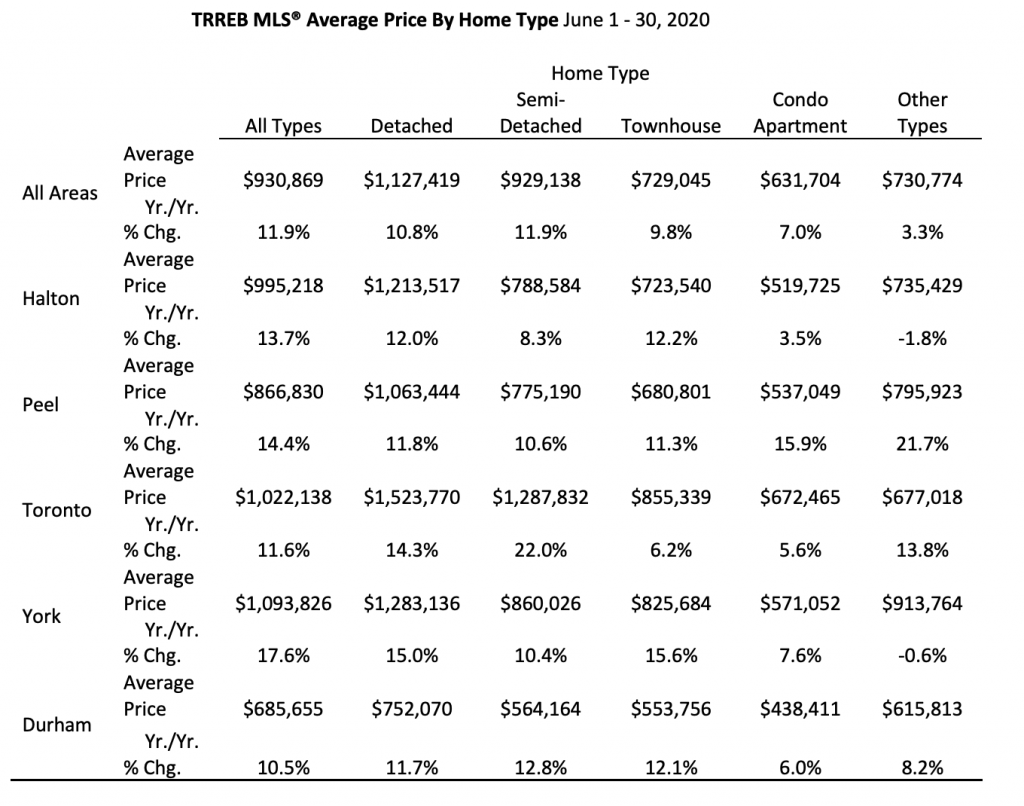

As with the sudden increase in housing sales and ultimately increase in demand for housing in the Greater Toronto Area (GTA), comes a corresponding upsurge in prices. The MLS Home Price Index Composite Benchmark increased by 8.2% on a year-over-year basis for the month of June, with the average selling price in the GTA averaging $930,869. Moreover, average selling prices for all different kinds of home types increased on a year-over-year basis, with the strongest surge in pricing recorded in the detached and semi-detached markets in the City of Toronto.

Following the reopening of non-essential businesses, sellers have also begun entering the real estate market once again. New housing listings have increased slightly on a year-over-year basis by 2.1% for the month of June. However, when compared to the same time only a year prior, active listings were down 28.8%. As such, the continued housing shortage attributes to the sudden surge in housing prices.

Going forward, the Toronto Regional Real Estate Board anticipates housing prices to continue on much the same trend as was reported for June 2020. If market conditions remain on a positive incline, the housing prices could very well remain above $900,000 for the rest of the year. However, such guidance assumes there is not a second wave of the coronavirus, and that restrictions continue to be lifted at the current pace.

Information for this briefing was found via Bloomberg and the Toronto Regional Real Estate Board. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.