Back in August, the Federal Reserve revealed a new model to meet inflation targets, called flexible Average Inflation Targeting (fAIT), which is supposed to be a more relaxed approach in bringing inflation to target over the duration of the business cycle. When utilized, the central bank will overshoot its target rate during expansions, to make up for deflation during economic downturns.

However, in order for the scheme to work, inflation rates will need to be low enough during the economic downturn, so that when the expansion does occur, the overshoot will be feasible and will not occur immediately. Although the Fed appears optimistic that the model will be effective, there is one problem that is being severely overlooked: both wage and goods inflation has been rising substantially over the past several months, despite official CPI figures. As a result, the Fed’s overshoot inflation target could be put in peril as early as 2021.

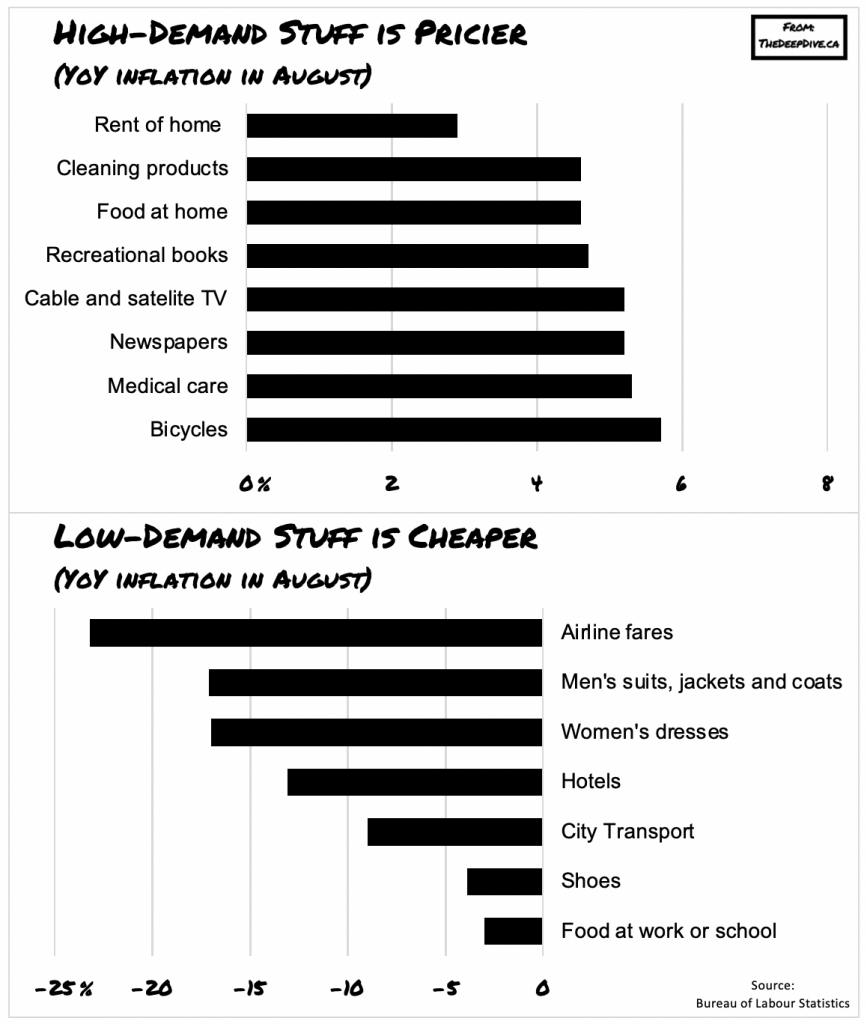

Although official CPI figures suggest that the US economy is going through a deflationary period, it doesn’t take long to realize that inflation has already set in for the goods that Americans are actually buying. The divide between the official annual inflation rate of 1.3% measured in August is becoming increasing diverged from the actual increase in prices of goods and services that everyday Americans are allocating their income towards.

The items that are in high demand during the pandemic have been subject to soaring price increases, while the items that are no longer being purchased are going through a deflationary period – but are still being accounted for in official CPI calculations. As Harvard professor Albert Cavallo notes, the true cost of current inflation is actually significantly higher due to sudden changes in consumer behaviour brought on by the coronavirus pandemic, something that the US Department of Labour has thus far overlooked.

With many more Americans spending their time at home, their income allocations have undoubtedly changed since the beginning of the year. Take for example those individuals that have been working from home: their food costs have increased by a staggering 4.6%, while prices of cafeteria food that once was a breakfast, lunch, and sometimes even dinner staple for many, has fallen by 3%. Although food prices are considered volatile, the emerging pattern holds for other categories as well.

The sudden and considerable changes in consumer buying habits as a result of the pandemic have brought attention to some of the fundamental underpinnings of the current inflation/deflation debate. Some economists argue that the official method used to measure CPI figures is not a true representation of most recent consumer behaviour, given that the index is based on a survey of what households are buying relative to spending patterns from several years prior. In addition, CPI is used to regulate social security payments, and is also the reference rate for various financial contracts such as Treasury Inflation Protected Securities (TIPS).

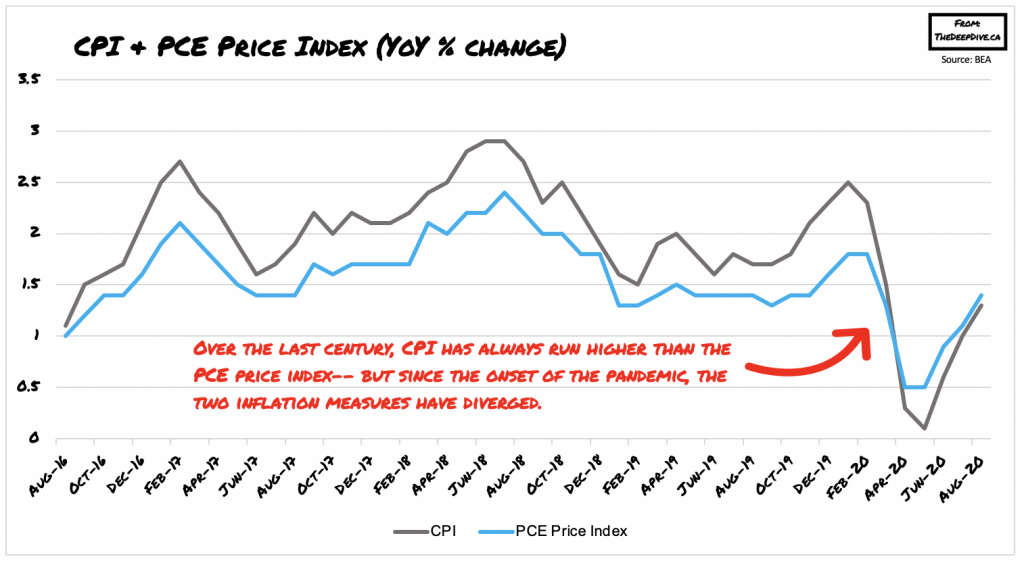

Conversely, the personal consumption expenditures price index (PCE), which is often overlooked in headlines, is used by the Federal Reserve and is based on surveys of what businesses are selling during a specific time period. Although both the CPI and PCE follow similar trends, over the last century CPI inflation has run several percentage points higher which can be attributed to the fundamental differences in the composition of the respective basket of goods. However, this year, which not only is the subject of a recession but a global pandemic that is making the economic landscape significantly more volatile, the two inflation measures finally diverged.

Although many economists debate on what will occur next, the current reality is that prices are swiftly rising for the goods that Americans need the most, while declining for the goods that are declining in demand. Nonetheless, the Fed does not consider this emerging phenomenon to require additional financial measures, even though for the average American the price surges are becoming increasingly difficult.

As a result, the implementation of the Fed’s Average Inflation Targeting model will certainly come with its own set of headaches, given that no one in a position of aptitude can agree on the true rate of inflation amid the pandemic – except the American people of course, who certainly are the only ones that can attest to the rapidly increasing prices on the things that they actually need…

Information for this briefing was found via the National Bureau of Economic Research, the DOL, and the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.