Despite optimistic vaccine rollouts that are beginning to unfold across many parts of the world, several key commodities will still remain subdued for the foreseeable future.

According to IHS Markit vice chairman Daniel Yergin, the global demand for oil will likely not reach its pre-pandemic levels until the end of 2021 or even early 2022, despite positive vaccine news developing across developed countries. In an interview with Al Arabiya English, the energy expert’s expectations coincide with previous forecasts released by the International Energy Agency (IEA) and OPEC, both of which are not anticipating oil demand to rebound by next year.

In its monthly Oil Market Report released earlier in December, the IEA expects that the continuation of reduced jet fuel demand will ultimately contribute to approximately 80% of the 3.1 million-bpd oil demand gap in 2021. Likewise, OPEC also downgraded its December oil demand forecast for 2021, and is now anticipating that oil demand will only reach 95.89 million bpd, a decrease of 410,000 bpd from November’s projection.

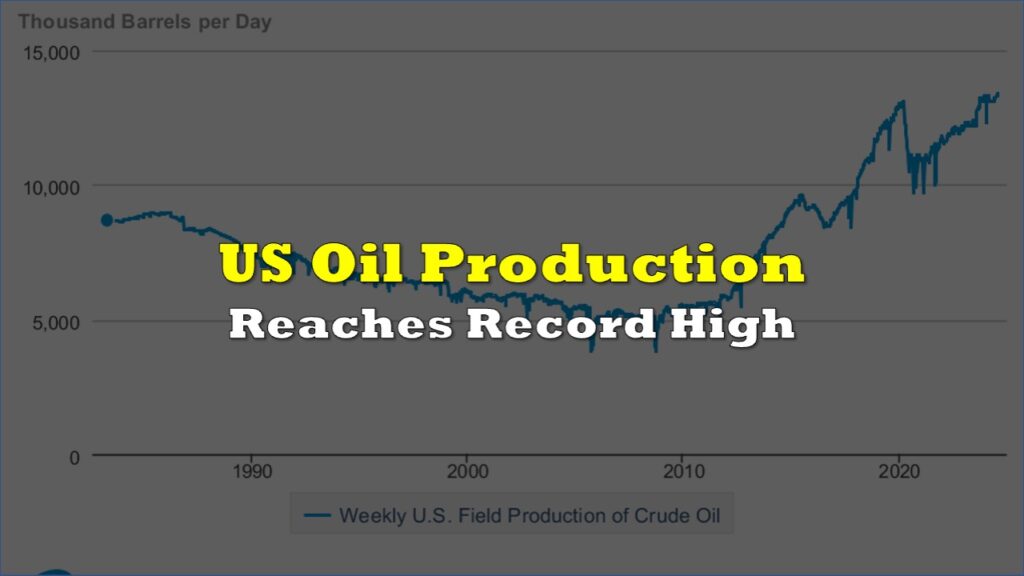

However, despite the disruptions in oil demand come next year, Yergin does not foresee it having a substantial impact on peak oil demand, which is expected to hit come 2030. The Pulitzer-Prize winning author also touched base on the state of the US shale patch, and its likelihood of returning to pre-pandemic growth. “Let me give you a very simple answer, the answer is no,” he told Al Arabiya English, with regards to whether or not US oil production has the potential to return to its 1.5-million-bpd yearly growth.

IHS Markit previously forecast that US shale production will remain relatively unchanged at approximately 11 million bpd until at least the end of 2021, before a moderate increase enters the horizon. However, according to Yergin, “that 1.5 million barrels per day, that two million barrels per day that was so disruptive for the oil market, that’s history.”

Information for this briefing was found via Al Arabiya English. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.