On September 2, Kirkland Lake Gold Ltd. (TSX: KL) announced that their measured and indicated mineral resource at their Detour Lake Mine. They announced a 216% increase of the prior resource, or 10,061,000 ounces, to 14,718,000 ounces at an average grade of 0.80 grams per tonne. The new results come from a total of 365 holes over 185,000 meters and the company says they are targeting a further 100,000 meters of additional drilling by the end of the year.

Kirkland Gold currently has 12 analysts covering the stock with an average 12-month price target of $66, or a 29% upside. The street high sits at $80 from M Partners and the lowest comes in at $49. Out of the 12 analysts, 5 have strong buy ratings, 5 have buys, 1 has a hold rating and 1 analyst has a strong sell rating.

BMO Capital Markets reiterated their outperform rating and $72 price target saying that this news is positive for the stock. They add that these drill results come from the Saddle Zone, which is what BMO calls a “super-pit.”

BMO talks more about this “super-pit” saying that Kirkland, “is working towards an expanded and optimized plan for Detour Lake.” They expect that resource definitions in the Saddle Zone between the main pit and west may “underpin an expanded operation at Detour Lake,” and coupled with the additional drilling to be done in 2021, will drive mineral reserve growth which is expected to be present in the December 2021 R&R estimates.

BMO calls Kirkland Gold, “A Long-Life, Low-Cost, Tier-One Jurisdiction Asset.” With BMO not raising their price target, the Detour Lake asset now accounts for 2/3rds of BMO’s estimated net asset value.

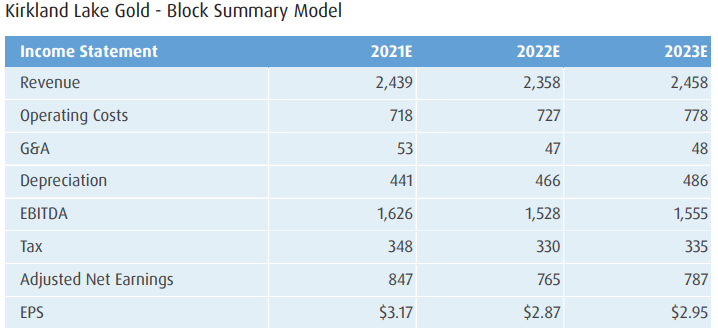

Below you can see BMO’s 2021-2023 full-year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.