The 10% decline in the S&P 500 Index over just the past 1 ½ weeks after the disappointing U.S. CPI print for August has spared few stocks. Growth, technology, defensive, and commodity stocks have all corrected quite noticeably as the yield on the U.S. two-year Treasury note has increased by about 40 basis points to a 15-year high of 4.2%; and the U.S. dollar-euro exchange rate has moved from approximate parity to around 0.97 euros to the dollar, a 20-year high for the greenback.

One stock which has possibly corrected too much is Kinetik Holdings Inc. (NASDAQ: KNTK), a misunderstood energy company which owns minority stakes in four natural gas, natural gas liquids and oil pipelines — two of which are located in the U.S. Permian Basin and are underpinned by very attractive, long-term take-or-pay contracts — as well as a growing midstream gas business. (Altus Midstream and BCP Raptor Holdco, LP merged in mid-February 2022 to form Kinetik.) Kinetik’s sensitivity to commodity prices is far smaller than the market apparently assumes.

Kinetik’s stock closed at US$32.07 on September 23, down a full 20% just since September 14 — despite its dividend yield of 9.35%, one of the highest for any U.S. stock. Furthermore, because of Kinetik’s free cash flow position and its structure — its midstream contracts have limited commodity sensitivity and, as noted above, its main pipeline investments benefit from long-term transportation agreements — the company seems likely to boost its dividend over the next few years. Indeed, in Kinetik’s 2Q 2022 investor presentation, management re-affirmed its intention to recommend that the Board increase its US$3.00 annual dividend payout by at least 5% in early 2023.

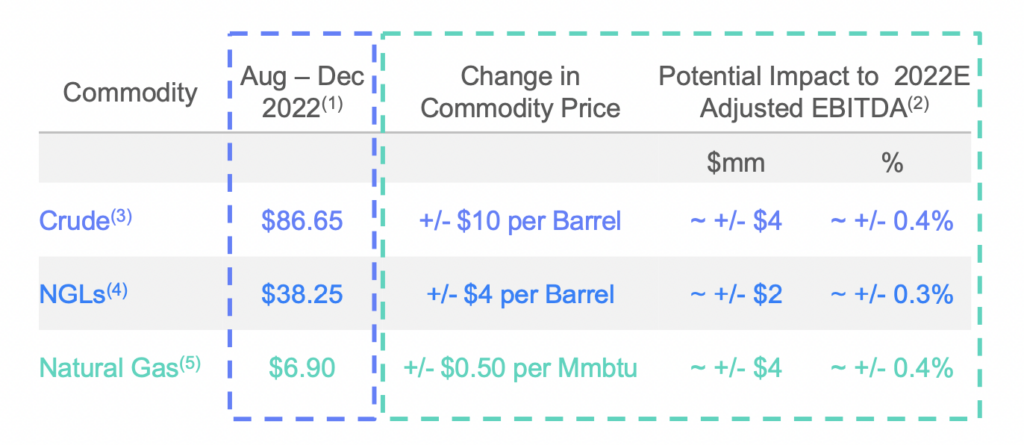

The company’s much more limited exposure to potential changes in energy prices than the stock market appears to assume, is reflected in the table below:

Two recent developments regarding Kinetik’s key natural gas pipeline investments look to have positive to at least neutral implications. First, in June 2022, Kinder Morgan, Inc. (NYSE: KMI), the operator and 26.7% owner of the Permian Highway Gas Pipeline (PHP), reached a final investment decision to expand the capacity of the 2.1 billion cubic feet per day (Bcf/d) pipeline by 0.55 Bcf/d. Like the original pipeline capacity, the expansion is supported by ten-year, commodity price-insensitive contracts. Kinetik currently owns a 53.5% stake in the pipeline and will own 55% of the total capacity when the capacity expansion is completed around November 2023.

The key takeaway from this project is Kinetik could realize around US$45 million of incremental EBITDA from expanding PHP’s capacity. Since Kinetik is valued at an enterprise value-to-EBITDA multiple of around 9x, that US$45 million could translate into about US$400 million of incremental equity value, equivalent to about US$3.00 in the company’s share price.

Second, in mid-September, Cheniere Energy, Inc. (NYSE: LNG) announced a joint venture with the Whistler Pipeline to build a 43-mile intrastate gas pipeline from the Agua Dulce, Texas terminus of Whistler to Cheniere’s liquefaction facility in the Gulf Coast city of Corpus Christi, Texas. This agreement likely postpones any thoughts of expanding the Gulf Coast Express (GCX) natural gas pipeline for at least a few years. Kinetik owns a 16.0% stake in the 2.0 Bcf/d pipeline and would have to incur substantial capital expenditures to maintain that stake if Kinder Morgan, a 34% owner and GCX’s operator, pursues expansion plans.

High-yielding Kinetik may have corrected too much over the last week and a half given its solid fundamentals. It is an energy stock where a significant portion of its cash flow is insulated from commodity fluctuations.

Kinetik Holdings Inc. last traded at US$32.07 on the NASDAQ.