Meta Platforms (Nasdaq: META) reported its Q3 2022 financials which continued the trend of year-on-year revenue decline first seen last quarter. The tech giant recorded US$27.71 billion in quarterly revenue, down from Q2 2022’s US$28.82 billion and Q3 2021’s US$29.01 billion.

This, however, lands within the projected US$26 – US$28.5 billion in revenue guidance announced last quarter.

The firm cited a slew of issues, including a difficult macroeconomic environment, increased competition from rival TikTok, and the repercussions from Apple Inc.’s ad-tracking modifications, all of which have weighed heavily on its enormous advertising business.

“The Reels work, the discovery engine work, all the ads work on signals, the business messaging work, I — we can’t tell you right now how big they’re going to scale to be. But I think that each of these things are kind of going in the right direction,” CEO Mark Zuckerberg said in the earnings call.

What increased year-on-year in Meta’s financials is total operating costs, ending at US$22.05 billion for the quarter, up from last quarter’s US$20.46 billion and last year’s US$18.59 billion. This also led the firm to record a lower operating income at US$5.66 billion compared to US$8.36 billion a quarter ago and previous year’s counterpart of US$10.42 billion.

Hugely dragging the income down is the net operating loss coming from the Reality Labs segment, amounting to US$3.67 billion from last quarter’s US$2.81 billion–pushing the total losses year-to-date at US$9.44 billion. CFO Dave Wehner noted last quarter that the firm anticipates “third quarter Reality Labs revenue to be lower than second quarter revenue,” as the business unit

Revenue in that business unit fell roughly 50% year on year to US$285 million, owing to “lower Quest 2 sales,” according to Wehner.

“We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year,” said Wehner in the earnings call. “Beyond 2023, we expect to pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run.”

The metaverse unit outlook comes after Altimeter Capital CEO Brad Gerstner, one of the tech giant’s investors, published a public letter to Zuckerberg advising a US$5-billion limit of metaverse spending.

Advertising revenue–accounting 98.2% of overall income–was US$27.2 billion for the quarter, down roughly 4% year on year and exceeding analysts’ prediction of falling to US$26.9 billion.

Corollary, net income dwindled down to US$4.40 billion from US$6.69 last quarter and US$9.19 billion last year. This bottomline also translates to US$1.64 earnings per share.

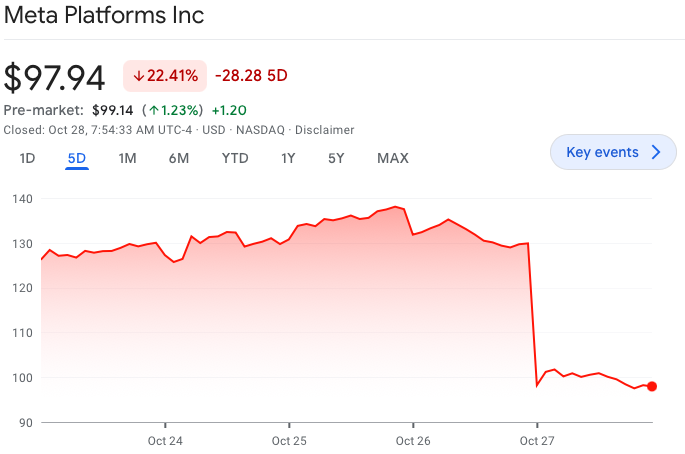

Meta’s shares fell 24.6% on the day following the earnings release, bringing it down below the US$100-mark, a level not reached since January 2016.

The firm also generated a lower net operating cash amount of US$9.69 billion compared to last quarter’s US$12.20 billion and last year’s US$14.09 billion. Free cash flow also declined to US$173 million from US$4.45 billion and US$9.55 billion in the previous quarter and year ago period, respectively–the decline heavily attributed to the growing capital expenditure combined with falling income.

“I would really think about our CapEx investment as kind of the AI and non-AI components,” said VP of Finance Susan Li, who’s transitioning to CFO position after Wehner shifts to Chief Strategy Officer. “On the AI side, which really is driving all of the CapEx growth in 2023, we will be pacing that future investment on the basis of the returns that we’re able to see and measure. So frankly, we’re hopeful that there will be a big opportunity to invest more here because we expect that this will be a high ROI area of investment for us.”

This further led to the company ending the quarter with US$14.31 billion in cash balance, putting the balance of the current assets at US$58.32 billion while current liabilities ended at US$22.69 billion.

The firm expects fourth-quarter revenue at US$30 billion – US$32.5 billion, compared to a consensus of US$32.2 billion. This estimates a 7% headwind to year-over-year growth from foreign currency.

It forecasts total expenses of $85B-$87B in 2022, down from $85B-$88B previously. It also expects capital expenditures in 2022 to be in the $32B-$33B range, up from $30B-$34B before.

Total expenses in 2022 is estimated to be between US$85 billion and US$87 billion, down from a previous forecast of between US$85 billion and US$88 billion. Further, overall expenses in 2023 are expected to range between US$96 billion and US$101 billion.

Meta Platforms last traded at US$98.59 on the Nasdaq.

Information for this briefing was found via The Wall Street Journal, CNBC, Seeking Alpha, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.