On November 15th, K92 Mining Inc. (TSX: KNT) reported its third quarter earnings. The company reported 21,908 ounces of gold produced and 21,675 ounces of gold sold. They also produced 364 tonnes of copper and 19,736 ounces of silver during the third quarter. The company’s average selling price per gold ounce was $1,707 while the all-in sustaining costs per gold ounce were $752, with a cash cost component of $596. Reported sales came in at $35.37 million with expenses equaling $16.78 million.

K92 Mining currently has 11 analysts covering the stock with an average 12-month price target of C$11.61, or a 41% upside to the current stock price. Out of the 11 analysts, 3 have strong buy ratings and the other 8 have buy ratings. The street high sits at C$14 from Stifel-GMP while the lowest comes in at C$8.75.

In BMO’s third quarter review, they reiterate their C$11 price target and outperform rating on the stock, saying that K92 continues to build for higher production.

For the results, BMO says that the best news to come out of the results was a reduction in costs compared with the second quarter. The company reported all-in costs of $752 versus the $1,057 from last quarter and the $980 that BMO anticipated. Additionally, BMO notes that September was a strong month for K92 with their Kainantu exceeding the stage 2 1,100tpd expansion rate.

Lastly, BMO calls the expected ramp-up of production at Judd a key catalyst for the company, writing, “Mining at Judd stands to raise production at Kainantu and aid in removing bottlenecks to production that was previously limited to the Kora deposit.”

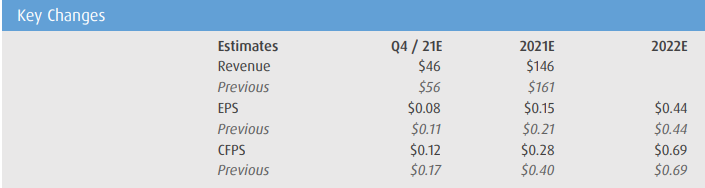

Below you can see BMO’s updated fourth quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.