Indonesian Investment Minister Bahlil Lahadalia floated the notion of an alliance of nickel exporting countries at the Group of 20 Summit in Bali this week. The minister argued that the international organization would assist to harmonize national policies on the in-demand battery metal.

The OPEC-like proposal was discussed by the Indonesian minister with counterparts in Australia and Canada–two of the world’s top nickel producers. Both hint at not supporting the formation of the organization.

While Minerals Council of Australia CEO Tania Constable acknowledge that it is “very useful that countries work together to solve the problems that we have around the supply of critical minerals,” she also said that Canberra will always be mindful of its international trade obligations.

“And you don’t see cartels forming,” she added.

According to a government official familiar with the situation, Canada is also unlikely to sign on to the proposal for a nickel alliance. Further, the official said Trade Minister Mary Ng refused to engage on the concept when she met with her Indonesian colleague.

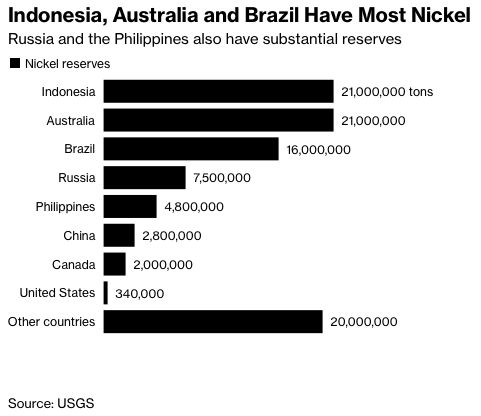

Unlike the actual OPEC, the top nickel producers in the world come from different continents. But should it materialize, the cartel would probably be led by countries with the most reserves–where Indonesia and Australia approximately have a tie.

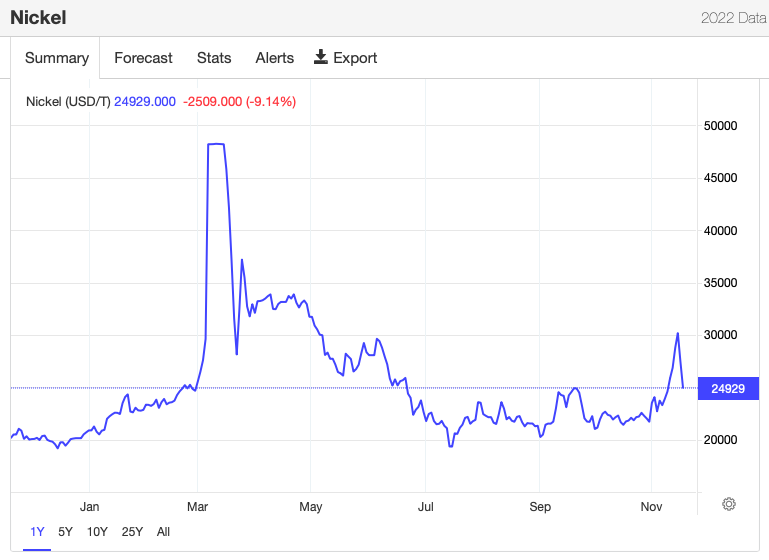

Nickel markets have returned to frenetic volatility, with the LME benchmark falling over 20% in the previous two days to $25,000 per tonne after reaching a six-month high of around $30,000 earlier this week.

In August 2022, LME suspended from its approved warehouses Russian nickel exports dated on or after July 20, related to the ongoing war with Ukraine. The move follows an earlier decision to ban other Russian metals including copper, lead, primary aluminum, and aluminum alloy from British warehouses.

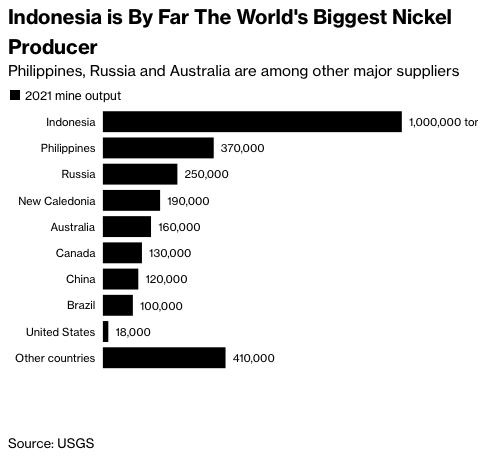

Russia is the world’s third largest nickel producer after Indonesia and the Philippines.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.