Several economic reports from both JPMorgan and the World Bank have recently been released, providing a forecast for the forthcoming economic implications from the coronavirus pandemic.

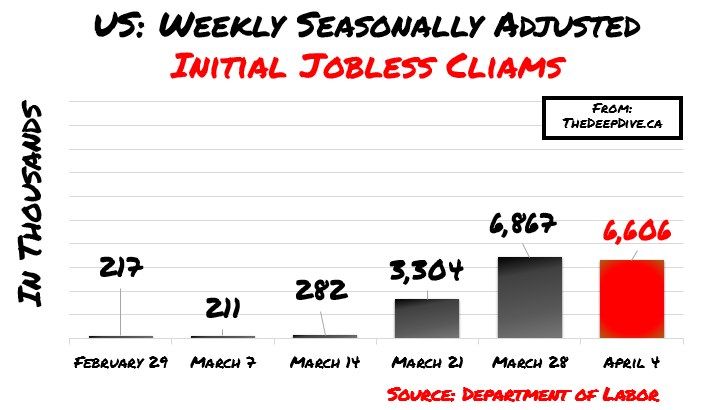

According to economists at JPMorgan, the economy is on a path to contract by nearly 40% in the forthcoming second quarter due to the direct and indirect impacts of the global coronavirus outbreak. They are anticipating that the US GDP will decrease by 40%, all while the unemployment rate will increase by over 20% by the end of April.

The economists had previously predicted only a 25% decrease in GDP growth, but given the current circumstances of the potential of over 25 million lost jobs by the end of April, the GDP prediction was adjusted accordingly. JPMorgan is however, predicting that by the third quarter, GDP levels may increase by 23%, and then further increase by 13% in the fourth quarter.

These stark economic predictions coincide with JPMorgan’s earlier announcements regarding its updated conditions for mortgage lending. Given the current economic circumstances and exponential increases in unemployment, lenders are exercising caution as a move to protect their capital. As a result, JPMorgan increased the minimum mortgage-qualifying FICO score to 700, as well as increased the down-payment from 10% to 20%.

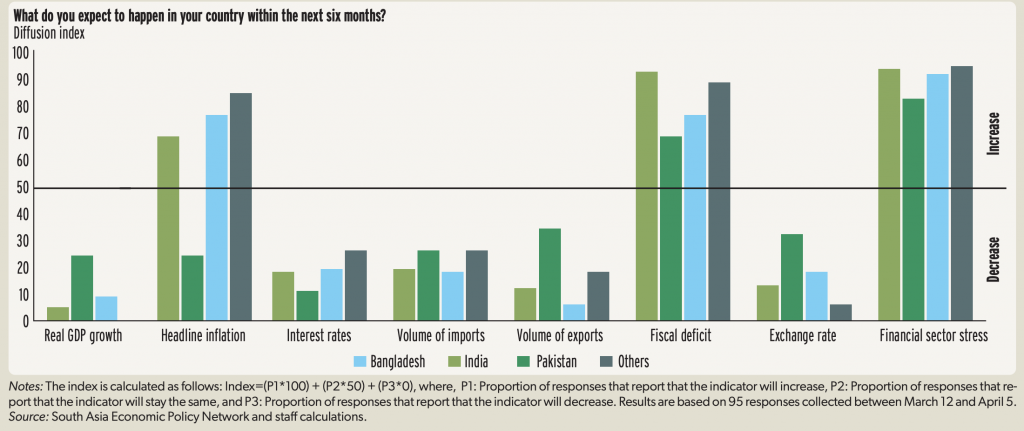

Meanwhile, the World Bank put out a report concerning the South Asian economies, stating that the forthcoming year could be subject to the worst economic decline since the past 40 years. According to the South Asia Economic Focus report, World Bank is predicting economic growth in South Asia to be between 1.8% and 2.8% for 2020- which is a startling contrast compared to the previous prediction of 6.8% growth.

The report includes predictions made by the South Asia Economic Policy Network, which is made up of renowned academics and researchers from various parts of South Asia. The compilation of expert’s opinions gave a grim outlook given the current global coronavirus outbreak. They are anticipating GDP growth to drastically decrease, alongside with interest rates, exchange rates, as well as the number of imports and exports. Simultaneously, these experts are also predicting a sharp increase in fiscal deficits.

Out of South Asia’s eight countries, it is predicted that the Maldives will have the steepest economic decline, with a potential contraction of 13% in 2020. In addition, due to the coronavirus pandemic, there is a growing possibility that Sri Lanka, Pakistan, and Afghanistan may slump into a recession. The rapid decline in economic growth can be attributed to several factors, including lack of tourism, decrease in demand for textiles, and supply chain disruptions.

Alas, it is worth mentioning that both JPMorgan and World Bank cited difficulties in maintaining accurate forecasts due to unpredictability of the coronavirus pandemic. The economists making these predictions are heavily reliant on historical data, and are thus facing various shortcomings and limitations. The world has not experienced such a modern-day economic impact from a virus, and as such, experts are reverting to post Second World War models. As a result, their predictions are subject to modifications as situations unravel daily.

Information for this briefing was found via CNBC, World Bank, and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

Yikes. Can’t imagine we see the economy start pulling back until September at the earliest.

TRUMP 2020!

V Shaped Recovery? It’s happening folks.

Shocking. All this talk about a quick recovery is insanity.