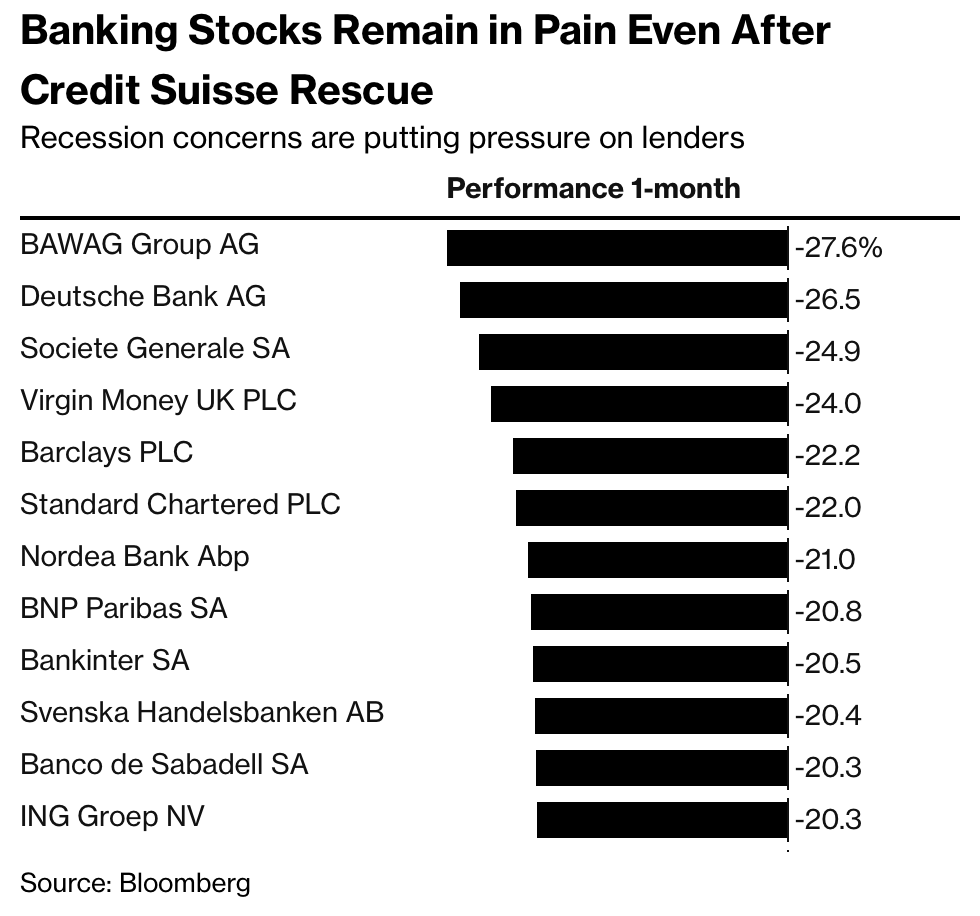

Deutsche Bank’s (NYSE: DB) shares have tumbled 8% in pre-market trading to $8.85 after default swaps on the bank’s euro, senior debt increased to the highest level since they were introduced in 2019, when Germany revised its debt structure to include senior preference notes. Other banks with a high exposure to corporate lending decreased as well, with Commerzbank plunging 9% and Societe Generale losing 7%.

The failure of Silicon Valley Bank and the emergency bailout of Credit Suisse last weekend shook investors and heightened concerns about the banking industry’s overall viability at a time of rising interest rates and increasing inflation.

Deutsche Bank $DBK, Germany’s largest bank, down 13.2%

— Rob Nunn (@robfnunn) March 24, 2023

Primarily due to a sudden spike in the cost of insuring it’s default. pic.twitter.com/aChEMJM1nn

Credit default swaps on five-year maturities increased to more than 220 basis points before easing back. They were at 210, or 7 basis points higher than the previous day’s close.

Bonds of Additional Tier 1 (AT1) were also under pressure. The yield on the 7.5% dollar AT1 bond was around 22.9%, more than double what it was two weeks ago.

WTF? Costs of insuring against Deutsche Bank default (CDS prices) jump in violent move while share price plunge as stress in banking system keeps rising following Fed rate hike. pic.twitter.com/yt56WL1df9

— Holger Zschaepitz (@Schuldensuehner) March 23, 2023

The European banking crisis seems to be spreading. $DB is plunging pre-market after its credit default swaps are blowing out in the wake of the $CS debacle.

— Markets & Mayhem (@Mayhem4Markets) March 24, 2023

This is likely to spread some nervousness to US markets during the cash session, particularly financials.

Be nimble.

The measures follow yesterday’s losses in US banks, which fell even after US Treasury Secretary Janet Yellen told legislators that regulators would be prepared to take additional steps to protect deposits if necessary.

The Stoxx 600 Banks Index fell 4.4% on Friday, making it Europe’s worst-performing sector.

Separately, a Deutsche Bank tier 2 subordinated bond rose toward face value on Friday after the firm suddenly revealed its intention to redeem the note early.

According to Bloomberg statistics, the notes, which maturity in 2028, had fallen to as low as 90 cents in the aftermath of the Credit Suisse Group AT1 wipe out.

Rival UBS agreed to buy Credit Suisse for 3 billion Swiss francs ($3.2 billion) on Sunday, with Swiss authorities playing a significant role in the deal as nations sought to halt a global banking system contagion.

While price had rebounded in recent days, it was still indicated at around 94, indicating a high likelihood of Deutsche Bank exercising their call option.

Information for this briefing was found via Bloomberg, Seeking Alpha, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.