As was widely expected, the Federal Reserve decided to maintain the overnight rate at 5.5%.

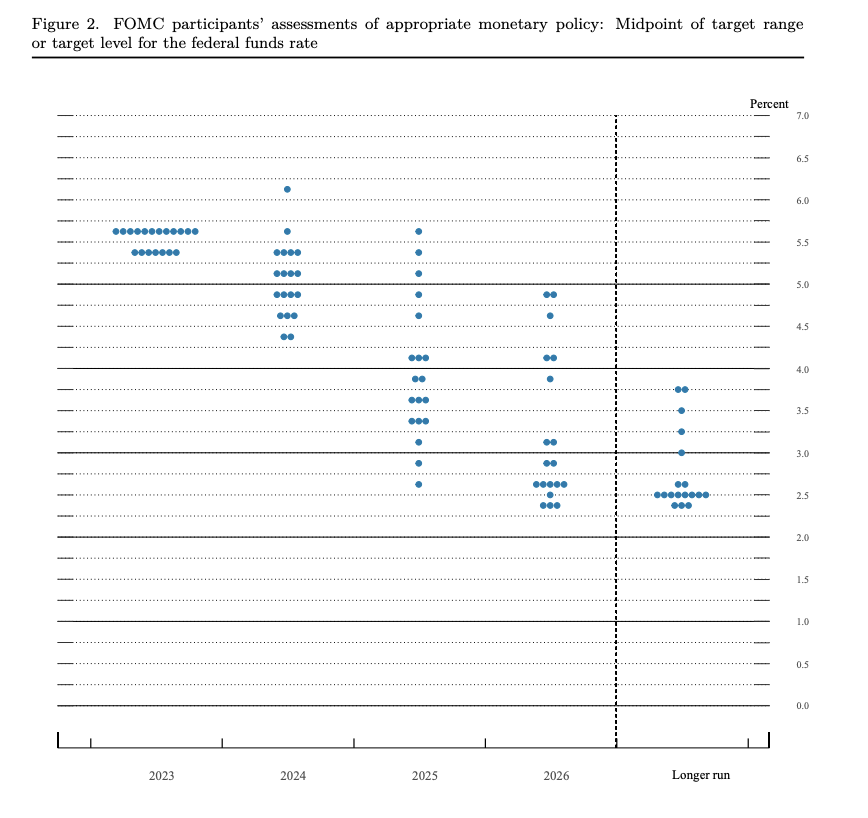

Following the two-day policy meeting, Federal Reserve policy makers voted to keep interest rates— which are currently at a 22-year high— unchanged. However, they indicated a willingness to implement another rate increase this year yet to address inflation concerns in light of economic activity proving more robust than initially expected. In fact, policy makers now project that they might need to sustain the current interest rates through 2024!

Previously in their July meeting, the Fed had increased the benchmark federal-funds rate to between 5.25% and 5.5%, as part of a series initiated in March 2022, where rates started ascending from near zero. Interestingly, this recent meeting is the second instance this year where the Fed chose not to raise the rates; the first being in June.

Fed Chair Jerome Powell, in a significant address in Jackson Hole, Wyoming, had expressed his hesitation to prematurely claim success against inflation. He highlighted that the recently observed decrease in inflation is just the start of a sustainable downward trajectory. Furthermore, any unexpected economic strength might jeopardize the progress made on the inflation front.

Post the July meeting, there’s been some evidence suggesting a generalized decrease in inflation, but still nowhere close to the Fed’s target of 2%. And, even though the labor market dynamics have also shifted in favour of the Fed’s monetary objectives with the unemployment rate slightly increasing to 3.8% last month from 3.5% in July, it was only because more Americans joined the workforce.

As such, several Fed officials are hesitant to put a halt to the rate hikes, as the economy continues to show substantial growth. This resilience has raised concerns that the combination of strong economic activity and increased costs in oil and transportation could counteract the observed inflation decline.

Another apprehension is the potential disruption if the financial markets perceive a stabilization in inflation and interest rates, only to later face the contrary. This sentiment is further reinforced by the behavior of the 10-year Treasury note yields, which have surged to above 4.3%, a peak unseen since 2007, escalating from 3.9% during the Fed’s July meeting.

Information for this story was found via the Federal Reserve. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.