Loblaw Companies Ltd. (TSE: L) is facing controversy for allegedly spinning a price freeze as a gesture of goodwill for Canadians grappling with inflation when the timing coincides with the annual industry-wide practice of price freezes.

“On average, No Name prices are already 25 percent cheaper than comparable name brands,” said Loblaws president Galen Weston who announced the prize freeze on Monday. “Coupled with this price lock, that could make a real difference in both your grocery bills and your peace of mind. You’ll know that if other food prices go up, No Name prices won’t… guaranteed.”

Weston was soon called out by Montreal-based grocery chain rival Metro, Inc. (TSE: MRU) who said that the holiday blackout on prices is a “long-standing practice.” And the claim was supported by the Financial Post’s sources in the Canadian manufacturing sector who called Weston’s move “disingenuous” when the price lock lines up with the one period in each year that chains like Loblaws, which is the biggest grocery store chain in Canada, get the least pressure to raise prices from suppliers.

And this practice also isn’t done to help consumers, either, it’s basically the result of big chains refusing to negotiate with suppliers to simplify their operations — and get certainty on their margin and cost levels — before the holiday rush begins.

But Loblaws insisted that the No Name brand price freeze is “not standard,” nor something they’ve ever done before, pointing out that a holiday blackout is done to stabilize costs at a wholesale level, meaning grocers can still choose to hike at retail. The No Name price lock, they said, applies to all of the brand’s more than 1,500 products, while holiday blackouts typically do not extend to all products and categories at the store.

“Bottom line: it is not common for a grocer to commit to holding prices at any time of year — particularly on 1,500 items and the nation’s second-largest brand,” said Loblaw spokesperson Catherine Thomas.

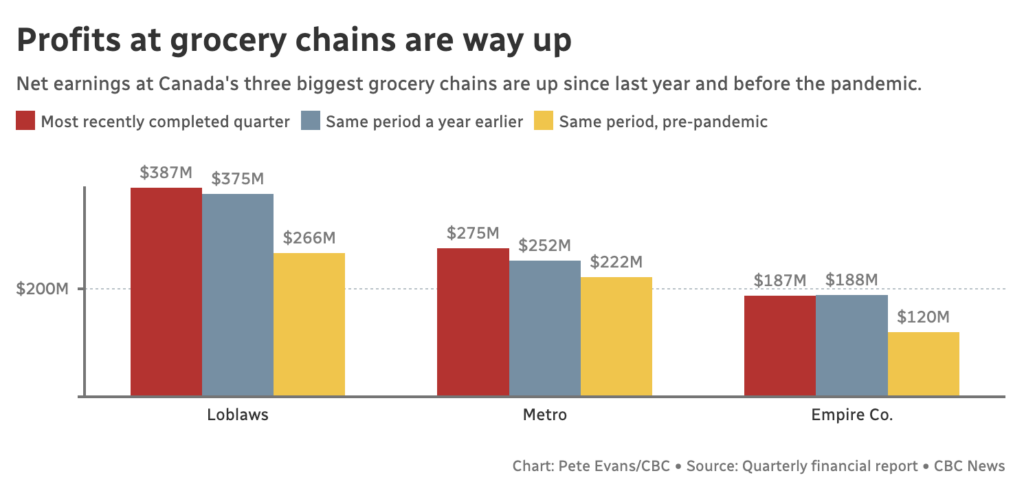

Whether the prize freeze is indeed a case of magnanimity or simply a way to burnish their reputation, Loblaws, along with rivals Metro and Sobeys have all been making more profit while rising inflation continues to stretch customers thin.

New Democratic Party Leader Jagmeet Singh on Monday called for action to investigate price hikes, saying that major Canadian grocery chains have together made $2.3 billion in profit so far this year.

$2.3 billion

— Jagmeet Singh (@theJagmeetSingh) October 16, 2022

That's how much grocery corporations have made so far in 2022.

On Monday, I'm forcing a vote in Parliament to investigate price-gouging and lower your food prices.

Help us pressure Justin Trudeau and Pierre Poilievre to do the same.https://t.co/4n10mrhPkH

Loblaws and Metro both saw growth in earnings in the last completed quarter compared to the same period the year before, and all three, including Empire Co. (TSE: EMP.A) which owns Sobeys, saw tremendous earnings growth compared to the same period in 2019 before the pandemic.

Loblaws is the biggest winner with earnings up by $12 million year on year and $121 million from the same period in 2019.

Loblaws last traded at $110.52 on the TSE.

Information for this briefing was found via CBC, the Financial Post, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.