If there’s one thing the market learned from Canopy Growth Corp. (TSX: WEED) (NYSE: CGC)‘s February 14 report of their (fiscal) Q3 financials (period ending December, 2019), it’s that there are still elements of the market and the financial press who want to believe. In the capital markets, it’s best not to under-rate that.

The 15% rally on earnings day brought out a digital fist pumping from Ben Smith, who celebrated by invoking a famous summary execution.

Who knows how fleeting/lasting this rally could be, but for 1 day at least, battering up #cannabis shorts has to feel good.

— Benjamin A. Smith❄️ (@BenjaminA_Smith) February 14, 2020

– The Saint Valentine's Day Massacre was the 1929 Valentine's Day murder of seven members and associates of Chicago's North Side Gang. $CGC $WEED pic.twitter.com/ii8k9JsR5Y

Weed’s $4.10 gap up Friday took it above its moving averages on 9 million shares worth of volume.

Is the optimism warranted? Let’s go to the charts.

Operations

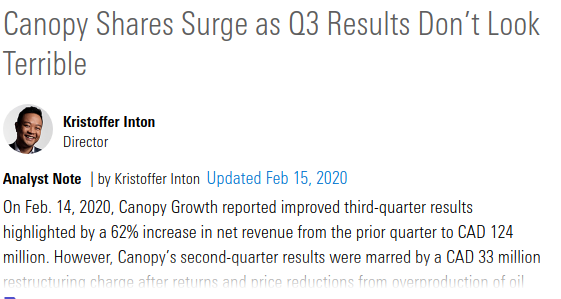

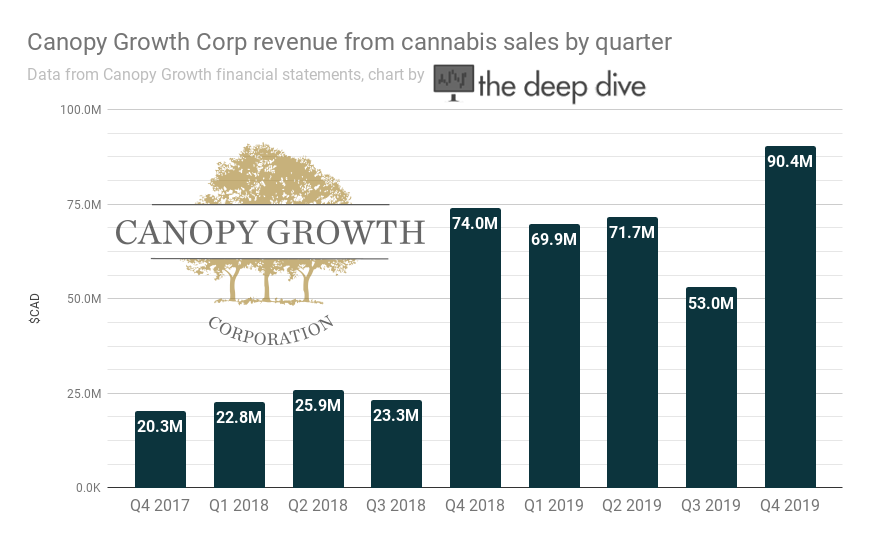

The sexy upshot here, quarter over quarter, is a 60% jump in gross revenue, an 80% leap in revenue from cannabis, and what appears to be a massive improvement in company-wide gross margin, from an embarrassing -13% to a respectable 34%. That’s a tremendous turnaround in just one quarter! As usual, this column is most interested in the unit sales…

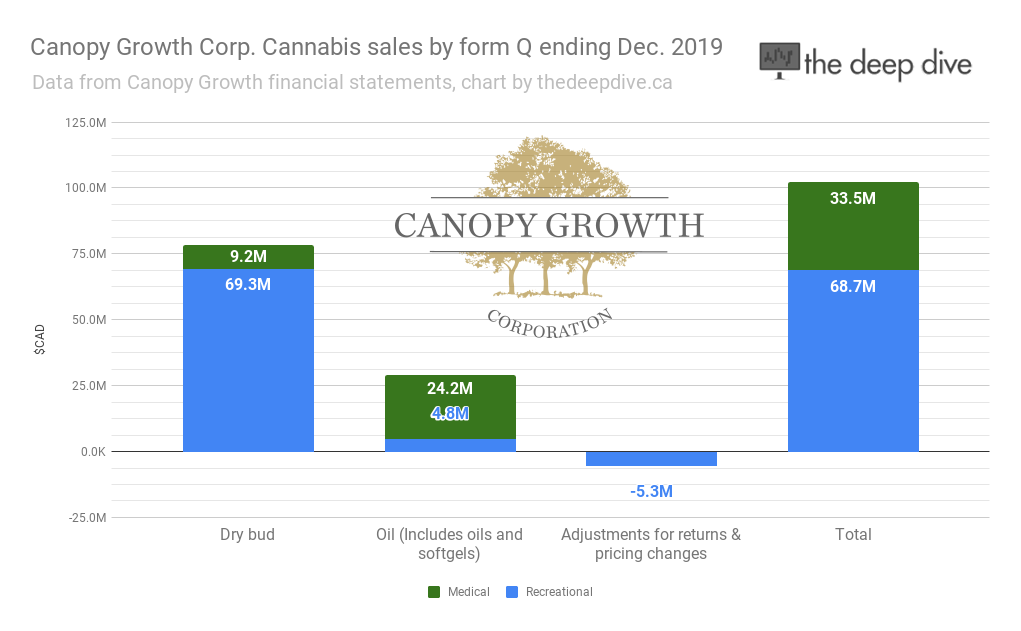

…where Canopy appears to have done just fine. Volume was up slightly across all unit segments. We were looking for a big jump somewhere, but they’re all in line with the September quarter, proportionally, in terms of both revenues and units. The per-unit gross is up a bit, but not much… so what gives? How did Canopy get an 80% revenue bump out of a 20% sales bump?

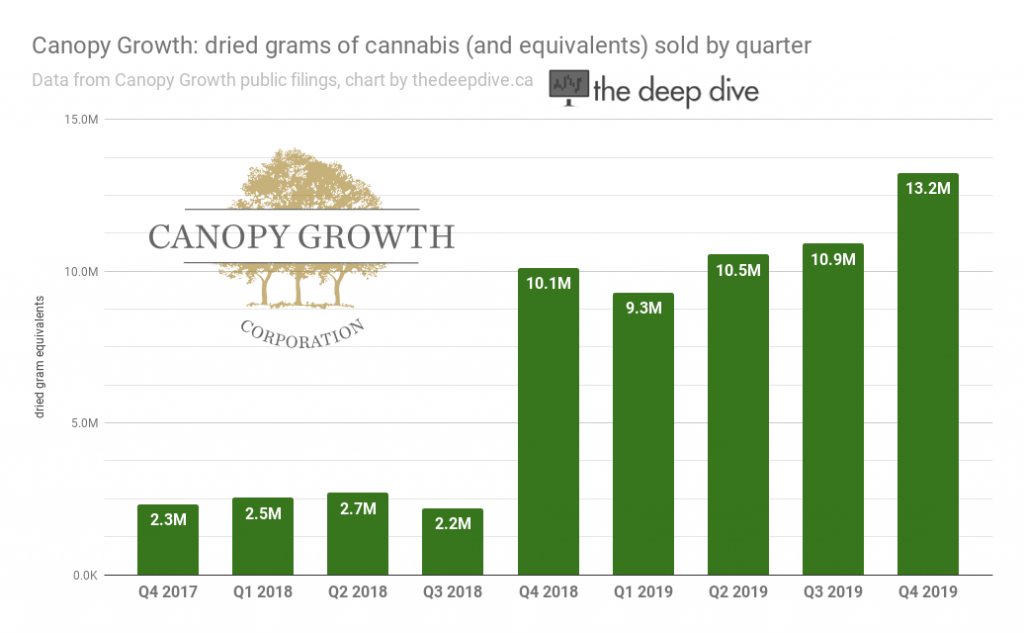

Returns, that’s how.

Canopy sandbagged themselves in the September quarter with a $32.7 million provision for returns. Put into perspective, that was about a third of their total cannabis sales at the time. Canopy attributed it to a projected over-supply of oils and soft gels.

In the December quarter, the company allowed for only $5 million worth of returns, and didn’t specify where they might come from.

| Segment | $ / g |

| Recreational | 5.79 |

| Canadian Medical | 7.16 |

| International Medical | 49.34 |

Meanwhile, the product Canopy sells to the international marketplace fetch the highest per-gram price of any of their verticals, and oil and softgells made up 72% of Canopy’s overseas medical take in the December quarter.

Overseas medical represents 17% of the gross revenue, but only 10% of the sales by weight, so it would make sense for Canopy to focus on growth in that market. December was the first full quarter of revenue from C3 – the company’s German division.

Inventory

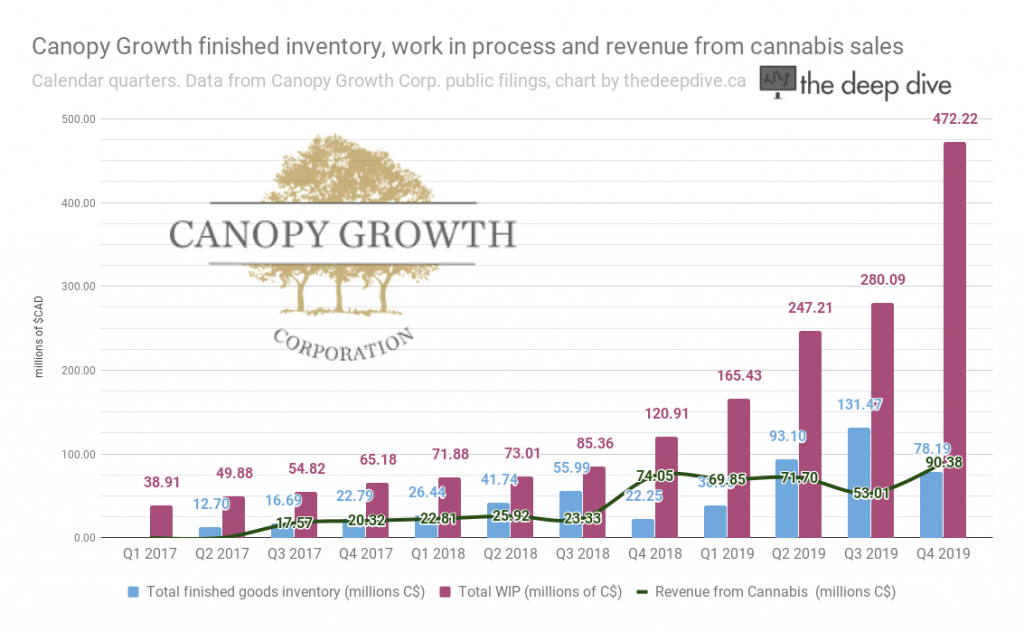

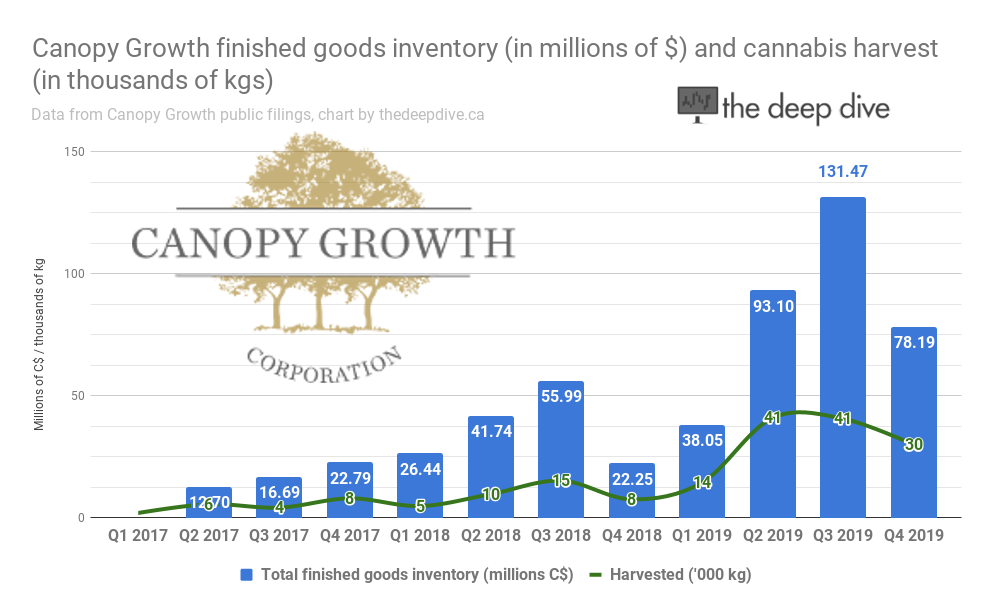

Canopy’s inventory profile shows yet another leap in work-in-process inventory in Q4. The 68% jump is the largest since we’ve tracked it. The finished goods profile is moving in the opposite direction, falling 40% to $78 million in book value.

This seems to indicate that Canopy is in fact able to sell the inventory that it has packaged up, at least. It’s hard to know if the associated 26% fall in harvest is relevant, but we include it because it might be significant. Canopy’s team may have reasoned that they have quite enough unprocessed inventory.

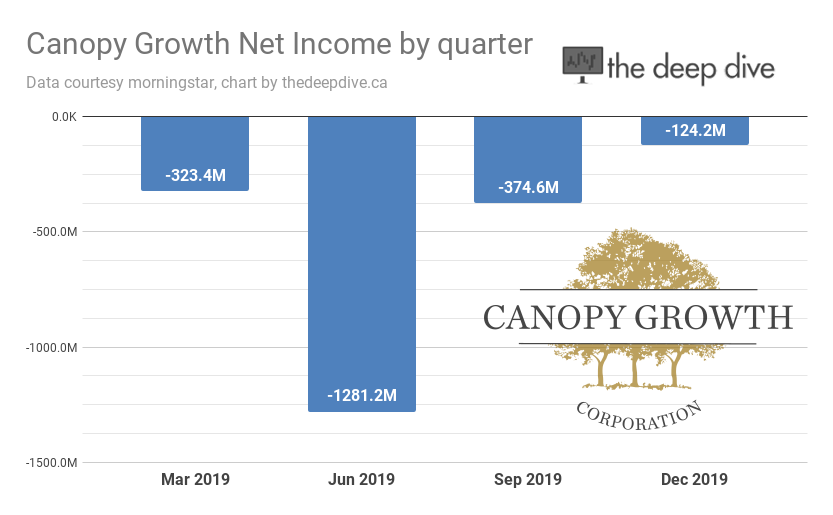

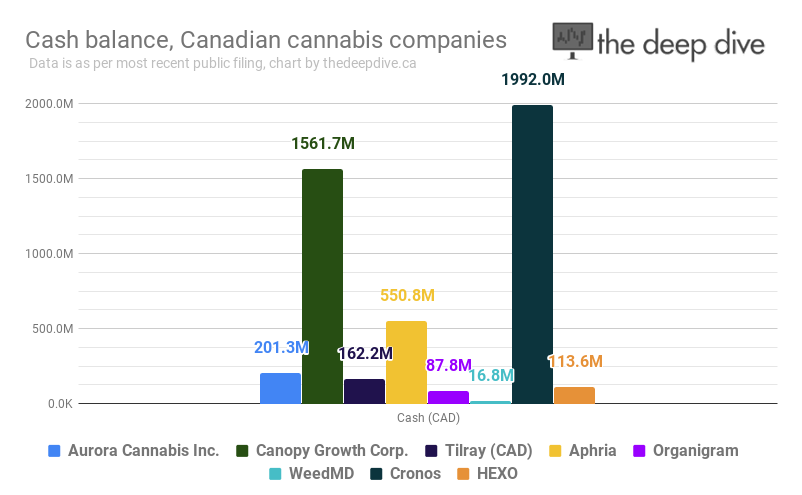

In an ops context, Canopy’s big quarter is starting to look like a trick of the light. This is a performance being measured against a dismal September, and a landscape of competitors (notably Aurora) who are falling apart for lack of the one resource Canopy has plenty of.

So far, no publicly traded cannabis company in Canada produces a regular bottom line profit. Trulieve (CSE: TRUL) is the only company on the continent who’s been able to deliver consistently. The rest of these companies are stuck spending to figure out how to do it. Canopy, the biggest company, burned through -$189 million in an operational cash this quarter, and the reason it took us this long to mention it is because Canopy can afford it.

Sundial (NASDAQ: SNDL), Aurora (TSX: ACB) (NYSE: ACB) and Supreme Cannabis (TSX: FIRE), all put themselves in much worse balance sheet shape than Canopy before moving their capital markets-focused CEOs off of the helm recently. Canopy is making them look like they’re playing catch-up, having dumped Bruce Linton back in July. The lag may represent the difference between having a board that represents the shareholder base, and one who is just along for the ride.

Information for this briefing was found via Sedar and Canopy Growth Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Canopy’s Quarter in Charts

Whenever there’s a negative margin, those of us in the financial content biz like to...