K92 Mining Inc. (TSX: KNT) recently reported its second quarter financial results. The company announced that it produced 26,085 ounces of gold equivalent ounces, or 22,934 ounces of gold, 1,229,961 lbs of copper, and 25,224 ounces of silver. The quarter reportedly saw record plant and mine throughput of 108,853 tonnes and 114,471 tonnes, respectively, which equates to 1,196 tonnes per day and 1,258 tonnes per day, respectively.

K92 saw its cash and all-in sustaining costs decrease to US$617 and US$893, respectively. The average realized selling price per ounce increased slightly to US$1,783, with the company selling 23,674 gold ounces this quarter.

K92 Mining currently has 13 analysts covering the stock with an average 12-month price target of C$11.38, or an upside of 37%. Four of the 13 analysts have strong buy ratings, while the other nine have buy ratings on the stock. The street high price target sits at C$13, representing an upside of 57%.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and $11 12-month price target on the stock, saying the results “showed strong all-in sustaining costs of $893/oz.”

They add that the K92 beat their all-in sustaining cost estimate of $1,085 per ounce but missed their earnings per share estimate of $0.05. They add that the company ending the quarter with a cash balance of $81.7 million plus an additional $47.5 million raised in a bought deal after the quarter ended puts K92 in a good spot for exploration and expansion at their Kainantu mine.

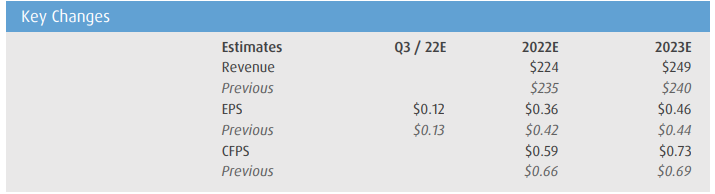

BMO notes that with Kainantu seeing record throughput during the second quarter, they expect management to continue the growth, going from 400kpta to 500ktpa. With K92 planning on releasing economic studies for the Stage 3 and Stage 3A expansions by the end of the year, BMO has updated its models to “incorporate placeholders for Stage 3 and 3A” until the full details are released.

They now model that Kainantu will expand to 1.2mtpa by the end of 2024, growing to 1.7mpta by the end of 2026. However, they expect that there will be a reduction in grade to roughly 9 g/t gold equivalent for stage 3, with this dropping to 7.8 g/t gold equivalent in 2027 and beyond. Lastly, they believe that the initial and sustaining capital will be $378 million from 2023 to 2024, significantly higher than the $125 million and $160 million combined initial and sustaining capital forecasted by the PEA.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.