Strong price action in silver has been most welcome news for a long-standing cult following of the white metal who have been talking it up for as long as anyone can remember.

The gold trade brings out its fair share of eccentrics, but the silver bulls are a really special bunch. The apex archetype of the Silver Guy might be Bernard von NotHaus, founder of the National Organization for the Repeal of the Federal Reserve and Internal Revenue Code (NORFED), who created a silver-backed “Liberty Dollar” to compete with US Dollars – a sort of libertarian RC Cola to the Coca-Cola that is US currency.

Von NotHaus ended up getting jacked up on federal counterfeit charges in 2007, and whether it was just deserts for an ill advised, crackpot funny money scheme, or proof positive that the US Government can’t abide the freedom that Real Money™ would afford their citizens is in the eye of the beholder.

Silver Guys are an off-brand species of gold bug, always acting like they’re on some inside track. They’re often found at coin shows attracting attention, practically begging to be asked what their deal is, then acting like it’s a state secret when someone does. For those with the patience to wait expectantly, The Silver Guy will lean in and go on in hushed tones about a gold:silver price ratio, and silver always being in line for a late, quick upside move that lags gold.

There’s no mathematical or technical reason that that such a ratio ought to be anything or move towards any center, because the prices of gold and silver don’t depend on each other directly or indirectly. They’re governed by supply and demand realities that are different enough that they ought not matter, but that never stopped The Silver Guy from treating it like an immutable law, because the one major demand-side commonality of the metals that does matter plays directly into his favorite bias: they’re used by investors to hedge against inflation.

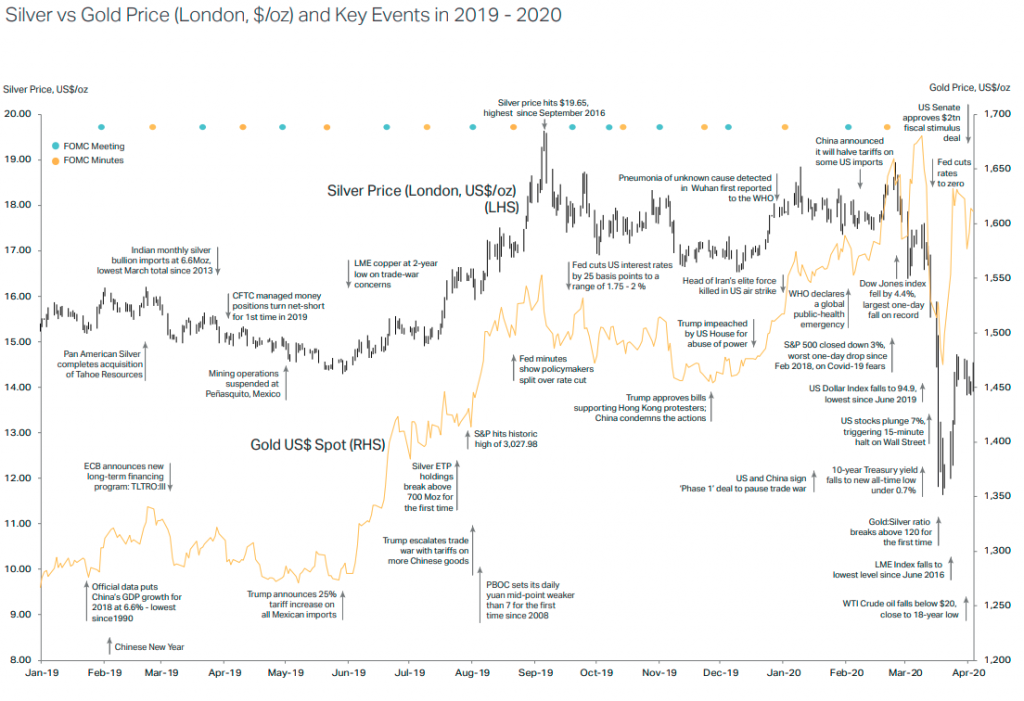

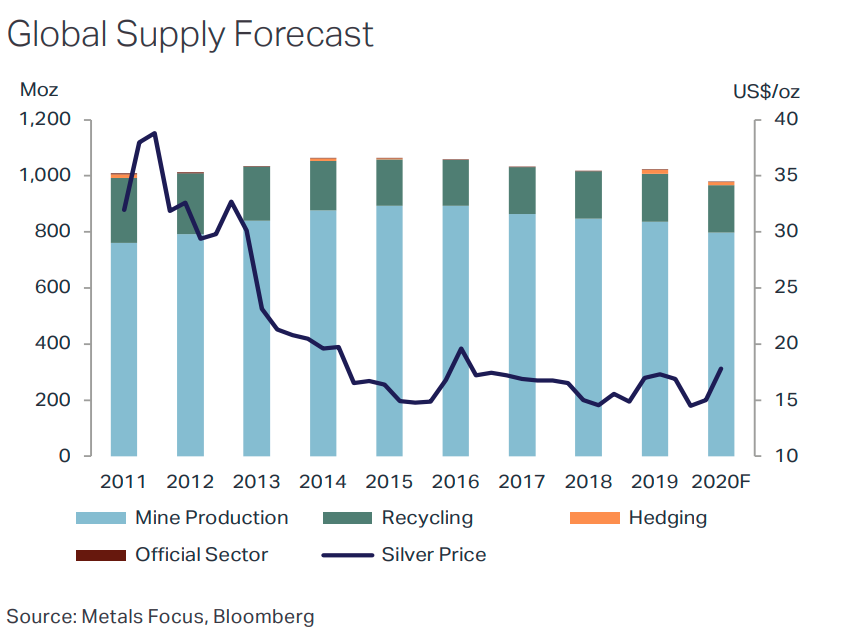

This borderline chart crime was lifted from the 2020 World Silver Survey, a publication of the Silver Institute, who otherwise do some fine work. The double axes make it nearly unintelligible, and the notations are arbitrary, but it comes around to making a case for silver being under-valued as an inflation hedge this past April, lagging the gold move caused by the very same demand cycle.

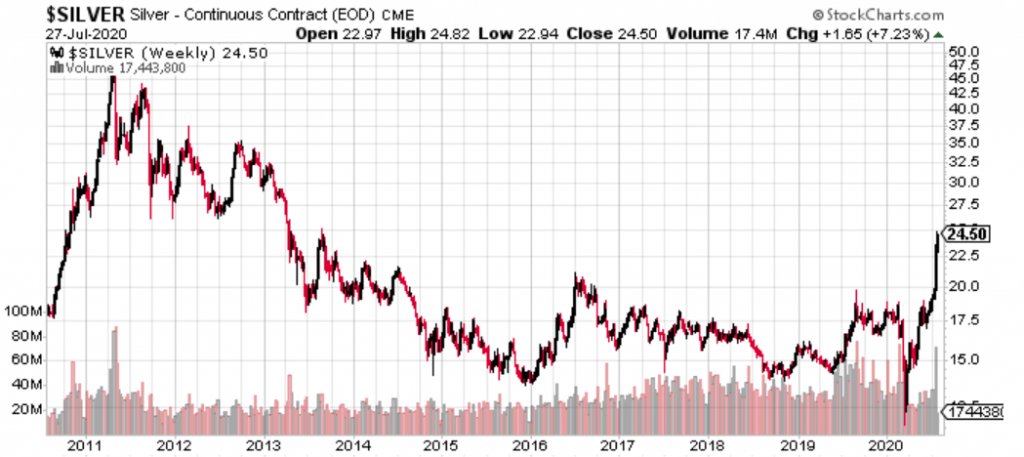

This past week has seen The Institute and the Silver Guys vindicated, as the late upside move prophesied by The Ratio came to pass.

A runaway spring gold price, and a lack of reciprocal action in silver had the price of gold at all-time highs above 125 ounces of silver. The recent jump has taken it down to trade closer to its 5 year average around 80 ounces of silver.

A Demand Driven Move

It could be that the silver pop was driven in part by the physical metals trade’s growing popularity among the wage earner class of the mainstream. $20/oz silver has a lower barrier to entry than $1900/oz gold, and the prospect of a double seems well in reach. Even at $40/oz silver, one could pick up a 10 ounce bar for the money they were supposed to spend on a brake job, whereas a $4,000 gold ounce is something one would surely have to explain to the wife.

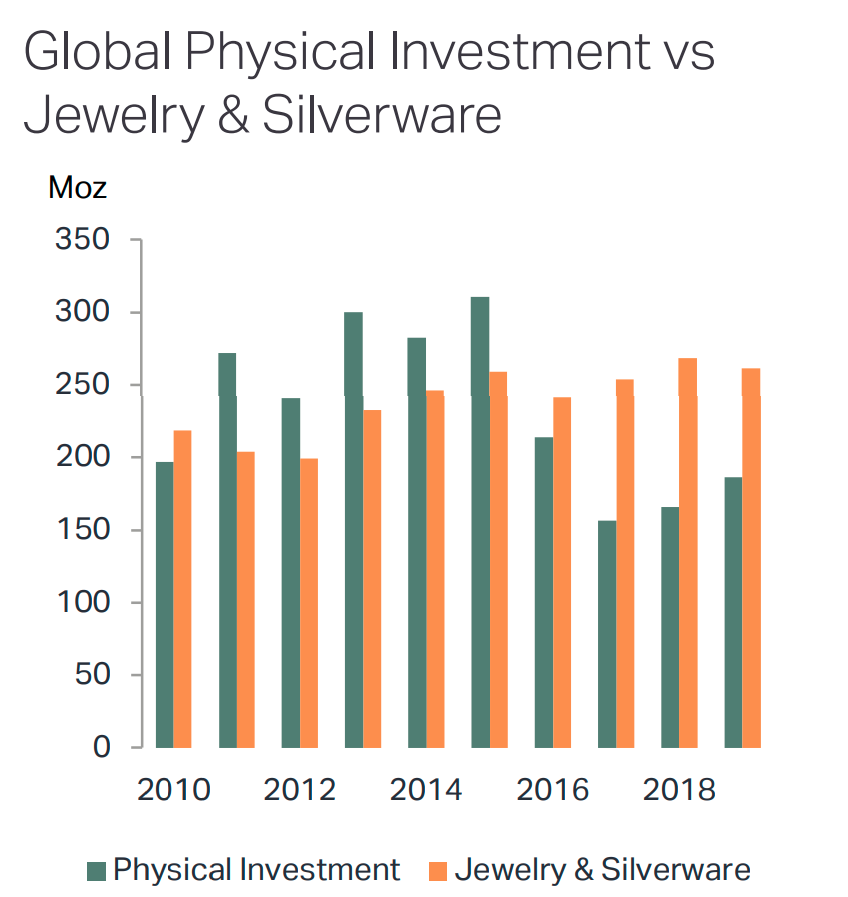

Demand being driven by silver investing going mainstream would be consistent with data from the Silver Institute, that shows physical demand having been lower than industrial demand from silverware and jewelry since 2016.

Noteably, 2010-2013 featured much higher silver prices.

The Supply Side

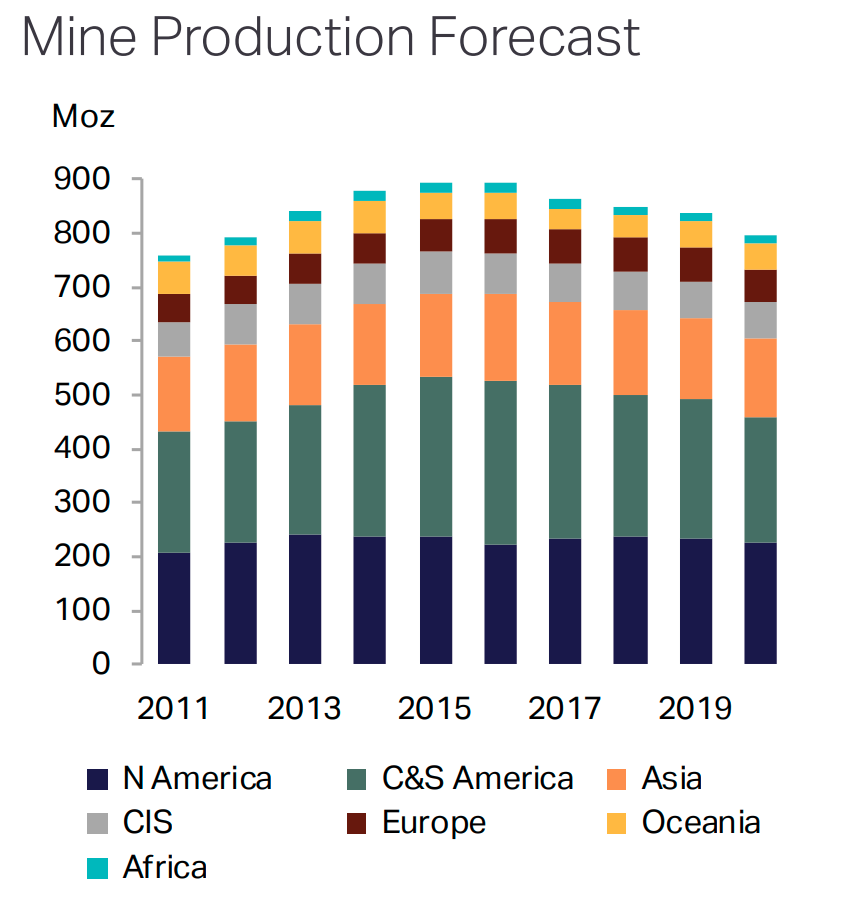

As we mentioned, the notion that these prices must correlate for any reason is specious at best and pure voodoo at its worst, but that isn’t likely to keep it from meaning something to the investing public, who are as hardwired to look for a bet now as they ever were and, by all accounts, have multiplied in the Robinhood era. The Institute had forecast a decline in 2020 mining output before COVID, and shutdowns have already impacted delivery.

The primary function of markets is price discovery, and silver investors should be conscious that better prices, at some point, will bring silver into the scrap market by the ton. There’s no telling how much old jewelry and candlesticks are hanging around, ready to lose their sentimental value as out of work people continue to stock up on the back-rent.

We suspect that The Institute’s next edition of this chart will have a much larger recycling bar, the price having made grandma’s silverware worth hauling down to the precious metals buyer.

Silver Guy Bonus

This fly line of a chart comes courtesy of Kitco.com contributor, Richard Baker, a Silver Guy if we ever saw one, who has a lot more faith in the gold:silver ratio than we do. Read here about how Baker monitors the ratio’s stability as a technique for discovering price local extrema.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Thanks for using my photo… but I never winked conspicuously or in any other way!