It was blood in the pot market streets today, and the site of the main bleed was 1 Hershey Drive. Sector bellwether Canopy Growth Corp (TSX: WEED) (NYSE: CGC) printed a $3.70 per share loss, lending gravity to an ongoing crisis of confidence in the marijuana sector.

Canopy’s downward gap towards its support level this morning spilled over, sending the Horizons Marijuana ETF – a de-facto index – towards its own support level on a water slide, and sending marijuana-capital-futurists with a long bias on a search of answers. Don’t worry, Todd Harrison: we’ve got you covered.

Operationally, Canopy isn’t the train wreck this bottom line makes it out to be. Company wide revenue was down over last quarter, but both cannabis revenue and shipped units were up. Crucially, an already thin 16% margin from last quarter shrunk to 13%, impressing nobody. Jay had a top level report up on Canopy’s earnings last night that hit all the key points, and it serves as a great overview and primer.

The drag on Canopy’s ops continues to be the under-use of their enormous footprint. This quarter’s language finally made much of the dark space sound like capacity they are working into, as opposed to rooms that they were figuring out how to use. That will help them later on if they can pay it off, but the explanation everyone is looking for is the one that addresses the gaping hole in Canopy’s bottom line. Here it is:

Open up (the treasury), we have a warrant!

Constellation Brands’ (NYSE: STZ) $5 billion investment in Canopy in November, 2018 came with warrants to purchase 88.5 million more shares of Canopy at a price of $50.40/share. When Constellation exercises those warrants, they trigger the right to buy ANOTHER 51.3 million shares from the Canopy treasury at whatever the market price is when they exercise.

In the heady days of fall 2018, this structure assured the liquor giant that they wouldn’t suffer competition for control of a Canopy Growth Corp that performed at the top end of its lofty expectations. Obviously, it didn’t turn out that way.

This past spring, with the marijuana capital world fixated on the potential in state-level US operators, Canopy and the other over-sized ventures fighting for control of a Canadian marijuana market that will ultimately end up being one tenth the size of its US counterpart were starting to look like yesterday’s news. So Canopy’s CEO at the time, Bruce Linton, cooked up a plan: a legal structure that would allow WEED to hold an option to buy US multi-state operator Acreage Holdings (CSE: ACRG.u). A US$300 million cash payment to Acreage shareholders would allow Canopy the right to buy all of the outstanding shares of Acreage for 0.5818 Canopy shares at a later point in time once things are federally legal. To get it done, he had to sell Constellation on the idea.

Linton sweetened the pot by giving Constellation warrants to buy another 38.5 million shares of Canopy at $76.68, with follow on warrants to buy another 12.8 million shares at market. And while you really have to hand it to Linton’s ability to sell a dream, Constellation isn’t a total sucker. The re-pricing came with an effective commitment from Canopy to buy back $1.538 billion worth of stock, or 27.37 million shares, whichever is cheaper.

The rider puts a floor under Constellation’s investment in April. Either a cash-machine Canopy of the future was going to buy $1.53 billion worth of stock out of the market, or Constellation was going to get a $1.53 billion discount when they exercised those $76.68 warrants.

Despite the rebate / buyback commitment not becoming relevant until those $76.68 warrants become worth exercising, it amounts to a treasury commitment, so Canopy had to take an equity charge this quarter. On an income statement, that looks ugly, but it isn’t as ugly as it looks. It isn’t a cash charge so much as a right-sizing of Canopy’s balance sheet. And it invokes unfamiliar questions about Canopy’s cash position

“What happened to the LAST $5 billion I gave you?”

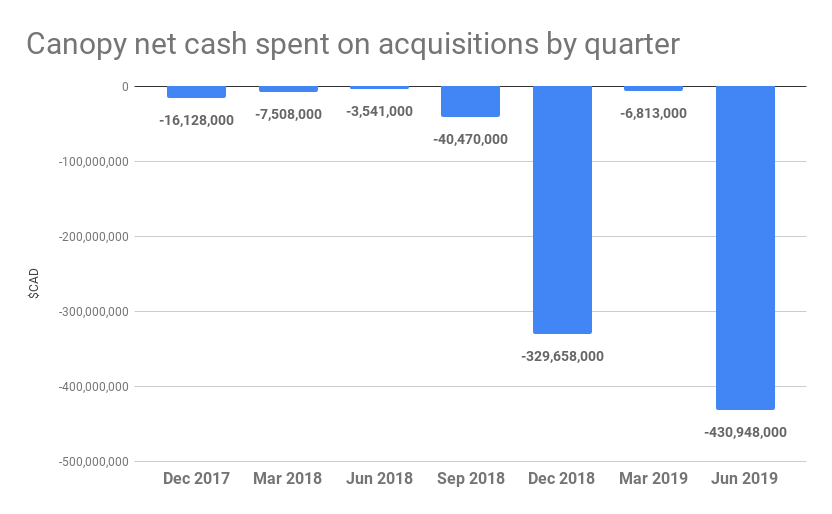

Canopy reports a $1.8 billion cash balance in these statements. On a cash-basis, it burned $158 million on operations, and another $405 million making capital investments in subsidiaries.

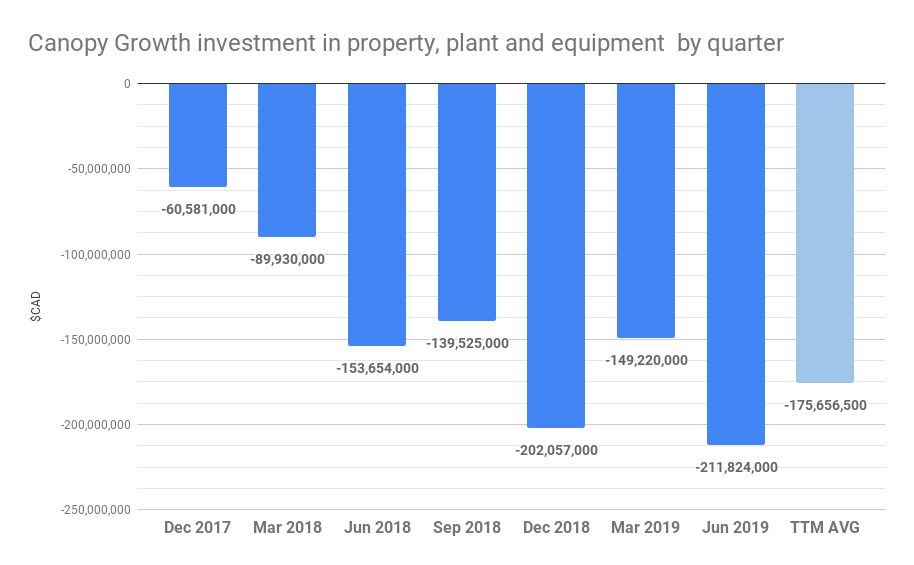

Despite its size, Canopy Growth is a company that is still being built out. Much of their cultivation footprint is still being dialed in, and certain key elements of the Canopy of the Future – including that massive extraction facility in Saskatchewan and the bottling line in Smith Falls that Constellation is surely making a priority – are still under construction.

Canopy averaged $175 million a month in capital spend on property, plant and equipment alone in the past 12 months. Acquisitions rarely being accretive in the Marijuana business, the companies Canopy acquires are ventures themselves, and end up adding to the capital spend in subsequent quarters to complete their build-outs.

There’s no telling the total cost of turning Canopy Growth into a machine that produces weed, instead of a machine that eats money. And if it ends up being more than $1.8 billion, they’re going to have to get it from the market. Surely, uncle Constellation is good for it – just not at the $50 – $76 per share that he had previously envisioned. Right now, it’s dawning on him that he’s handcuffed to this hungry pig, and will likely have to make an average-down investment or two before it reliably gets on track.

In that context, don’t expect anyone in Smith Falls to go out of their way defending the share price. The last guy who did that got fired.

Information for this briefing was found via Sedar and Canopy Growth Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Canopy’s Quarter in Charts

Whenever there’s a negative margin, those of us in the financial content biz like to...