In the most direct admission yet, Treasury Secretary Janet Yellen said she got everything totally wrong last year when she predicted inflation would be transitory, acknowledging that she “didn’t fully understand” the then-forthcoming shocks to the economy.

No one could have predicted that when the money printer goes brrrr inflation would soar, and certainly not Janet Yellen! In an interview with CNN, the 75 year-old Treasury Secretary officially admitted that she was mistaken all along, and that inflation did, in fact, turn out to be anything but transitory. “I think I was wrong then about the path that inflation would take,” she said, opting to blame the various geopolitical events over the past six months as the culprit behind the highest inflation in decades.

Before you judge others, walk a mile in their shoes pic.twitter.com/lmmuYxb2Sj

— Kasumi UwU 🍥 (@thatKasumi) June 1, 2022

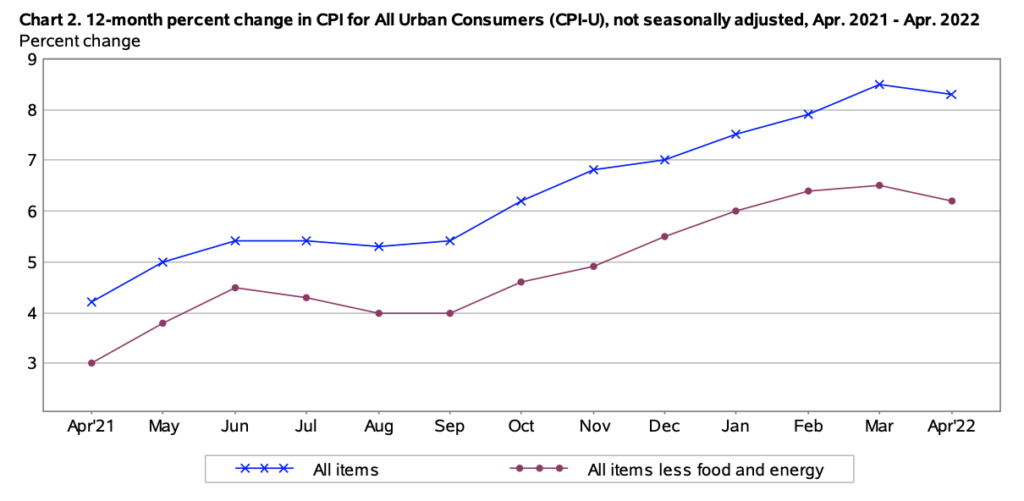

“There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t, at the time, fully understand.” Yellen continued. Her latest confession comes amid the Biden administration’s attempt to soothe the American public into believing the state of the US economy isn’t in peril despite stagnating growth and an eye-watering CPI reading of 8.3%.

Recall, it was merely a year ago that Yellen wholeheartedly peddled the “transitory” agenda, convincing Americans that price pressures will abate very soon, and that inflation only posed a “small risk” to the US economy. “I think it’s manageable,” she said at the time. Fast forward a year later, here is Yellen eating her words:

.@SecYellen on inflation being transitory: "I was wrong then about the path that inflation would take. As I mentioned, there have been unanticipated and large shocks to the economy […] that I, at the time, didn't fully understand." https://t.co/AlrXn4kT0r pic.twitter.com/9tqxo0iA3B

— The Hill (@thehill) June 1, 2022

On Tuesday, Yellen joined US President Joe Biden and Fed Chair Jerome Powell for a meeting at the White House to desperately discuss a new plan on tackling the surging cost of living. Biden, for his part, unveiled a three-step plan that includes slashing the federal budget deficit, boosting “productive capacity” by embarking on a month-long messaging campaign advocating for his economic agenda, and giving the Fed autonomy to tackle inflation as monetary policy makers see fit.

Information for this briefing was found via CNN and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.