The uranium business continues to grow (from a low level) and, perhaps equally important, garners increasing investor attention. For example, on March 31, two uranium developers which trade on the Australian exchange, Deep Yellow Limited and Vimy Resources Limited, agreed to merge in an A$658 million share-for-share exchange. The merged company will have two advanced uranium projects in separate Tier-1 mining jurisdictions, Australia and Namibia.

Furthermore, the next day, another Australian-listed uranium mining company, Paladin Energy Ltd., raised A$200 million of new equity from investors. The proceeds will be used to fund the restart of its Langer Heinrich uranium mine in Namibia. Commercial uranium production is expected begin sometime in 2024.

Spot uranium prices continue to trade near an 11-year high, at around US$58 per pound. Prices rose about US$13 per pound in March alone on Russian supply fears. Uranium prices were confined to the US$25 per pound range as recently as early 2020. (We do note that spot uranium represents only a fraction of the uranium used worldwide; most transactions are done via long-term contracts.)

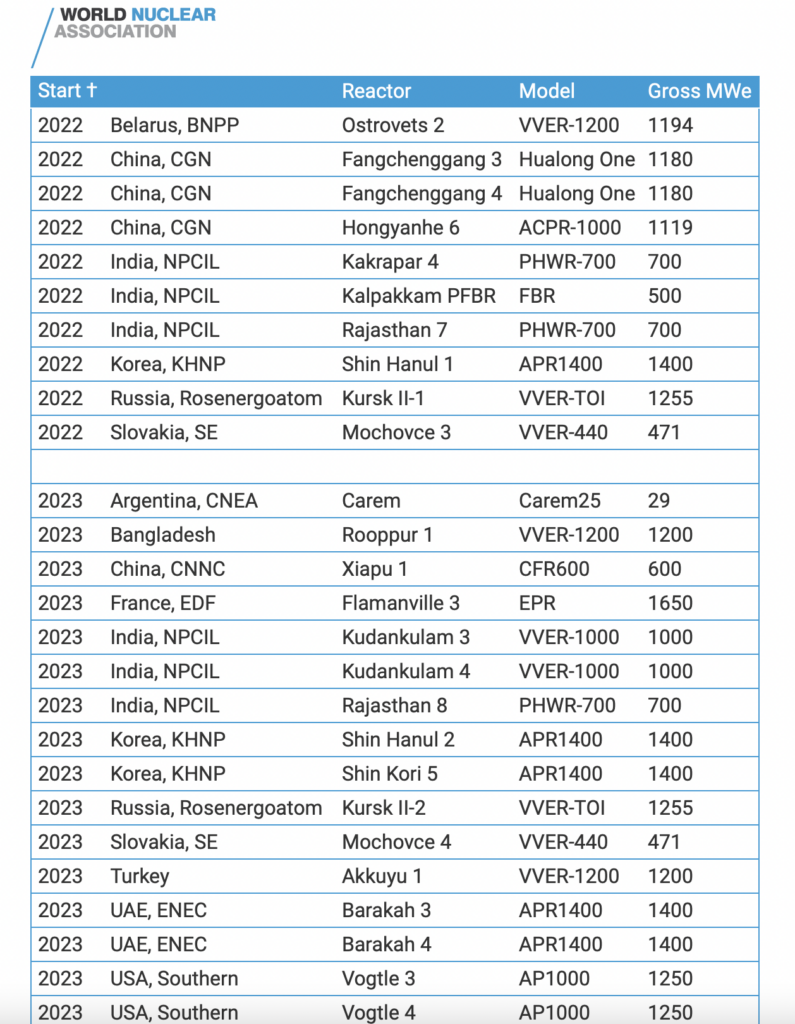

When viewed over the medium to longer terms, uranium prospects look bright. Approximately 55 nuclear reactors are currently under construction in 19 countries. Ten of those units with total generating capacity of around 9,700 megawatts (Mw) are expected to enter service this year.

Uranium prices may also be bolstered in the longer term by European countries’ cutting exposure to oil and natural gas supplied by Russia. For example, UK Prime Minister Boris Johnson has said he expects to have some small new nuclear facilities operating in the country by 2030, and he hopes that nuclear power accounts for about 25% of Great Britain’s fuel mix by 2050, up from around 15% today.

Separately, several Republican U.S. senators from western states have introduced a bill that would require America to establish a national uranium reserve. This could potentially allow long-dormant U.S. mines to restart and help, in time, to reduce U.S. purchases of Russian uranium. The U.S. as a whole now mines very little of the uranium its commercial nuclear plants consume. U.S. production has been falling dramatically for the last six to seven years, and now it is so low that the U.S. Energy Information Administration generally does not release the total amount produced.

The uranium investment space promises to remain quite active for the foreseeable future. The Russia-Ukraine war seems to have catalyzed incremental investor interest, but the bigger positive seems to be a consistent stream of new nuclear plant openings over the next five years.

Information for this briefing was found via Edgar and the companies mentioned. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.