Yesterday, Kinross Gold (TSX: K) announced the sale of its Chirano mine in Ghana. The company said it has sold its 90% interest in the mine for total consideration of $225 million to Asante Gold (CSE: ASE). The terms of the deal are that Kinross will receive $115 million in cash, $50 million in Asante shares, and a $60 million deferred payment. 50% of the deferred payment is due on the first anniversary of the closing, while the other 50% is due on the second anniversary.

Kinross Gold currently has 13 analysts covering the stock with an average 12-month price target of C$11.05, or an upside of 64% from the current stock price. Out of the 13 analysts, 3 have strong buy ratings, 7 have buys and the other 3 have hold ratings. The street high sits at C$14 from 2 analysts and represents an 110% upside to the current stock price.

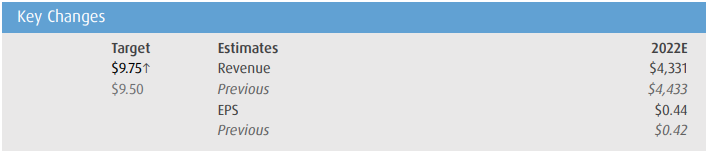

In BMO’s note on the sale, they reiterate their outperform rating and raise their 12-month price target on the stock from $9.50 to $9.75, saying that Kinross was able to sell the mine for above their NAV. They add, “This transaction also importantly streamlines the Kinross portfolio.”

BMO says that the sale was not unexpected as the Chirano mine is a relatively small mine with a short mine life and offers no synergies with other Kinross assets. They also enjoy seeing the relatively high up-front cash payment made by Asante, saying that the low upfront payment made to them in their Russian asset sale was a common criticism of the transaction.

Lastly, BMO believes that Kinross’ shares remain undervalued on selling pressure related to its Russian assets and believe that the company’s shares can get rerated if they can make the market forward-looking and bring attention to those forward-looking opportunities for growth and value creation.

Below you can see BMO’s updated 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.