Kinross Gold (TSX: K) continues to monetize assets. The company this morning announced that it will be selling its Chirano Mine to Asante Gold (CSE: ASE), which follows the recent sale of its Russian assets at firesale prices.

The transaction will see the company sell its stake in the mine for $225 million in cash and shares. The cash component is to consist of $115 million, which will be paid upon closing. An additional $60 million is to be paid in cash as well, with $30 million payable on the first anniversary of the transaction closing, and $30 million to be paid on the second anniversary.

The remaining $50 million is to be paid in common stock of Asante, with Kinross’ ownership to be limited to 9.99%. If this threshold in ownership is met, the remaining figure owed is to be paid in cash under the deferred payment schedule. The company has also committed to holding equity in Asanti for at least one year from the date of closing.

Kinross held a 90% stake in the Chirano Mine, with the remaining interest held by the Ghana government.

While not the best asset under Kinross’ belt, the property is notable for Asante in that it is immediately south of Asante’s Bibiani Gold Mine, which will now be combined into a district scale asset.

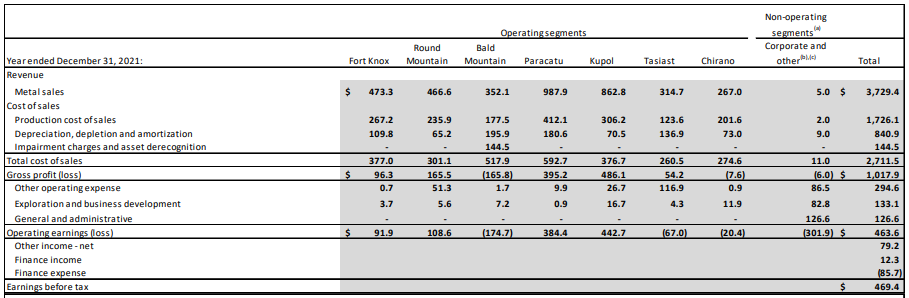

In terms of operating performance, the Chirano Mine was the firms smallest revenue generation in 2021, posting revenue of $267.0 million for the year, while cost of sales came in at $274.6 million, resulting in negative gross profits of $7.6 million. After exploration and development costs, the operation resulted in negative operating earnings of $20.4 million for the year, while accounting for just 3% of the firms total miner reserve estimates.

The company has indicated it intends to publish revised 2022 and three year guidance at the time of its first quarter financial release, which will reflect recent asset sales.

The sale of the Chirano Mine is expected to close by May 31, 2022.

Kinross Gold last traded at $6.95 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.