iAnthus Capital Holdings (CSE: IAN) is looking to change the narrative. The equity as of late has been pummeled by investors as it continues to free fall, despite its dedication to continuing to execute on its strategy. A large part of this still stems from the issue earlier this year, wherein iAnthus elected to reprice a number of options in favour of management and employees at a much lower price point.

Although it fixed its mistake as soon as the pushback began from investors, the damage had been done to the firm in terms of the respect it is viewed to have for its stakeholders. The firm has worked towards repairing that narrative, and it took a further step this morning when it announced that it had eliminated its dual class share structure. Previously, two classes existed for iAnthus shareholders, common shares, and Class A Restricted Voting Shares. The latter was held by management, effectively to hold more control on the firm.

However, in reaffirming its commitment to shareholders, the executive management team has taken the uncommon step of converting all Class A shares to that of common shares, and effectively cancelling the Class A class entirely.

We believe that all our shareholders are well served by transparency. With this change, we are effectively eliminating our dual class equity structure with different voting rights and moving to one class of common. Unlike multiple voting share structures which are prolific in the industry and aggregate voting power in the hands of certain controlling shareholders, our capital structure is simple. Specifically, all the Class A Shares were converted to common shares in an even exchange and the shareholders have the same voting power per each common share held. We believe this structure is simple and easier for shareholders to understand and will clearly align all shareholders by having all shareholders owning the same class.

Hadley Ford, CEO of iAnthus Capital

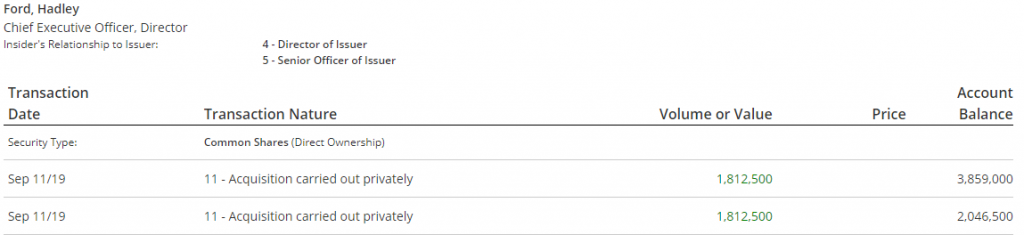

In total, over 13.5 million shares were converted among members of management – which explains the perceived “selling” that was filed by CEO Hadley Ford among others yesterday after the bell. Screenshots of the selling quickly spread like wild fire on social media, wherein many investors were concerned that the CEO of iAnthus among other members of the executive team were selling out their massive positions within the company. This however was not the case, as it was simply a filing required by security regulations to identify the class change of managements holdings.

iAnthus Capital Holdings closed yesterdays session at $2.68 on the Canadian Securities Exchange.

Information for this briefing was found via Sedar and iAnthus Capital Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.