On October 20th, Kinross Gold (TSX: K) held an investor call to give more details on their recent three-year guidance and long term pipeline opportunities. Carey MacRury of Canaccord commented on the event, saying, “overall, while many of the opportunities are still early stage, we view the update as positive, with more confidence that Kinross can continue to extend its production profile into the future. K remains a top pick among the senior producers.”

Simultaneously, the firm upgraded their long term price target to C$17 from C$16 and reiterated their buy recommendation on Kinross Gold.

Over at BMO Capital markets, analyst Jackie Przybylowski also commented on the event, stating, “the longer-term plan is flexible. It draws from a wealth of potential development opportunities — as the projects are studied and de-risked we will have increasing clarity to the costs and makeup of this pipeline. We anticipate more information on these projects over the coming quarters. We maintain our Outperform rating and we have raised our target price to US$14.50/share (from US$14.25).”

In the call, Kinross said that they expect to produce an average of 2.5 million ounces of gold equivalent annually between 2020 to 2029. MacRury said that the base case is basically in line with their model but that they only include Lobo Marte in their model. He also says, “We view the risk profile of the company’s expected projects as relatively low given the use of existing infrastructure,” and sees future upside from Kinross’s base case because of potential future resource conversions.

Meanwhile Przybylowski says that the presentation “hit the right notes in balancing the themes of disciplined capital allocation with longer-term project development.”

Przybylowski adds that the information provided was “more of a road map than a detailed plan (so far).” She explains that this helped investors get a better understanding of the options that Kinross will consider for developing its pipeline, while it does not deliver on specific details on most projects, especially those in the early stages. Because of this, she writes, “the market probably still will not capture the full upside value from these options yet, but we recognize this as a good starting point.”

Przybylowski changed her revenue and EPS forecasts just slightly for 2020. The new revenue and EPS forecasts are $4.367 billion and $0.80, revised from $4.416 billion and $0.76.

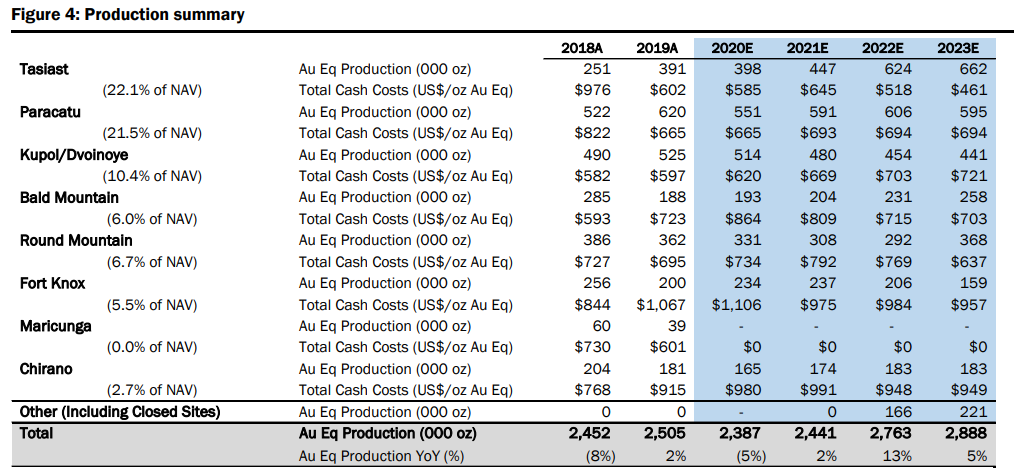

Below are Canaccord’s estimates for each site.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.