FULL DISCLOSURE: Japan Gold is a sponsor of theDeepDive.ca.

Japan Gold (TSXV: JG) has concluded their arrangement with Barrick Mining (TSX: ABX), which was previously referred to as the Barrick Alliance. The Alliance, which initially began back in early 2020, is set to wrap up officially on October 31.

“Barrick’s involvement with Japan Gold over the last five years reflects the growing international interest in Japan as an emerging country with the potential for the discovery of new gold deposits, and we thank Barrick for their participation in this journey,” commented John Proust, CEO of Japan Gold.

Originally formed to jointly explore, develop, and mine certain gold properties and projects in Japan with the potential of Tier 1 and Tier 2 mining projects, the Barrick Alliance collectively saw Barrick spend $23.2 million exploring claims held by Japan Gold. The arrangement saw the development of a comprehensive geochemical and geophysical database that covers most of the 3,000 square kilometres of claims held by the company.

That exploration spend saw Barrick conduct just 8 drill holes over the five year partnership, for a total of 3,062 metres drilled across three initial scout programs. While valuable from a geological perspective, drilling to date has been insufficient to fully evaluate the potential of these projects at scale.

“Japan’s exceptional geology, rich history of high-grade gold mining, underexplored district-scale opportunities and stable mining regulatory environment continue to attract industry participants seeking a new, highly prospective geopolitically safe jurisdiction,” continued Proust.

READ: Bristow Out As CEO Of Barrick Mining, Mark Hill Named Interim CEO

With the Alliance concluding, Barrick will no longer have any rights to or interest in any of Japan Gold’s portfolio of mineral rights, including the three projects previously deemed to be Barrick Alliance projects, which namely are Hakuryu, Togi, and Ebino.

“Japan Gold consistently demonstrated exceptional in-country expertise and operational excellence. We thank them for their dedication and professionalism throughout our alliance,” commented Joe Holliday, VP of Exploration for Barrick.

The Alliance notably terminates at the same time that Barrick Mining has seen a leadership shake-up, with the departure of Mark Bristow from the role of President and CEO being announced this morning.

Next Steps

Going forward, Japan Gold has signaled that they intend to continue to advance two district scale areas in both Kyushu and Hokkaido, alongside several individual projects independently or through new joint ventures or partnerships.

Discussions are said to be ongoing with parties that have expressed in Japan Gold’s current exploration portfolio.

“Japan Gold remains well-funded and committed to advancing its projects, and the geological prospectivity of Japan remains unchanged. With full operational control, our experienced management team is well-positioned to prioritize our high potential assets and implement a tailored exploration strategy,” concluded Japan Gold.

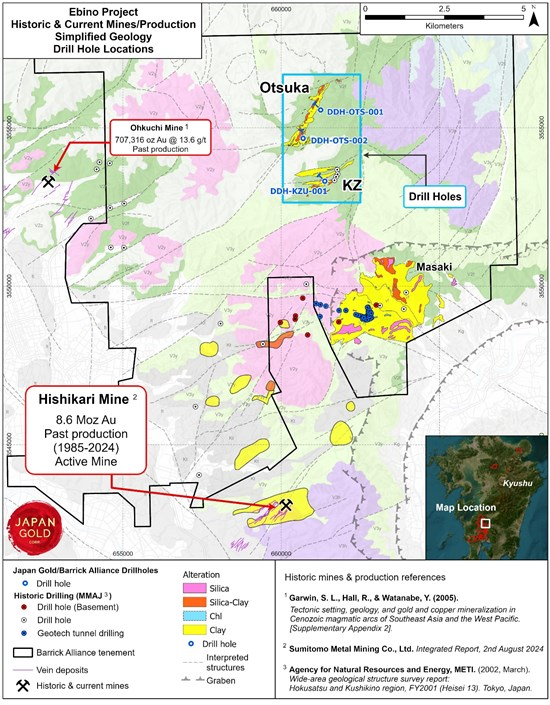

The company also disclosed this morning that a three hole drill program has been completed at the Ebino project, which was part of the Barrick Alliance. The program confirmed the extension of a regional alteration system within the Hokusatsu District, which has both past and present major gold mines, including the Hishikari Mine, which is the only active large-scale gold mine in Japan.

A total of 1,528 metres of drilling tested targets at the Otsuka and Kuwanoki-zuru prospects within a highly prospective and underexplored region. All three holes intersected hydrothermal clay alteration characteristic of a shallow environment in an epithermal system. Results are said to have been encouraging, with broad zones of alteration intersected that can be used to vector into potential epithermal targets within the vicinity of Ebino.

Japan Gold last traded at $0.15 on the TSX Venture.

FULL DISCLOSURE: Japan Gold Corp. is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Japan Gold Corp. The author has been compensated to cover Japan Gold Corp. on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.