On Saturday, both the Virginia House and Senate approved a recreational cannabis bill, which will allow sales to start in 2024, which is being sent to Governor Ralph Northam, which he is expected to sign the bill. On the Governors desk as well is another bill that allows flower sales under the current medical program which, if signed, is expected to enable the sales to start happening as soon as the fall.

On the back of this news, Canaccord raised Jushi Holdings’ (CSE: JUSH) price target to U$10 from U$8 and reiterated their speculative buy rating.

Jushi Holdings currently has five analysts covering the company with a weighted 12-month price target of C$12.63. This is up from the average last month, which was C$10. Three analysts have strong buys while the other two have buy ratings.

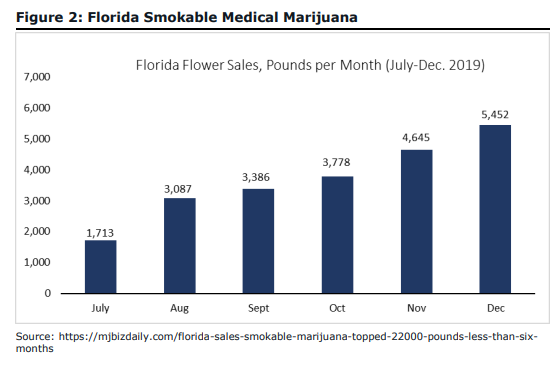

Canaccord’s Bobby Burleson believes that Virginia will have a meaningful spike in sales due to these bills and will be parallel to what happened in Florida when flower was allowed in their medical program.

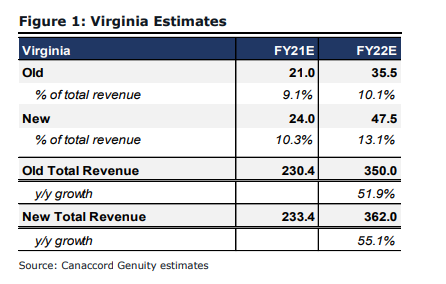

He has revised his Virginia 2021 and 2022 estimates. 2021 only got a slight $3 million bump, while 2022 got a $12 million bump. You can see his new and old estimates below.

The bulk of the estimate bump goes into the 2022 estimates, with Burleson bumping 2022 revenue by $12 million to $362 million and EBITDA slightly to $108 million. He writes, “we believe JUSHF is likely to command a premium multiple on our increased 2022 estimated EBITDA given the company’s leading position in the rapidly transforming Virginia market.”

The main reason for Burleson bumping revenue this much is due to Jushi’s market position. They have their HSA II designation, which captures nearly 2.5 million people and is one of the most densely populated HSA’s. Burleson writes, “It is also home to two of the state’s highest-income counties and half of VA’s wealthiest ten neighborhoods. Major technology companies base their operations in the area and employ thousands of millennials.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.