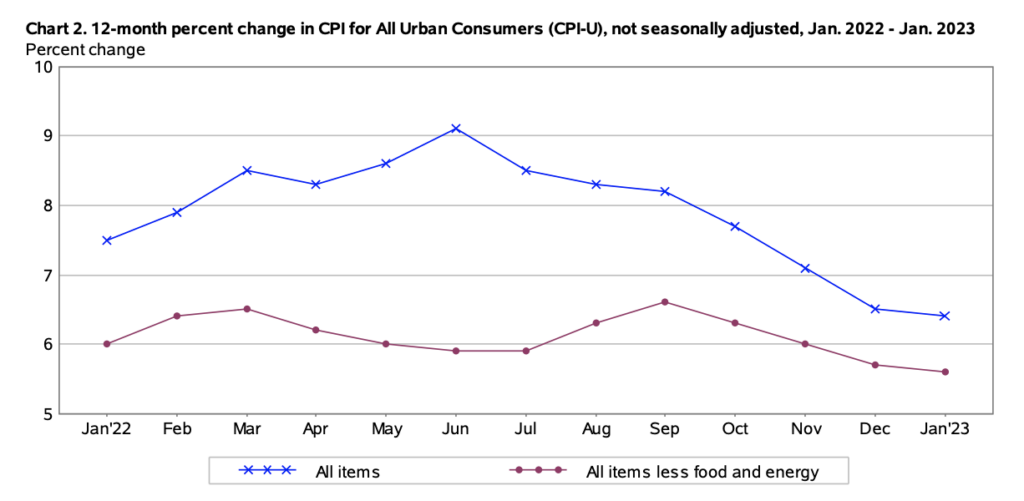

It appears the road to the Federal Reserve’s 2% inflation target just got a lot longer.

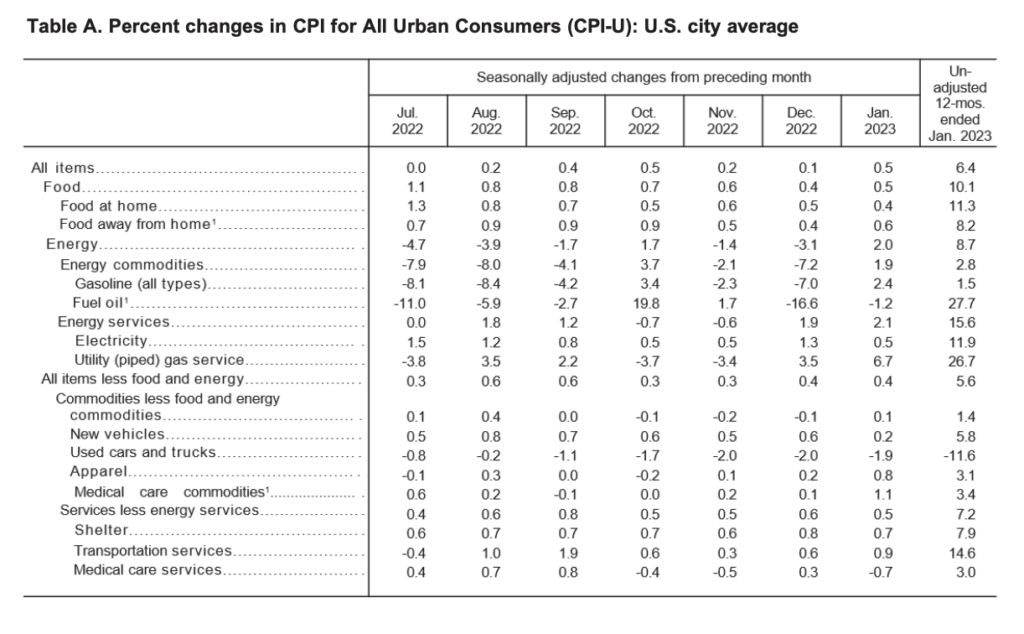

Latest CPI figures from the BLS show last month’s CPI shockingly rose 0.5% to an annualized 6.4%, against consensus forecasts calling for a decline to 6.2%. Core CPI, which strips out volatile components such as food and energy jumped 0.4% to an annualized 5.6%, despite economists predicting a decline to 5.5%.

Most notably, food costs continued to rise to the ire of consumers’ wallets, rising another 0.5% month-over-month as four out of the six major grocery categories underwent increases. Likewise, shelter prices were also up last month, rising 0.7% on a monthly basis. Energy prices were also up, rising 2% between December and January.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.