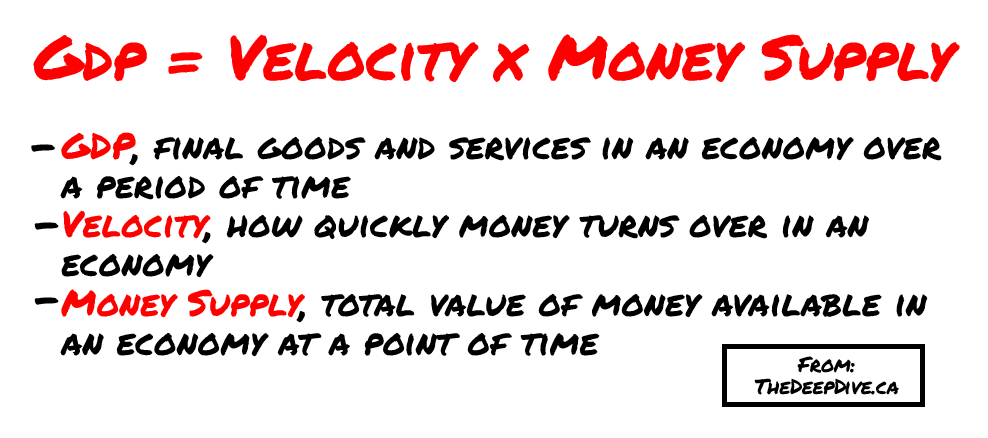

When trying to wrap my head around economics, I like to simplify basic principles down their nuts and bolts. A formula that has always resonated with me is GDP = Velocity x Money Supply.

In essence:

This basic principle is central to Modern Monetary Theory. The concept is simple. The measuring stick is full employment; equilibrium between job seekers and job creators. From the governments perspective, if the economy is too hot (beyond full employment), you reduce the money supply via increasing taxes or sale of treasuries. Conversely, if the economy is too cold (below full employment), then do the opposite, increase the money supply via reducing taxes and buying securities.

The major difference between what we have today and MMT is the wall between central banks and fiscal decision makers. With recently announced measures, we are beginning to see those walls get smashed down.

Where Are We Right Now?

Things are bad. Catastrophic. We haven’t seen jobless claims or declines in productivity like this ever. Over the course of 3 weeks, we’ve seen depression level declines for almost every area of the economy absent for staple food products and essential services. Buckle up, the world is about the change. Politicians are no longer asking us to shutdown the economy; they are forcing us to.

We’ve seen 10 million Americans make jobless claims in the last two weeks, the Italian service sector close its doors, AirBnB listings flood the rental market, oil down nearly 70%, and global stock markets shed $12 trillion dollars of fat. Many politicians are now admitting this could go on until August. In other words, we’re just getting started.

Last night, Bernie Sanders said on Real Time with Bill Maher that a ‘Great Depression like’ scenario is possible. And this morning I woke up to a text from my friend Muddy who said, ‘Depression is guaranteed.’ This would have all been crazy talk just one month ago. Now it’s starting to sink in.

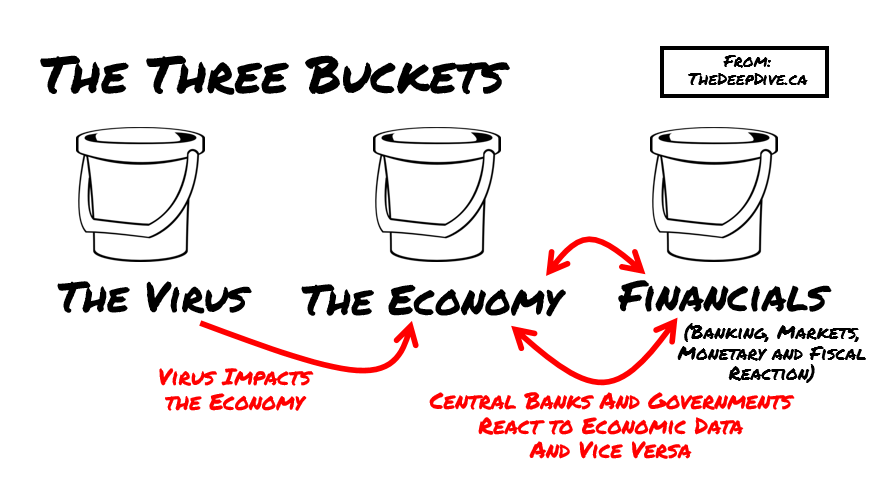

The Three Buckets

We have to look at the Coronapocalypse in three buckets. The Virus, the Economy, and the Financials.

First there is the virus. In order to stop the virus, we basically need to stop living our normal lives. Meaning we need to shut down the economy, and focus on keeping it together until the restart. The tool-set to do this will involve a combination of monitoring data, adding liquidity via central banks, and spending taxpayer dollars on government programs.

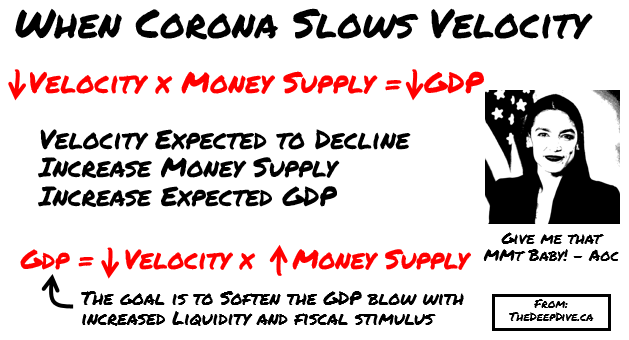

Velocity Has Come to a Grinding Halt

When you shut down the economy, you are really shutting down velocity. This is where economics get interesting. A recent MNP study showed nearly half of Canadians believed they were insolvent before the crisis even began. So if their income gets shut down for more than a month, they can’t pay their bills. Economically speaking, money won’t be exchanging hands, and velocity is toast. GDP would likely see more than a 50% annualized decline in the quarter.

So what’s a government to do? Remember, GDP = Velocity x Money Supply.

Jack The Money Supply Baby!

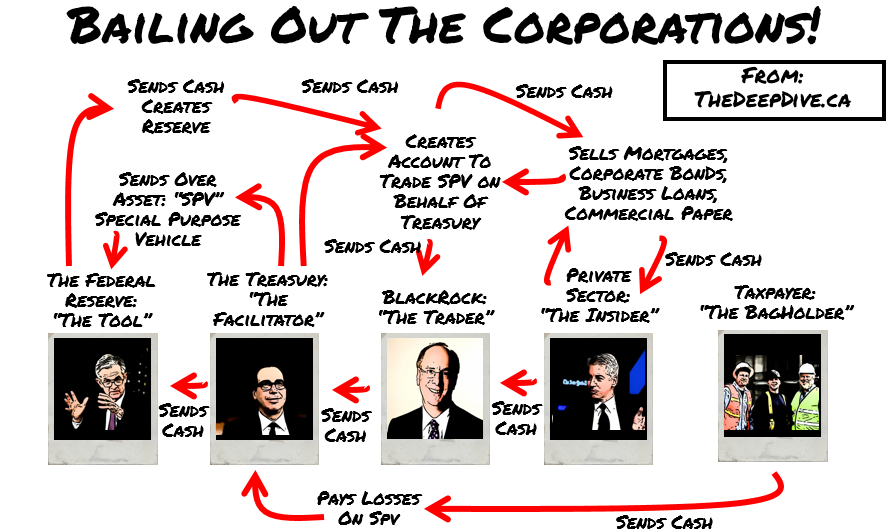

Our great leaders will turn on the printing presses and start handing out cash to everyone. They will offer loans to their 24 primary dealers, buy treasuries and agency debt and offer debt facilities for pretty much everything. And that’s just the central bank!

In a piece I wrote last weekend, I broke down how the loan facilities will work. Regardless of if the money comes from the fiscal end or monetary end, the tax payer is on the hook.

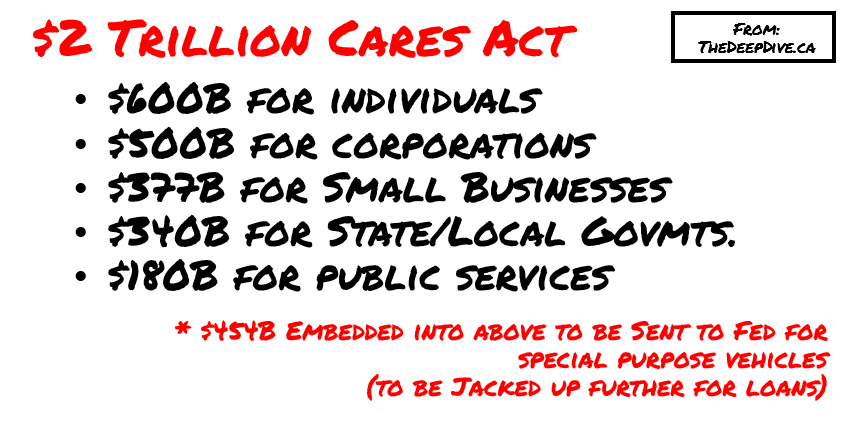

And on the fiscal side, the US government has already started with a two trillion dollar program called the CARES Act:

So overall, the Fed and the Treasury are looking to do somewhere in the ballpark of $6 trillion dollars between each other; with mumblings of more in the works. Which will increase the money supply and offset the reduction in velocity.

And What Are the Side Effects?

Eventually the economy will kick back on and velocity will speed back up. Let’s assume the monetary supply is now over 2x the size it was before the pandemic started. If we go to the same productivity as the pre-corona level, then expect twice the GDP. So in theory, we could have twice the GDP as before with no change in pre-corona productivity. What’s the difference you ask? Inflation.

The variable we can’t account for in economics is human behavior. History has taught us that when prices start rising at hyperinflationary levels, people want to get rid of their money as fast they receive it, speeding up velocity even further, known as runaway inflation.

How Likely Is Hyperinflation?

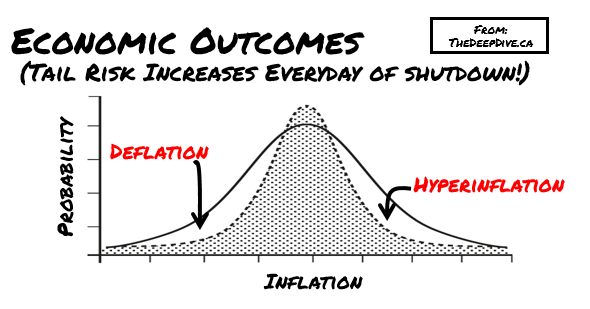

The longer the economy stays shutdown, the more money we will print; increasing the risk of this outcome. In our view, we are starting to build our portfolio around precious metals to help hedge this risk. We believe that pegging the US dollar back to gold is a relatively high potential outcome. Except this time gold will be pegged at a much higher value than today’s prices.

In the end, no one really knows how this will play out. The US is seeing the effects of a 22 trillion dollar economy shutdown for what could be anywhere from 3 to 18 months. The measures taken by leaders, create a real time experiment that is fattening the tail risk with every passing day. You’re damned if you do, you’re damned if you don’t. In the aftermath, watching governments attempt to unwind such large measures in real time will be the focus of economists around the globe.

Information for this briefing was found via the provided links. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

You nailed it el SmallCapO.

I’m more on the side of deflationary collapse. Will need a tremendous amount of helicopter drops to get hyperinflation.