On Monday, Kinetik Holdings Inc. (NASDAQ: KNTK), a little-known midstream energy company which operates in the prolific Delaware Basin in the United States and owns minority stakes in four natural gas, natural gas liquids, and oil pipelines reported solid fourth quarter 2022 earnings per share of US$0.25.

Furthermore, the company issued 2023 adjusted EBITDA guidance of US$800 to US$860 million, a range that looks impressive because it is predicated on 2023 natural gas prices of only US$2.07 per thousand cubic feet (Mcf). Given the commodity hedges it already has in place, Kinetik’s 2023 EBITDA would be reduced by only a few million dollars if gas prices fell to the US$1.55/Mcf range.

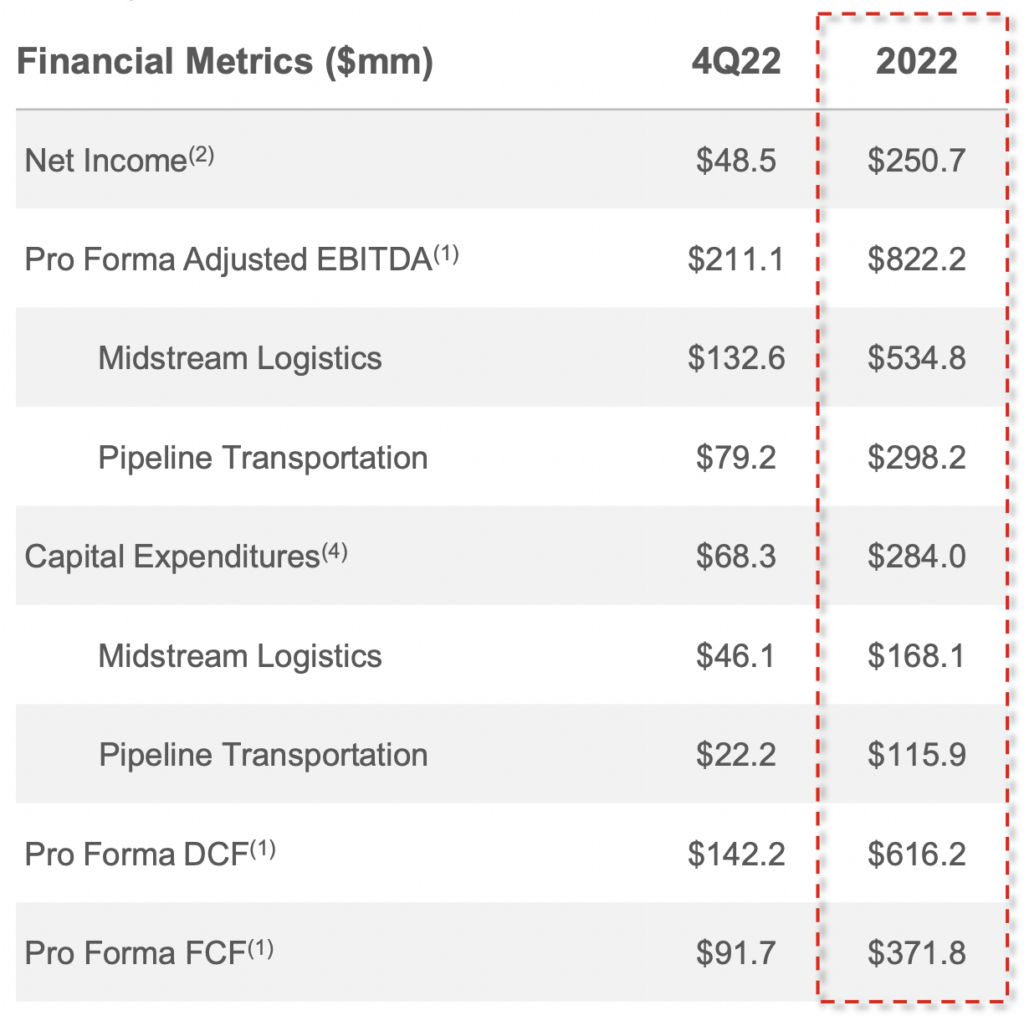

Kinetik reported pro forma free cash flow of US$142 million and US$616 million in 4Q 2022 and the full-year 2022, respectively. Free cash flow is defined as operating cash flow less capital expenditures.

Most importantly, the company seems poised to post a significant increase in adjusted EBITDA in 2024. The company expects that the annualized pace of its December 2023 adjusted EBITDA will be around US$900 million. The fully contracted November 1, 2023 capacity expansion of the Permian Highway interstate natural gas pipeline (PHP), in which Kinetik owns a 53% stake, plus a just-announced fee-based gathering and processing agreement with an undisclosed major E&P customer in New Mexico are the key drivers for the jump in the December 2023 cash flow run rate and ultimately 2024 cash flows.

The PHP expansion is supported by ten-year, commodity price-insensitive contracts. Kinetik could realize around US$45 million of incremental EBITDA from expanding PHP’s capacity.

Focus on shareholder returns

Kinetik announced a US$100 million stock buyback program which is significant in relation to its average trading volume, and particularly its float. More specifically, the stock’s average daily trading volume is only about 220,000 shares, or about US$6.5 million, and Kinetik’s float may be as little as 21.5 million shares, according to Yahoo Finance. Consequently, the buyback program could equate to around 15% of Kinetik’s float.

Interesting to note: Kinetik’s executive management team requested, and the Board approved, that its performance bonuses for the 2022 calendar year be paid in the company’s shares as opposed to cash. While certainly not dispositive, such an election by insiders represents a vote of confidence in the company.

The decision to begin repurchasing shares apparently played a role in Kinetik’s decision to maintain a US$3.00 annual dividend rate. For most of 2022, Kinetic management had reiterated its intention to recommend that the Board increase its US$3.00 annual dividend payout by at least 5% in early 2023.

Kinetik, which carries a 10.2% dividend yield, may represent solid value for yield-oriented investors. Its US$3.00 annual dividend is supported by free cash flow, and its 2023 cash flow is well insulated from commodity fluctuations.

Kinetik Holdings Inc. last traded at US$29.75 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.